- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8070

Chang Wah Electromaterials Inc.'s (TWSE:8070) 31% Price Boost Is Out Of Tune With Earnings

Chang Wah Electromaterials Inc. (TWSE:8070) shares have continued their recent momentum with a 31% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 47%.

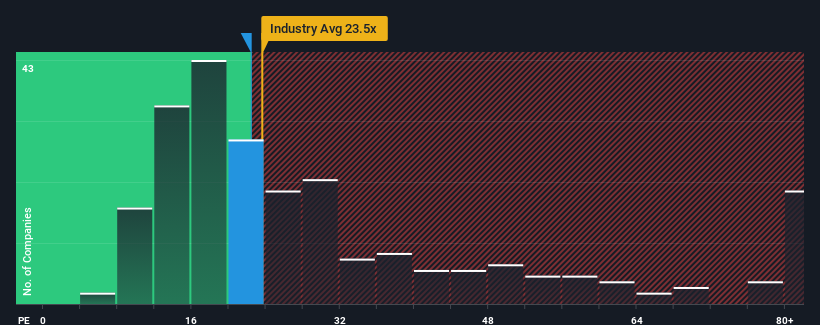

Although its price has surged higher, it's still not a stretch to say that Chang Wah Electromaterials' price-to-earnings (or "P/E") ratio of 22.4x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Chang Wah Electromaterials over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Chang Wah Electromaterials

How Is Chang Wah Electromaterials' Growth Trending?

In order to justify its P/E ratio, Chang Wah Electromaterials would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 40% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Chang Wah Electromaterials' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Chang Wah Electromaterials' P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Chang Wah Electromaterials revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Chang Wah Electromaterials that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8070

Chang Wah Electromaterials

Engages in trading of electrical, telecommunication, and semiconductor materials and parts in Taiwan, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives