- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6835

Is Weakness In Complex Micro Interconnection Co.,Ltd. (TWSE:6835) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

Complex Micro InterconnectionLtd (TWSE:6835) has had a rough week with its share price down 12%. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study Complex Micro InterconnectionLtd's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Complex Micro InterconnectionLtd

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Complex Micro InterconnectionLtd is:

17% = NT$277m ÷ NT$1.6b (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.17 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Complex Micro InterconnectionLtd's Earnings Growth And 17% ROE

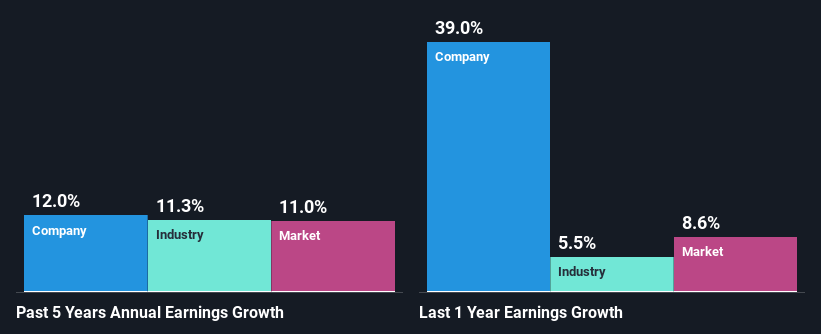

To begin with, Complex Micro InterconnectionLtd seems to have a respectable ROE. Especially when compared to the industry average of 8.7% the company's ROE looks pretty impressive. This probably laid the ground for Complex Micro InterconnectionLtd's moderate 12% net income growth seen over the past five years.

As a next step, we compared Complex Micro InterconnectionLtd's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 11% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Complex Micro InterconnectionLtd's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Complex Micro InterconnectionLtd Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 58% (or a retention ratio of 42%) for Complex Micro InterconnectionLtd suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

While Complex Micro InterconnectionLtd has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

Conclusion

In total, we are pretty happy with Complex Micro InterconnectionLtd's performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. Up till now, we've only made a short study of the company's growth data. To gain further insights into Complex Micro InterconnectionLtd's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6835

Complex Micro InterconnectionLtd

Manufactures and sells flexible circuit boards and cables in Taiwan, China, and Thailand.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Dillard's Inc. (DDS): The Retail Cash Machine – Navigating Seasonal Storms with a Fortress Balance Sheet in 2026.

Curtiss-Wright Corp. (CW): The Mission-Critical Architect – Driving Defense and Nuclear Modernization in 2026.

Vanguard Information Technology ETF (VGT): The AI Aggregator – Navigating Concentration Risk in a Mega-Cap Dominated Market.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks