- Saudi Arabia

- /

- Building

- /

- SASE:1302

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher due to easing core inflation and robust bank earnings, investors are increasingly looking towards small-cap stocks as potential opportunities. The S&P MidCap 400 and Russell 2000 indices have shown notable gains, highlighting the appeal of smaller companies that might offer unique growth prospects in a cooling inflation environment. In this context, identifying lesser-known stocks with strong fundamentals and innovative business models can be key to enhancing a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Bawan (SASE:1302)

Simply Wall St Value Rating: ★★★★★☆

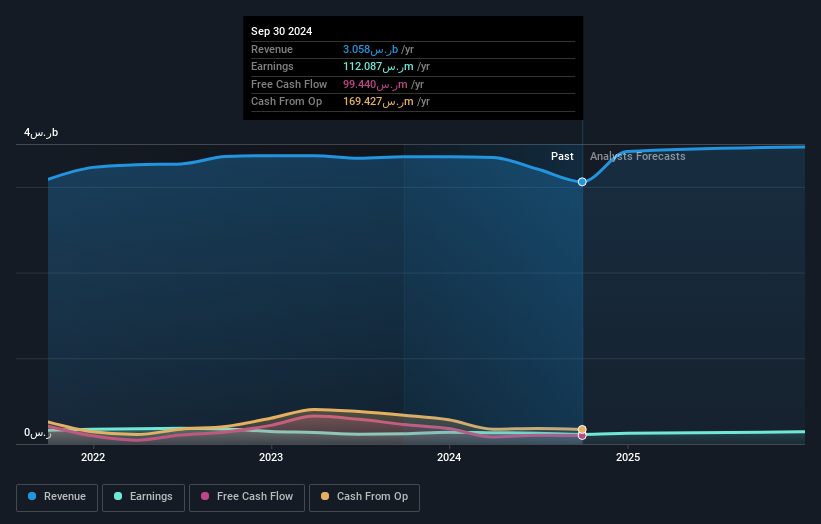

Overview: Bawan Company is engaged in the manufacturing and sale of metal and steel works in the Kingdom of Saudi Arabia, with a market capitalization of SAR3.74 billion.

Operations: With a primary focus on metal and wood, Bawan's revenue streams are diversified across segments, generating SAR2.12 billion from metal and wood, SAR571.18 million from electrical products, and SAR365.98 million from plastics.

Bawan, a relatively smaller player in the building industry, has seen its debt to equity ratio improve significantly from 129.4% to 50.4% over five years, although its net debt to equity remains high at 41.6%. Recent earnings reveal a drop in net income for Q3 2024 to SAR 23.45 million from SAR 40.1 million the previous year, with sales also falling from SAR 832.01 million to SAR 682.6 million. Despite these challenges, Bawan's interest payments are well-covered by EBIT at a multiple of 6.5x, and future earnings are expected to grow annually by about 17%.

- Navigate through the intricacies of Bawan with our comprehensive health report here.

Gain insights into Bawan's historical performance by reviewing our past performance report.

Suzhou Longway Eletronic Machinery (SZSE:301202)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Longway Electronic Machinery Co., Ltd specializes in the research, development, production, sale, and service of server cabinets and related data center products in China with a market cap of CN¥4.76 billion.

Operations: Longway Electronic Machinery generates revenue primarily from the sale of server cabinets and related data center products in China. The company reported a market capitalization of CN¥4.76 billion.

With a knack for navigating the tech industry, Suzhou Longway Electronic Machinery has demonstrated solid earnings growth of 6.8%, outpacing the broader sector's 3%. Over the last five years, its debt-to-equity ratio impressively shrunk from 83.5% to just 10.4%, indicating prudent financial management and reduced leverage risk. Despite recent volatility in share price and its removal from the S&P Global BMI Index, Longway's net income rose to CNY 55.59 million for nine months ending September 2024, up from CNY 43.47 million year-on-year, showcasing resilience amidst market fluctuations and strategic leadership changes.

Supreme Electronics (TWSE:8112)

Simply Wall St Value Rating: ★★★★☆☆

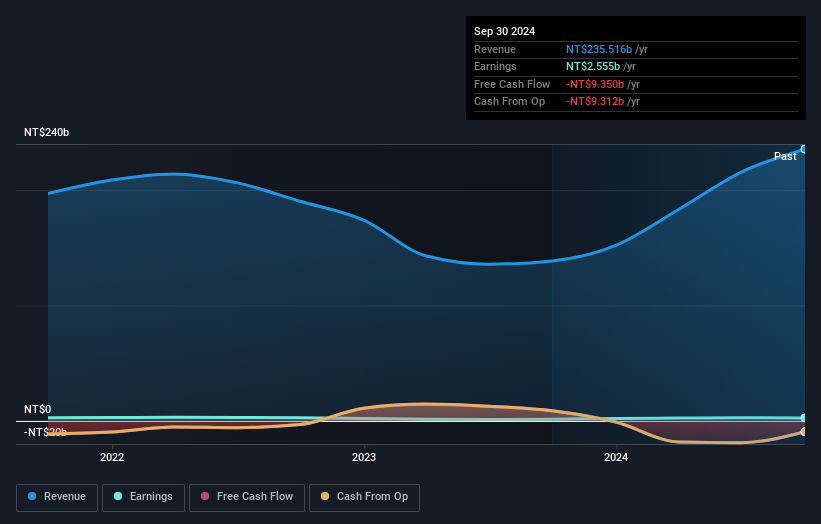

Overview: Supreme Electronics Co., Ltd. operates as an import and export dealer of electronic products and components across Taiwan, Hong Kong, China, the United States, and other international markets with a market capitalization of NT$31.45 billion.

Operations: Supreme Electronics generates revenue primarily from computer peripherals and electronic components, amounting to NT$235.52 billion. The company's market capitalization stands at NT$31.45 billion.

Supreme Electronics, a smaller player in the electronics industry, has shown notable growth with earnings surging 70.7% over the past year, outpacing the sector's 6.6%. Despite this impressive growth, its net income for Q3 2024 was TWD 523.79 million, down from TWD 684.43 million a year earlier, reflecting some pressure on profitability. The company trades at a value approximately 10.5% below estimated fair value and has managed to reduce its debt-to-equity ratio from 204% to about 186% over five years while maintaining interest coverage at three times EBIT—indicating solid management of financial obligations amidst high leverage (157%).

- Delve into the full analysis health report here for a deeper understanding of Supreme Electronics.

Understand Supreme Electronics' track record by examining our Past report.

Seize The Opportunity

- Delve into our full catalog of 4651 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bawan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1302

Bawan

Manufactures and sells metal and steel works in the Kingdom of Saudi Arabia.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives