- Taiwan

- /

- Semiconductors

- /

- TPEX:3680

Undiscovered Gems And 2 Other Compelling Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge despite small-cap stocks lagging behind. In this dynamic environment, identifying undiscovered gems within the small-cap sector can offer compelling opportunities for diversification and potential growth in your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 56.23% | 33.99% | 34.28% | ★★★★★★ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Western Carriers (India) | 34.72% | 9.79% | 14.42% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Tibet GaoZheng Explosive (SZSE:002827)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tibet GaoZheng Explosive Co., Ltd. is engaged in the production and sale of civil explosives in China, with a market capitalization of CN¥6.86 billion.

Operations: Tibet GaoZheng Explosive generates revenue primarily from the production and sale of civil explosives. The company's financial performance is characterized by its market capitalization of CN¥6.86 billion, reflecting its position in the industry.

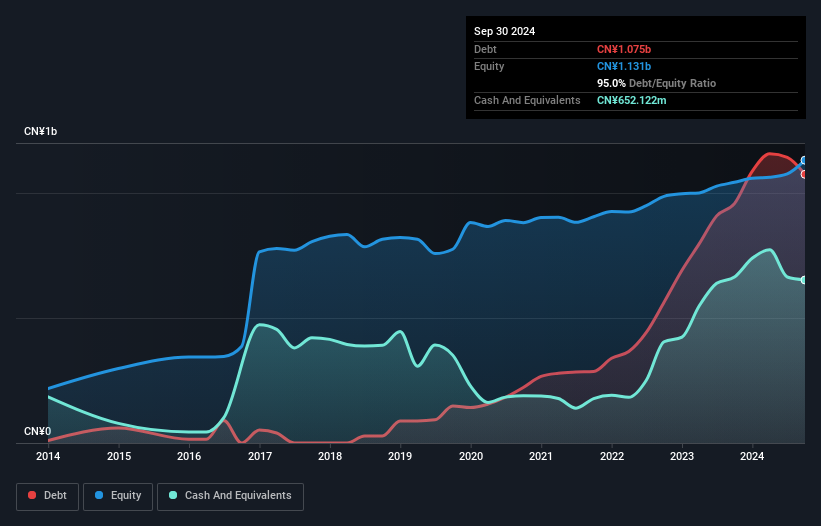

Tibet GaoZheng Explosive, a dynamic player in the chemicals sector, has shown impressive earnings growth of 30.3% over the past year, outpacing the industry average of -5.4%. The company's net debt to equity ratio stands at a satisfactory 37.4%, indicating prudent financial management despite an increase from 19.1% to 95% over five years. Interest payments are well covered by EBIT at 9.8 times coverage, reflecting solid operational performance. Recent dividend affirmations highlight shareholder returns with CNY 0.70 per share declared twice in early January 2025, suggesting confidence in ongoing profitability and growth potential forecasted at an annual rate of 46.66%.

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gudeng Precision Industrial Co., Ltd. offers technology services globally and has a market capitalization of NT$42.27 billion.

Operations: Gudeng Precision Industrial's primary revenue streams are from semiconductor manufacturing, contributing NT$5.01 billion, and semiconductor equipment manufacturing, generating NT$1.20 billion.

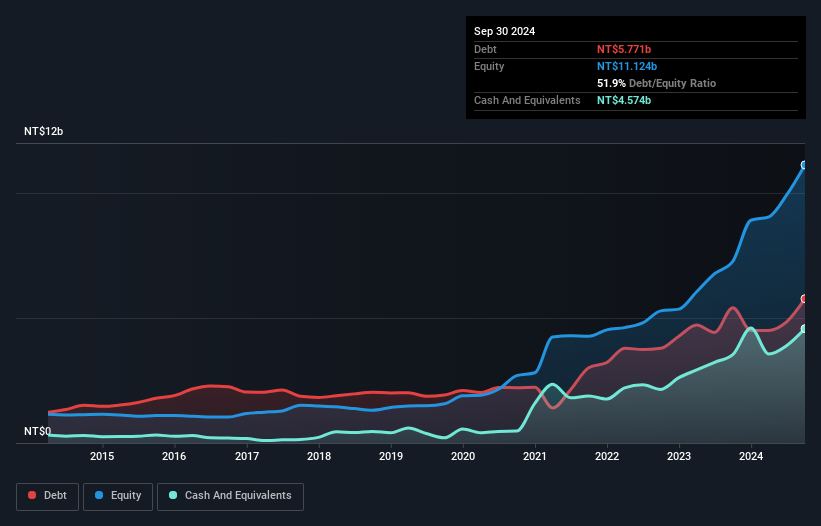

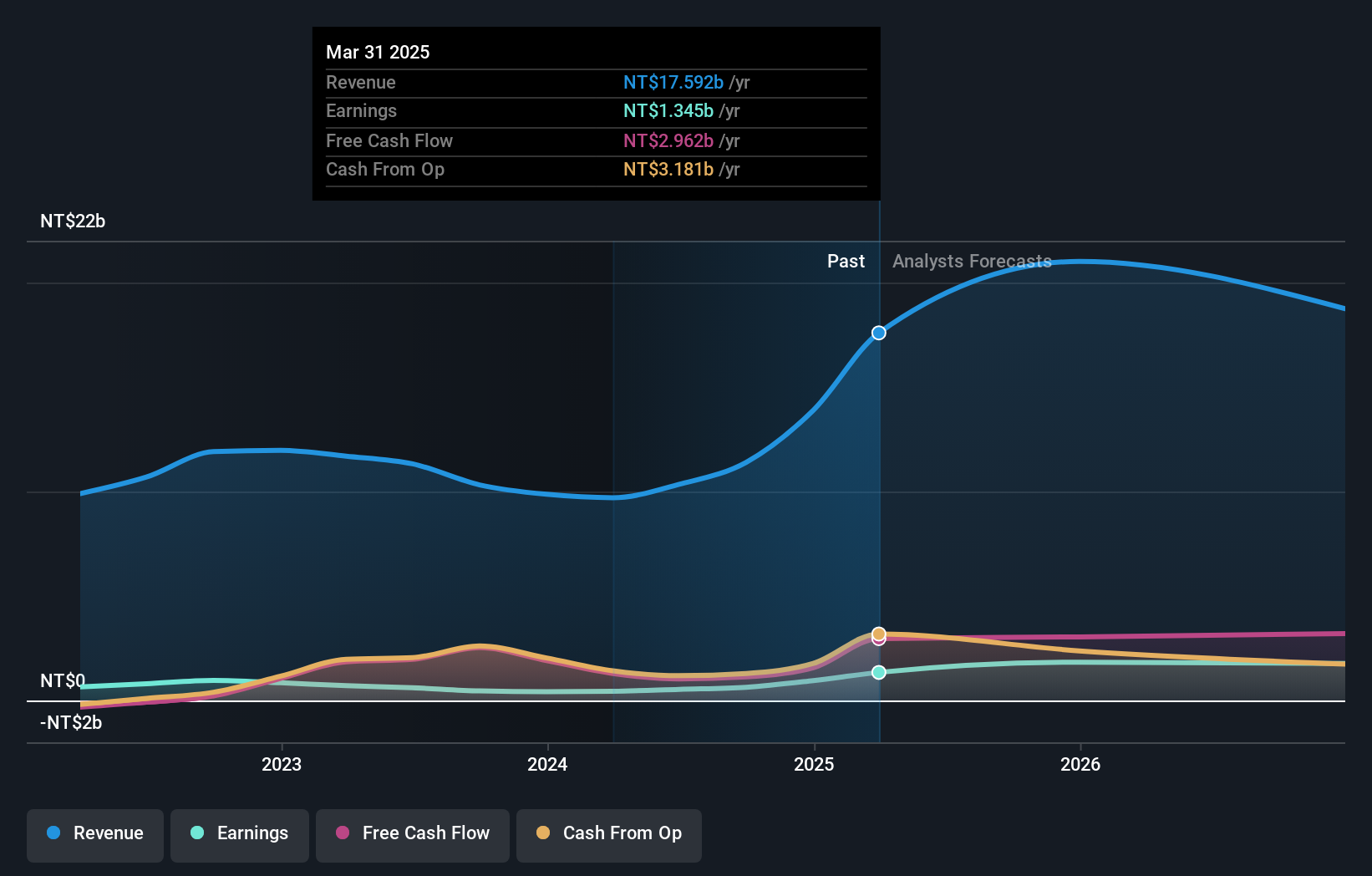

Gudeng Precision Industrial, a nimble player in the semiconductor sector, is making waves with its impressive 31.9% earnings growth over the past year, outpacing the industry's 5.9%. The company's debt management shines as its net debt to equity ratio has improved from 122.6% to a satisfactory 51.9% over five years. Despite not being free cash flow positive, Gudeng's interest payments are comfortably covered by EBIT at an impressive 116 times coverage. Recent strategic moves include plans for a new venture capital subsidiary and participation in high-profile conferences, indicating robust future prospects for this promising entity in Taiwan's tech landscape.

Posiflex Technology (TWSE:8114)

Simply Wall St Value Rating: ★★★★★★

Overview: Posiflex Technology, Inc. is involved in the manufacture and sale of industrial computers and peripheral equipment across Taiwan, the United States, and internationally, with a market capitalization of NT$33.34 billion.

Operations: The company generates revenue primarily from the United States (NT$7 billion) and its domestic business in Taiwan (NT$2.51 billion).

Posiflex Technology, a small-cap player in the electronics industry, has shown impressive growth with earnings surging by 39% over the past year, outpacing the sector's average of 8%. The company's net debt to equity ratio stands at a satisfactory 39%, down from a hefty 276% five years ago. This indicates prudent financial management and reduced leverage. Interest payments are well-covered by EBIT at nearly 15 times, suggesting strong operational efficiency. Despite recent shareholder dilution and volatile share prices over three months, Posiflex seems poised for continued growth with forecasted earnings expansion of approximately 27% annually.

- Navigate through the intricacies of Posiflex Technology with our comprehensive health report here.

Understand Posiflex Technology's track record by examining our Past report.

Where To Now?

- Investigate our full lineup of 4717 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3680

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion