- Taiwan

- /

- Renewable Energy

- /

- TWSE:6994

Market Participants Recognise Foxwell Power Co., Ltd.'s (TWSE:6994) Revenues Pushing Shares 47% Higher

Foxwell Power Co., Ltd. (TWSE:6994) shareholders would be excited to see that the share price has had a great month, posting a 47% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

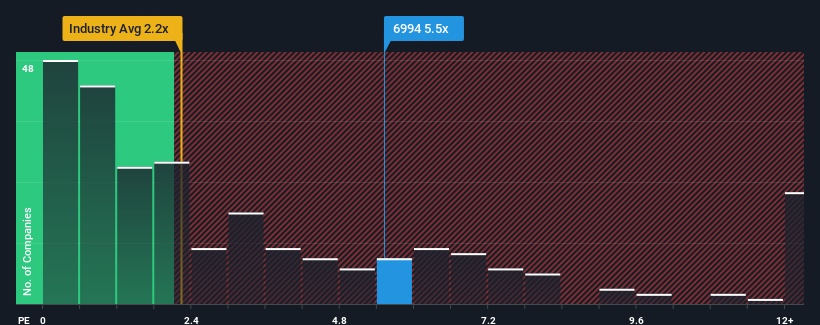

After such a large jump in price, you could be forgiven for thinking Foxwell Power is a stock not worth researching with a price-to-sales ratios (or "P/S") of 5.5x, considering almost half the companies in Taiwan's Renewable Energy industry have P/S ratios below 3.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Foxwell Power

How Foxwell Power Has Been Performing

Foxwell Power certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Foxwell Power.How Is Foxwell Power's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Foxwell Power's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 125% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 44% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 16% growth forecast for the broader industry.

With this information, we can see why Foxwell Power is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Foxwell Power's P/S Mean For Investors?

Foxwell Power shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Foxwell Power's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Foxwell Power that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6994

Foxwell Power

Foxwell Power Co., Ltd engages in the construction of energy storage systems.

High growth potential with solid track record.

Market Insights

Community Narratives