- Japan

- /

- Auto Components

- /

- TSE:7259

Asian Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As global markets grapple with renewed trade tensions and economic uncertainties, Asian economies are navigating these challenges with a mix of resilience and caution. In this environment, dividend stocks in Asia can offer potential stability and income, making them an attractive consideration for investors looking to balance growth with consistent returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.69% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| NCD (TSE:4783) | 4.00% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.11% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.55% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

| Daicel (TSE:4202) | 4.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

Click here to see the full list of 1149 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nippon Ceramic (TSE:6929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Ceramic Co., Ltd. develops, manufactures, and sells ceramic sensors and modules both in Japan and internationally, with a market cap of ¥68.74 billion.

Operations: Nippon Ceramic Co., Ltd. generates its revenue through the development, manufacturing, and sale of ceramic sensors and modules across domestic and international markets.

Dividend Yield: 3.9%

Nippon Ceramic's dividend payments have been volatile and unreliable over the past decade, despite some growth. While the payout ratio of 34.9% indicates dividends are covered by earnings, a high cash payout ratio of 91.5% suggests they aren't well supported by free cash flow. Recent downsizing could impact future performance, but current forecasts show revenue growth and strong earnings for 2025, with net income projected at ¥4.25 billion (US$29 million).

- Delve into the full analysis dividend report here for a deeper understanding of Nippon Ceramic.

- According our valuation report, there's an indication that Nippon Ceramic's share price might be on the cheaper side.

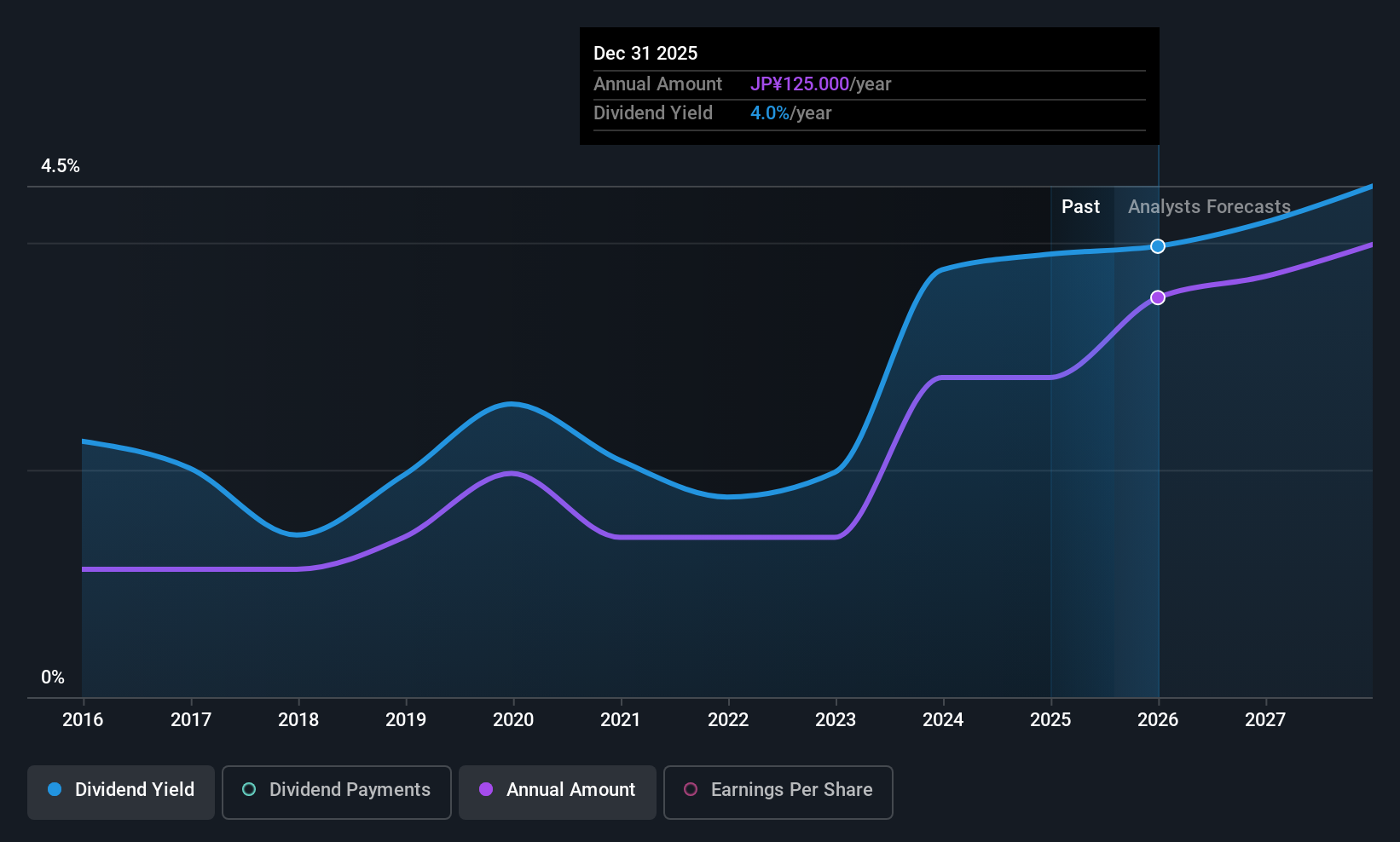

Aisin (TSE:7259)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aisin Corporation manufactures and sells automotive parts, as well as energy and lifestyle related products, with a market cap of ¥1.63 trillion.

Operations: Aisin Corporation's revenue is derived from several regions, including Japan at ¥3.16 billion, North America at ¥1.09 billion, China at ¥623.65 million, ASEAN India at ¥536.28 million, and Europe at ¥294.54 million.

Dividend Yield: 3%

Aisin's dividend payments have been inconsistent over the past decade, despite recent increases. The dividends are well covered by earnings and cash flows, with payout ratios of 34.5% and 28.7%, respectively. Although trading below estimated fair value, Aisin's dividend yield of 3.01% lags behind top-tier payers in Japan. Recent share buybacks totaling ¥8.32 billion could support future payouts, but historical volatility remains a concern for investors prioritizing stable income streams.

- Get an in-depth perspective on Aisin's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Aisin is trading behind its estimated value.

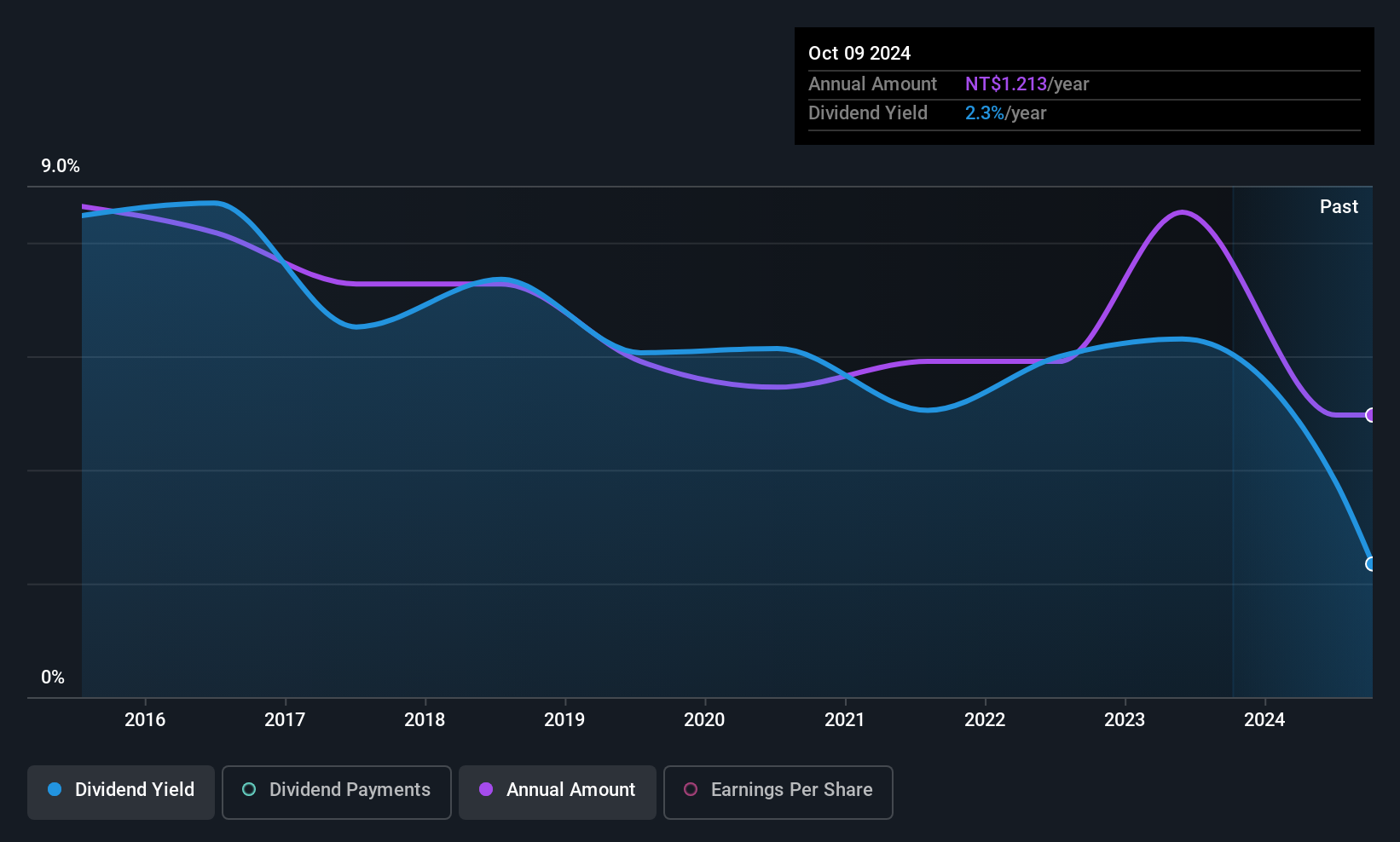

Creative Sensor (TWSE:8249)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Creative Sensor Inc. is engaged in the manufacturing and trading of image sensors and electronic components across China, Thailand, the Philippines, and internationally, with a market cap of NT$7.16 billion.

Operations: Creative Sensor Inc.'s revenue primarily comes from its Electronic Components & Parts segment, which generated NT$4.60 billion.

Dividend Yield: 3.8%

Creative Sensor's dividends are covered by earnings and cash flows, with payout ratios of 52.1% and 42.6%, respectively, despite a history of volatility. The company's recent earnings growth suggests potential for future stability, but its dividend yield of 3.8% remains below the top tier in Taiwan. Trading at a discount to estimated fair value, Creative Sensor's share price has been volatile recently, which may affect investor confidence in consistent income generation from dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Creative Sensor.

- The valuation report we've compiled suggests that Creative Sensor's current price could be quite moderate.

Next Steps

- Access the full spectrum of 1149 Top Asian Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7259

Aisin

Manufactures and sells automotive parts, and energy and lifestyle related products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives