- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2637

Improved Earnings Required Before Wisdom Marine Lines Co., Limited (Cayman) (TWSE:2637) Stock's 31% Jump Looks Justified

Wisdom Marine Lines Co., Limited (Cayman) (TWSE:2637) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 38%.

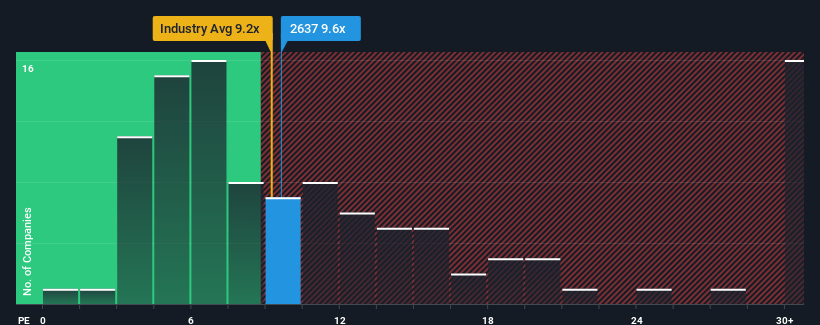

Although its price has surged higher, Wisdom Marine Lines Limited (Cayman) may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.6x, since almost half of all companies in Taiwan have P/E ratios greater than 22x and even P/E's higher than 40x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been advantageous for Wisdom Marine Lines Limited (Cayman) as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Wisdom Marine Lines Limited (Cayman)

What Are Growth Metrics Telling Us About The Low P/E?

Wisdom Marine Lines Limited (Cayman)'s P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 116% last year. Still, incredibly EPS has fallen 1.8% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 9.3% as estimated by the three analysts watching the company. Meanwhile, the broader market is forecast to expand by 24%, which paints a poor picture.

With this information, we are not surprised that Wisdom Marine Lines Limited (Cayman) is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Shares in Wisdom Marine Lines Limited (Cayman) are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Wisdom Marine Lines Limited (Cayman) maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Wisdom Marine Lines Limited (Cayman) (1 is potentially serious!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Wisdom Marine Lines Limited (Cayman). So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wisdom Marine Lines Limited (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2637

Wisdom Marine Lines Limited (Cayman)

Provides marine cargo transportation services in Singapore, the Netherlands, Germany, Panama, Switzerland, Denmark, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives