- Philippines

- /

- Banks

- /

- PSE:PNB

Discover 3 Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in global markets, with smaller-cap indexes showing resilience, the Asian market continues to present intriguing opportunities for investors. As economic indicators fluctuate and geopolitical tensions influence broader sentiment, identifying stocks with solid fundamentals and growth potential becomes crucial. In this context, uncovering lesser-known companies with strong business models and strategic positioning can offer promising prospects for those looking to navigate the complexities of today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Asian Terminals | 25.94% | 9.18% | 13.41% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 13.24% | -0.17% | ★★★★★★ |

| Toukei Computer | NA | 5.68% | 13.35% | ★★★★★★ |

| Shenzhen Bsc TechnologyLtd | NA | 16.05% | 1.02% | ★★★★★★ |

| Hokkan Holdings | 66.84% | -5.71% | 18.42% | ★★★★★☆ |

| Well Lead Medical | 25.36% | 7.92% | 12.58% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| ShenZhen QiangRui Precision Technology | 18.68% | 41.36% | 14.12% | ★★★★★☆ |

| Guangdong Sanhe Pile | 76.56% | -2.58% | -32.76% | ★★★★☆☆ |

| Tibet TourismLtd | 27.63% | 9.10% | 17.00% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★☆☆

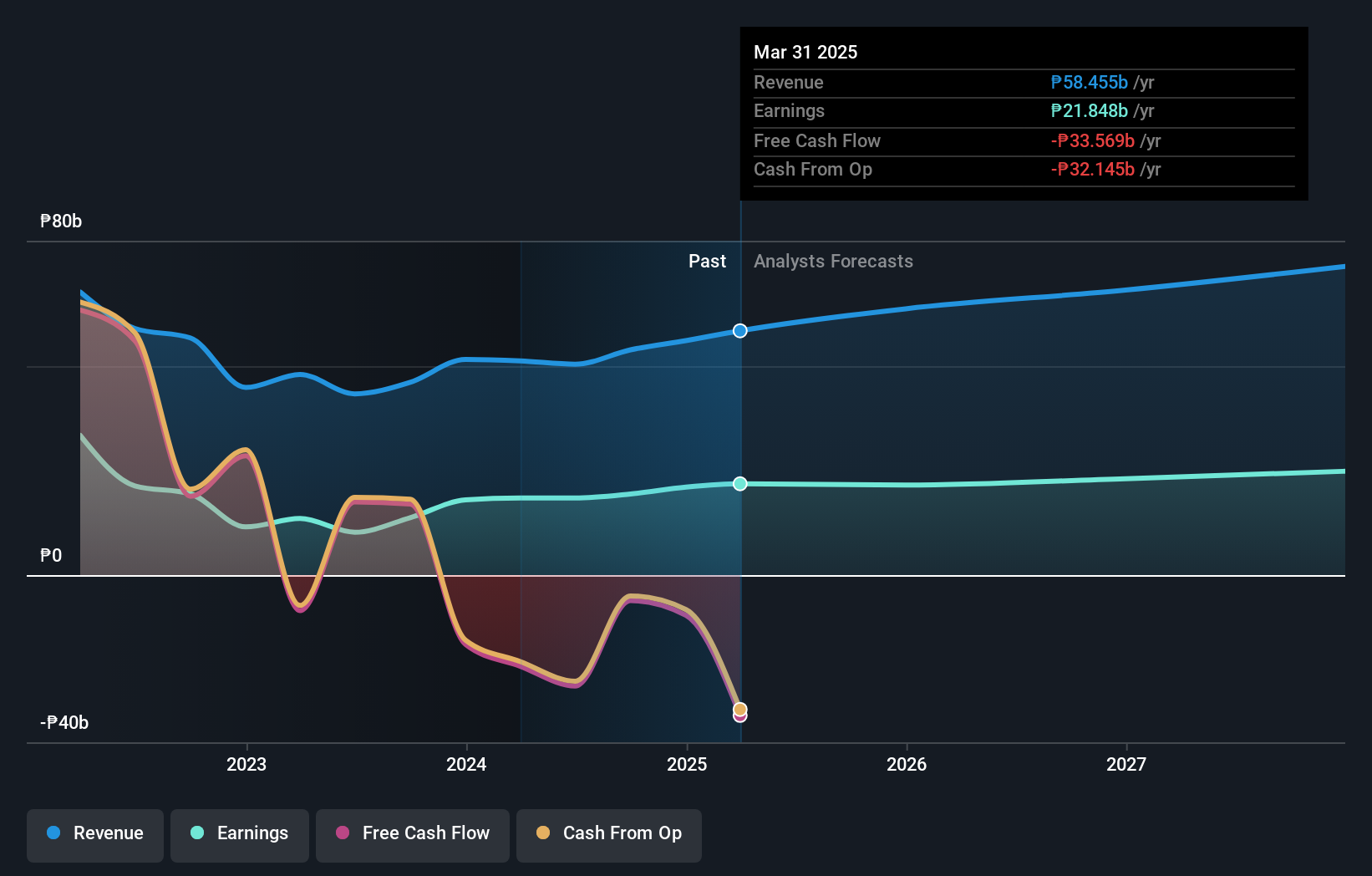

Overview: Philippine National Bank offers a range of banking and financial products and services, with a market capitalization of ₱82.16 billion.

Operations: Philippine National Bank generates revenue primarily from Retail Banking, contributing ₱33.79 billion, and Corporate Banking, which adds ₱12.42 billion. Treasury operations also play a significant role with ₱11.50 billion in revenue.

Philippine National Bank, with total assets of ₱1,279.3 billion and equity of ₱218.7 billion, presents a compelling case in the banking sector. Its earnings growth of 18.5% outpaced the industry average of 10.9%, although it faces challenges with a high level of bad loans at 6.9%. Despite this, PNB benefits from low-risk funding sources, with 93% liabilities stemming from customer deposits rather than external borrowing. Trading at nearly half its estimated fair value suggests potential upside for investors seeking undervalued opportunities in Asia's financial landscape amidst recent leadership changes enhancing strategic direction.

Telink Semiconductor(Shanghai)Co.Ltd (SHSE:688591)

Simply Wall St Value Rating: ★★★★★★

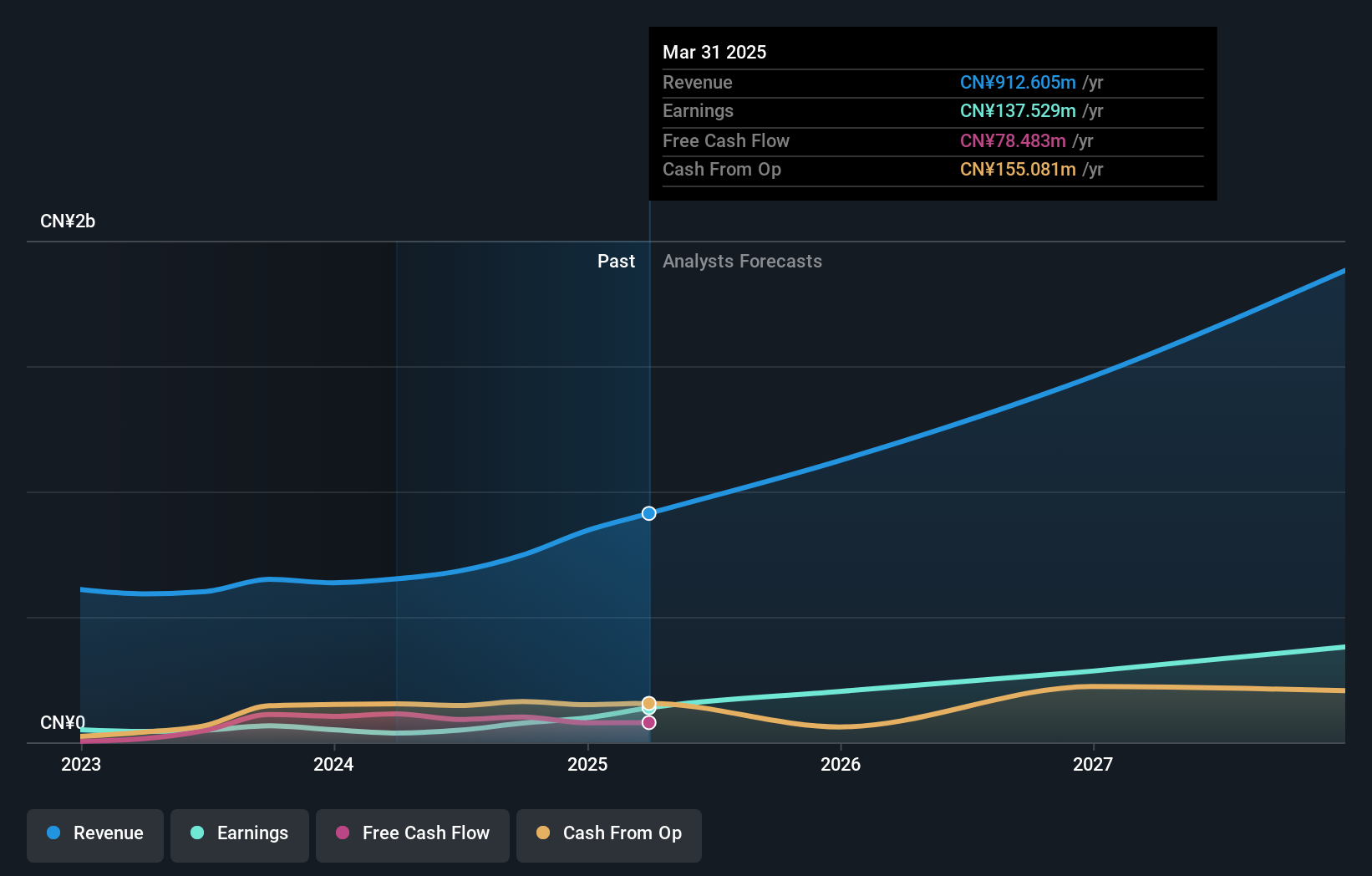

Overview: Telink Semiconductor (Shanghai) Co., Ltd. focuses on the research, development, design, and sales of low-power wireless IoT chips with a market capitalization of CN¥9.08 billion.

Operations: Telink generates its revenue primarily from the semiconductor segment, amounting to CN¥912.60 million.

Telink Semiconductor, a nimble player in the semiconductor industry, posted impressive earnings growth of 271.6% over the past year, outpacing the industry's 8.8%. This surge is reflected in their latest financials for Q1 2025, where revenue hit CNY 230.05 million from CNY 161.47 million last year, and net income rose to CNY 35.71 million from a net loss of CNY 4.41 million previously. The company enjoys debt-free status with high-quality earnings and positive free cash flow at CNY 113.56 million as of March this year, although its share price has been notably volatile recently.

Posiflex Technology (TWSE:8114)

Simply Wall St Value Rating: ★★★★★★

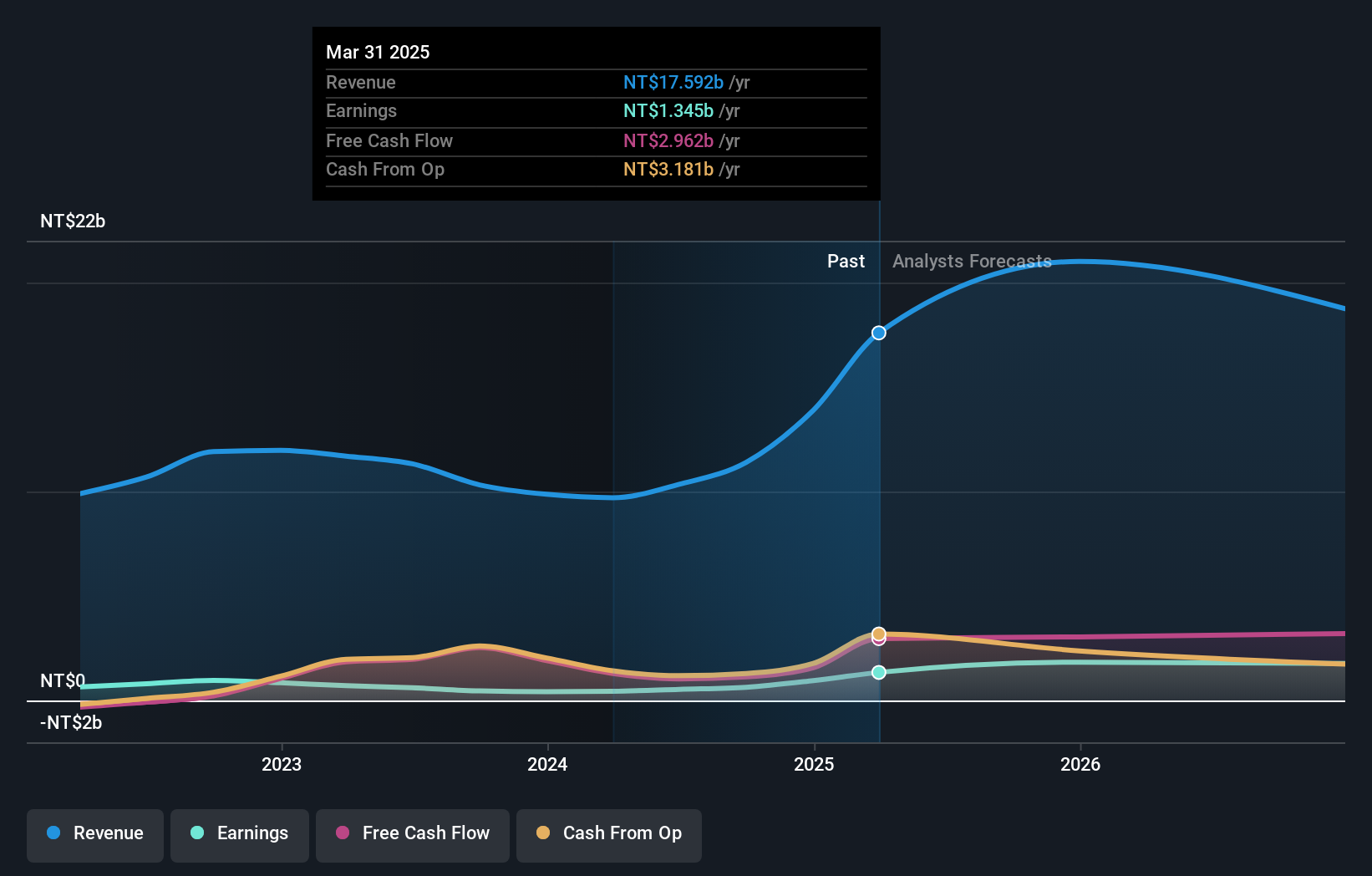

Overview: Posiflex Technology, Inc. specializes in the manufacture and sale of industrial computers and peripheral equipment across Taiwan, the United States, and international markets, with a market cap of NT$29.90 billion.

Operations: Posiflex Technology generates revenue primarily from the United States, contributing NT$13.19 billion, followed by its domestic business in Taiwan at NT$2.46 billion.

Posiflex Technology, a nimble player in the electronics sector, has been making waves with impressive financial strides. The company reported a significant earnings growth of 205.8% over the past year, outpacing the industry average of 14.2%. Its debt to equity ratio has impressively reduced from 274.2% to 57.5% over five years, reflecting prudent financial management and positioning it as an attractive value proposition trading at 46.5% below its estimated fair value. Despite recent volatility in share price and shareholder dilution, Posiflex's robust cash flow and strategic partnerships hint at promising future potential in AI-enhanced solutions for diverse applications.

Taking Advantage

- Navigate through the entire inventory of 2618 Asian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PNB

Philippine National Bank

Provides various banking and financial products and services.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives