- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2480

Discovering February 2025's Hidden Stock Gems with Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, small-cap stocks have experienced mixed fortunes, with indices like the S&P 600 reflecting these broader economic dynamics. Amidst this backdrop of volatility and opportunity, identifying hidden stock gems requires a keen eye for companies that demonstrate resilience and innovation in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kerur Holdings (TASE:KRUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kerur Holdings Ltd., with a market cap of ₪1.10 billion, operates in the food sector in Israel through its subsidiaries.

Operations: Kerur Holdings generates revenue primarily from its operations in the food sector. The company recorded a gross profit margin of 15% in the latest financial period, reflecting its efficiency in managing production and sales costs.

Kerur Holdings, operating in the beverage sector, seems to be navigating mixed waters. Despite a 2% annual earnings dip over five years, its net income for Q3 2024 rose to ILS 29.97 million from ILS 28.91 million the previous year. The company's price-to-earnings ratio stands at a favorable 13.9x compared to the IL market's 14.6x, suggesting it might be undervalued relative to peers. With high-quality earnings and more cash than total debt, Kerur maintains robust financial health despite an increased debt-to-equity ratio of 1.1% over five years and slower growth than industry averages last year at just 1.2%.

- Take a closer look at Kerur Holdings' potential here in our health report.

Gain insights into Kerur Holdings' past trends and performance with our Past report.

Stark Technology (TWSE:2480)

Simply Wall St Value Rating: ★★★★★☆

Overview: Stark Technology Inc. offers system integration services for information and communication technology products in Taiwan, with a market capitalization of NT$15.85 billion.

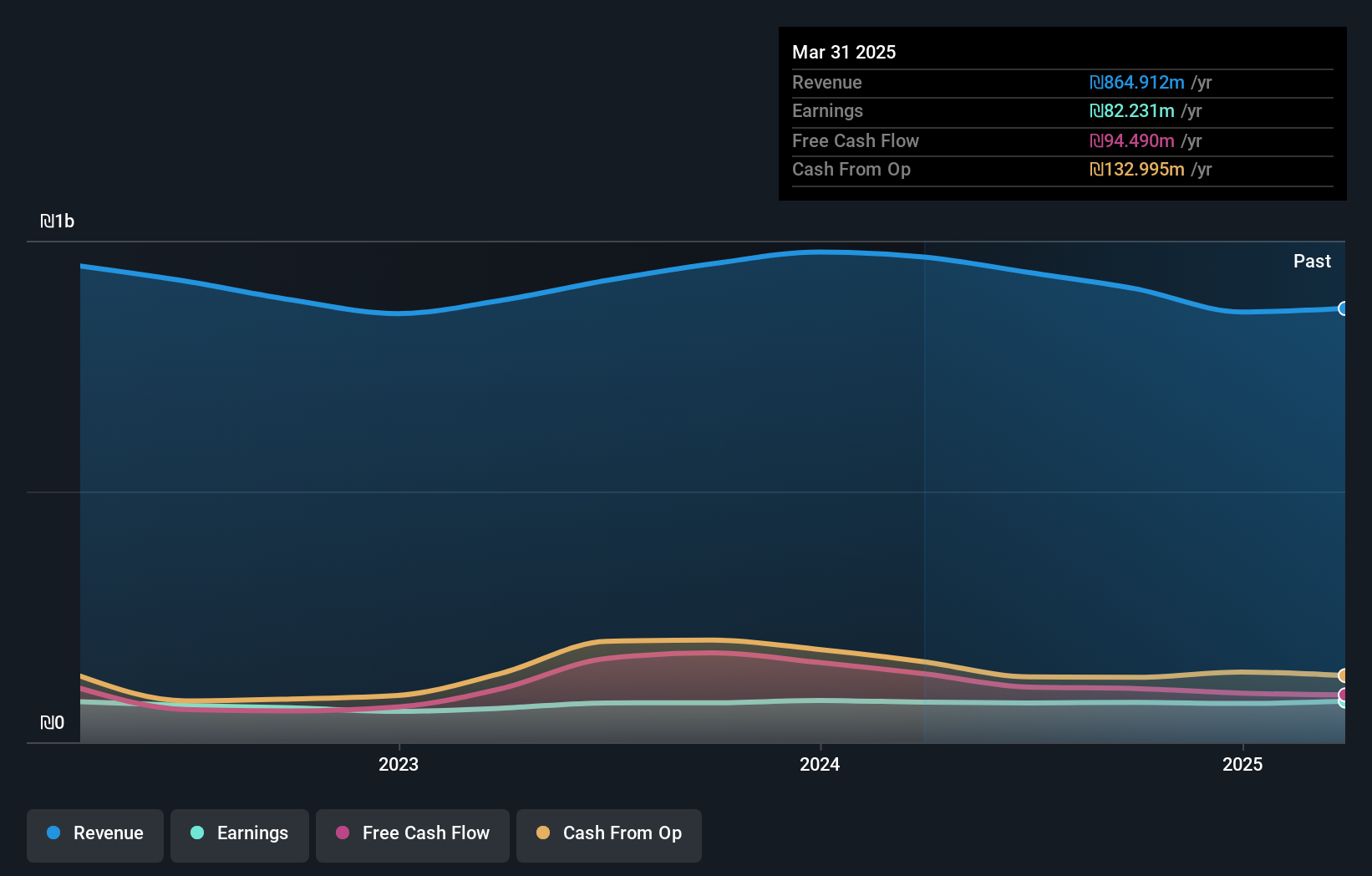

Operations: Stark Technology generates revenue primarily through its computer services segment, which amounts to NT$7.27 billion.

Stark Technology, a small player in the tech space, is trading at 46.7% below its fair value estimate, which may catch the eye of value seekers. Despite negative earnings growth of -0.1% over the past year compared to an industry average of 6.6%, it remains profitable with no cash runway concerns. The firm's debt-to-equity ratio has climbed from 1.3 to 2 over five years, indicating rising leverage but manageable given its high-quality earnings and positive free cash flow status. Stark's ability to cover interest payments comfortably adds a layer of financial stability amidst these challenges.

- Click here and access our complete health analysis report to understand the dynamics of Stark Technology.

Explore historical data to track Stark Technology's performance over time in our Past section.

TWOWAY Communications (TWSE:8045)

Simply Wall St Value Rating: ★★★★★★

Overview: TWOWAY Communications, Inc. specializes in the research, development, manufacturing, and sale of RF and optical transmission equipment on a global scale with a market cap of NT$11.48 billion.

Operations: TWOWAY Communications generates revenue primarily from its Broadband Network Equipment Division, contributing NT$3.21 billion, followed by the IOT Division at NT$377.92 million and the Labor and Other Business Division at NT$226.55 million. The company incurs adjustments and write-offs amounting to -NT$1.53 billion, impacting overall financial performance.

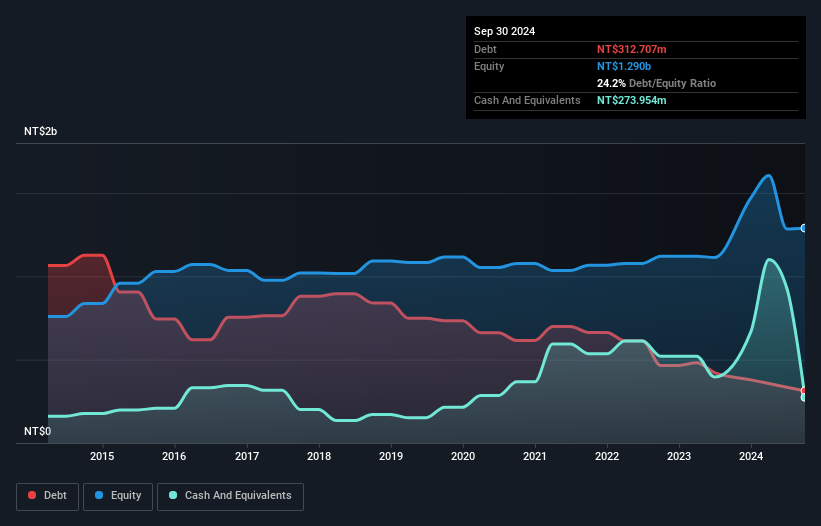

TWOWAY Communications, a relatively small player in the communications sector, has shown impressive earnings growth of 53.5% over the past year, outpacing the industry average of -9.2%. The company's debt situation appears robust with a net debt to equity ratio at a satisfactory 3%, reduced from 65.8% to 24.2% over five years. Despite high-quality past earnings and positive free cash flow, recent financial results indicate challenges; sales dropped to TWD 390 million from TWD 787 million year-over-year for Q3, with net income falling sharply to TWD 5.91 million from TWD 173 million previously.

- Dive into the specifics of TWOWAY Communications here with our thorough health report.

Evaluate TWOWAY Communications' historical performance by accessing our past performance report.

Next Steps

- Explore the 4678 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2480

Stark Technology

Provides system integration services for information and communication technology products in Taiwan.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives