- United States

- /

- Auto

- /

- NasdaqCM:SBLX

Is Ayro (NASDAQ:AYRO) In A Good Position To Deliver On Growth Plans?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Ayro (NASDAQ:AYRO) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Ayro

SWOT Analysis for Ayro

- Currently debt free.

- Expensive based on P/S ratio compared to estimated Fair P/S ratio.

- Forecast to reduce losses next year.

- Has less than 3 years of cash runway based on current free cash flow.

How Long Is Ayro's Cash Runway?

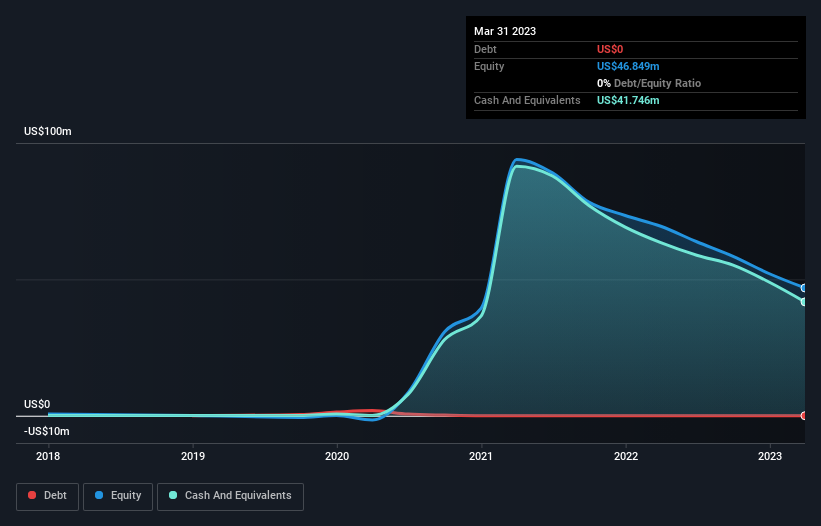

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at March 2023, Ayro had cash of US$42m and no debt. In the last year, its cash burn was US$22m. That means it had a cash runway of around 23 months as of March 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Ayro Growing?

It was fairly positive to see that Ayro reduced its cash burn by 25% during the last year. But the revenue dip of 29% in the same period was a bit concerning. Considering both these factors, we're not particularly excited by its growth profile. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Ayro To Raise More Cash For Growth?

Even though it seems like Ayro is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$25m, Ayro's US$22m in cash burn equates to about 87% of its market value. Given just how high that expenditure is, relative to the company's market value, we think there's an elevated risk of funding distress, and we would be very nervous about holding the stock.

So, Should We Worry About Ayro's Cash Burn?

On this analysis of Ayro's cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. Summing up, we think the Ayro's cash burn is a risk, based on the factors we mentioned in this article. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 4 warning signs for Ayro that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SBLX

StableX Technologies

Designs, manufactures, and sells electric vehicles for closed campus mobility, urban and community transport, local on-demand and last mile delivery, and government use in the United States.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives