As global markets navigate a landscape marked by mixed corporate earnings and competitive pressures in the AI sector, U.S. stocks have experienced volatility, with notable fluctuations in tech-heavy indices like the Nasdaq Composite. In this context, identifying high-growth tech stocks requires careful consideration of companies that can adapt to rapid technological advancements and maintain robust performance despite market uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zealand Pharma (CPSE:ZEAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zealand Pharma A/S is a biotechnology company focused on the discovery, development, and commercialization of peptide-based medicines in Denmark, with a market capitalization of DKK52.03 billion.

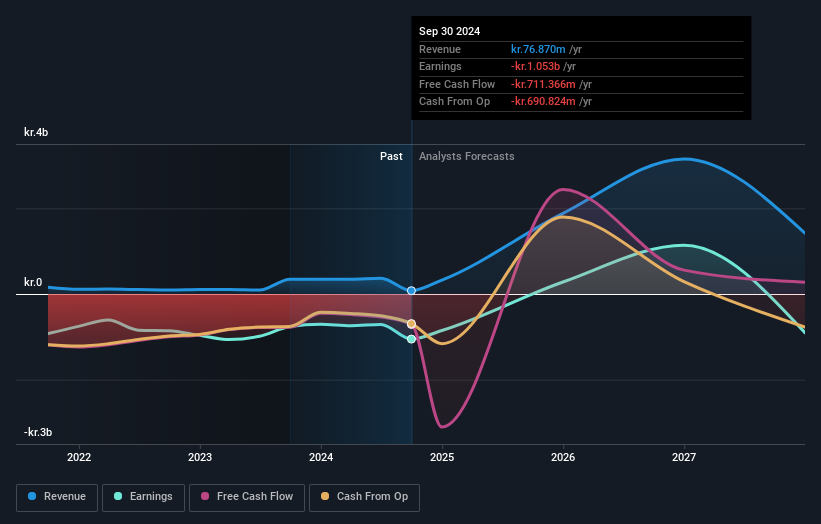

Operations: Zealand Pharma generates revenue primarily from its biotechnology segment, amounting to DKK76.87 million. The company's business model centers on the development and commercialization of peptide-based medicines.

Zealand Pharma, recently added to the OMX Nordic 40 Index, is navigating a pivotal phase with its innovative drug glepaglutide, targeting short bowel syndrome. Despite facing a setback from the FDA requiring further trials, the company's commitment to R&D is evident as it plans a new Phase 3 trial in 2025. Financially, Zealand reported significant revenue growth at an annual rate of 38.4%, although it currently operates at a loss with recent figures showing a net loss of DKK 266.4 million for Q3 2024. The firm's strategic focus on specialized biotech solutions and its robust pipeline underscore its potential in high-growth markets despite current profitability challenges.

- Dive into the specifics of Zealand Pharma here with our thorough health report.

Gain insights into Zealand Pharma's historical performance by reviewing our past performance report.

Hunan Kylinsec Technology (SHSE:688152)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Kylinsec Technology Co., Ltd. is a company that supplies software products and has a market capitalization of CN¥4.70 billion.

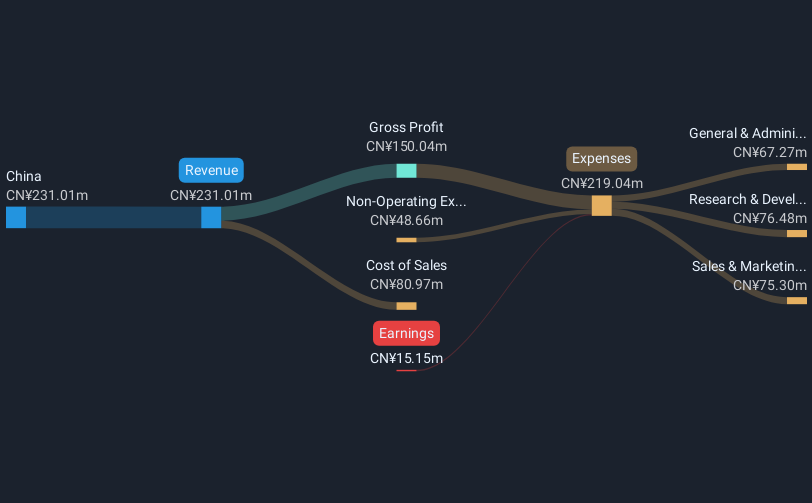

Operations: Kylinsec Technology focuses on the development and supply of software products. The company operates within the technology sector, leveraging its expertise to generate revenue through its software offerings.

Despite recent challenges, including being dropped from the S&P Global BMI Index, Hunan Kylinsec Technology remains a notable contender in the tech sector with its robust revenue growth of 44.9% per year, significantly outpacing the CN market average of 13.5%. This growth is underpinned by substantial R&D investments aimed at fostering innovation and maintaining competitive edge in a rapidly evolving industry. Looking ahead, earnings are expected to surge by an impressive 117% annually over the next three years, positioning Hunan Kylinsec for potential profitability and making it a company to watch as it navigates these transformative periods.

- Delve into the full analysis health report here for a deeper understanding of Hunan Kylinsec Technology.

Understand Hunan Kylinsec Technology's track record by examining our Past report.

TWOWAY Communications (TWSE:8045)

Simply Wall St Growth Rating: ★★★★★★

Overview: TWOWAY Communications, Inc. specializes in the research, development, manufacturing, and sale of indoor and outdoor RF and optical transmission equipment across Taiwan, the United States, Asia, Europe, and other international markets with a market capitalization of NT$12.36 billion.

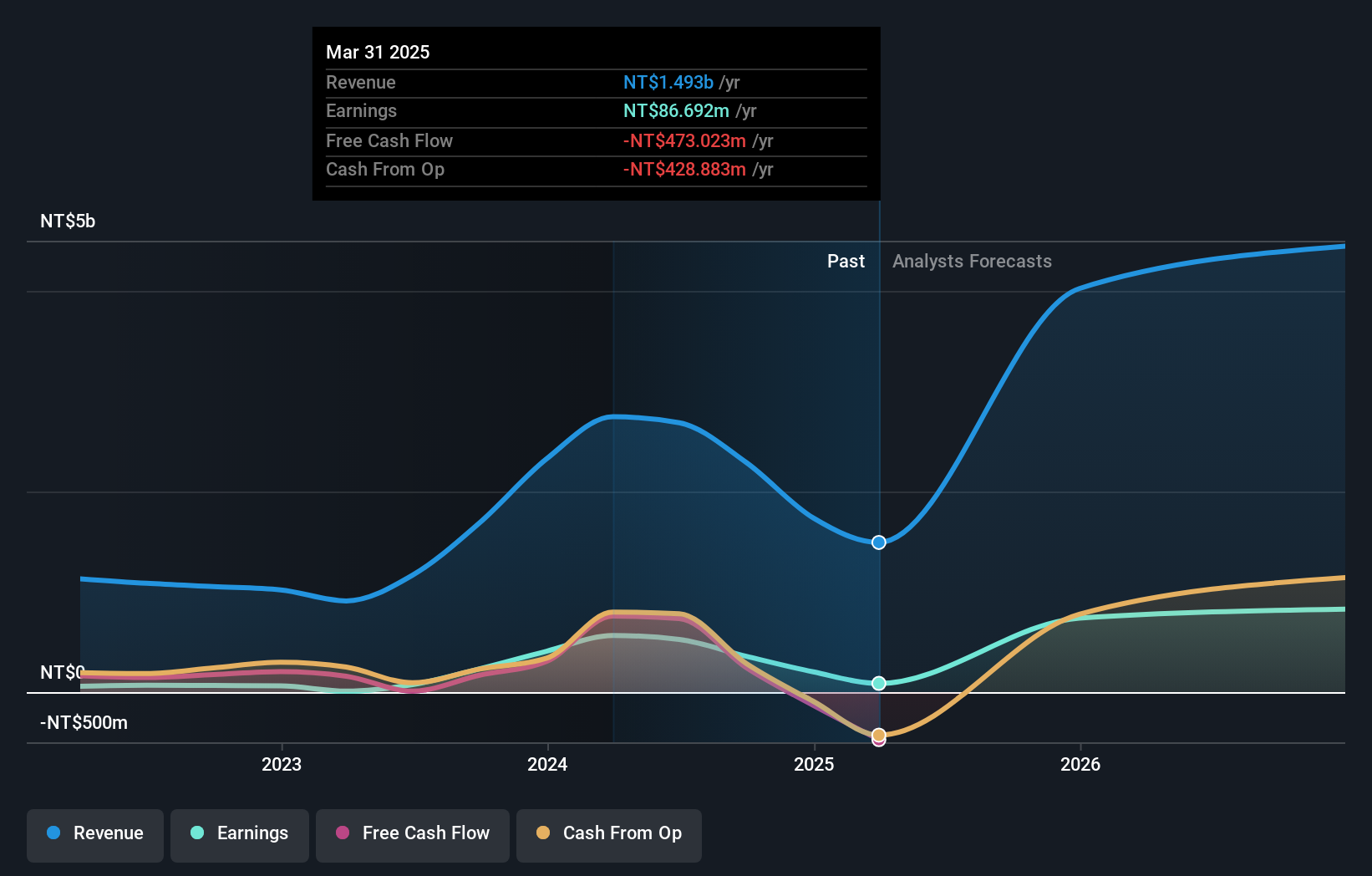

Operations: The company generates revenue primarily from its Broadband Network Equipment Division, which contributes NT$3.21 billion, and the IOT Division with NT$377.92 million. It also operates a Labor and Other Business Division, adding NT$226.55 million to its revenue streams.

TWOWAY Communications, despite a volatile share price in recent months, showcases robust potential with earnings growth of 51.6% per year and revenue increasing at 38.5% annually—both metrics outpacing the TW market's average growth rates significantly. This performance is bolstered by strategic R&D investments which have not only fueled innovation but also positioned the company well above industry norms in earnings expansion. Recent activities including a successful follow-on equity offering raising TWD 524 million underscore its proactive approach to capital management and market positioning, promising an intriguing trajectory ahead amidst competitive pressures and evolving tech landscapes.

- Click here to discover the nuances of TWOWAY Communications with our detailed analytical health report.

Gain insights into TWOWAY Communications' past trends and performance with our Past report.

Next Steps

- Delve into our full catalog of 1226 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zealand Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ZEAL

Zealand Pharma

A biotechnology company, engages in the discovery, development, and commercialization of peptide-based medicines in Denmark and the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion