- Taiwan

- /

- Communications

- /

- TWSE:5388

3 Reliable Dividend Stocks Yielding Up To 9.9%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating interest rates and geopolitical tensions, investors are keeping a keen eye on the performance of major indices. With U.S. stocks experiencing volatility amid AI competition fears and European markets buoyed by strong earnings, the search for reliable income sources like dividend stocks becomes increasingly relevant. In such an environment, selecting dividend stocks that offer stability and attractive yields can be a prudent strategy for those seeking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

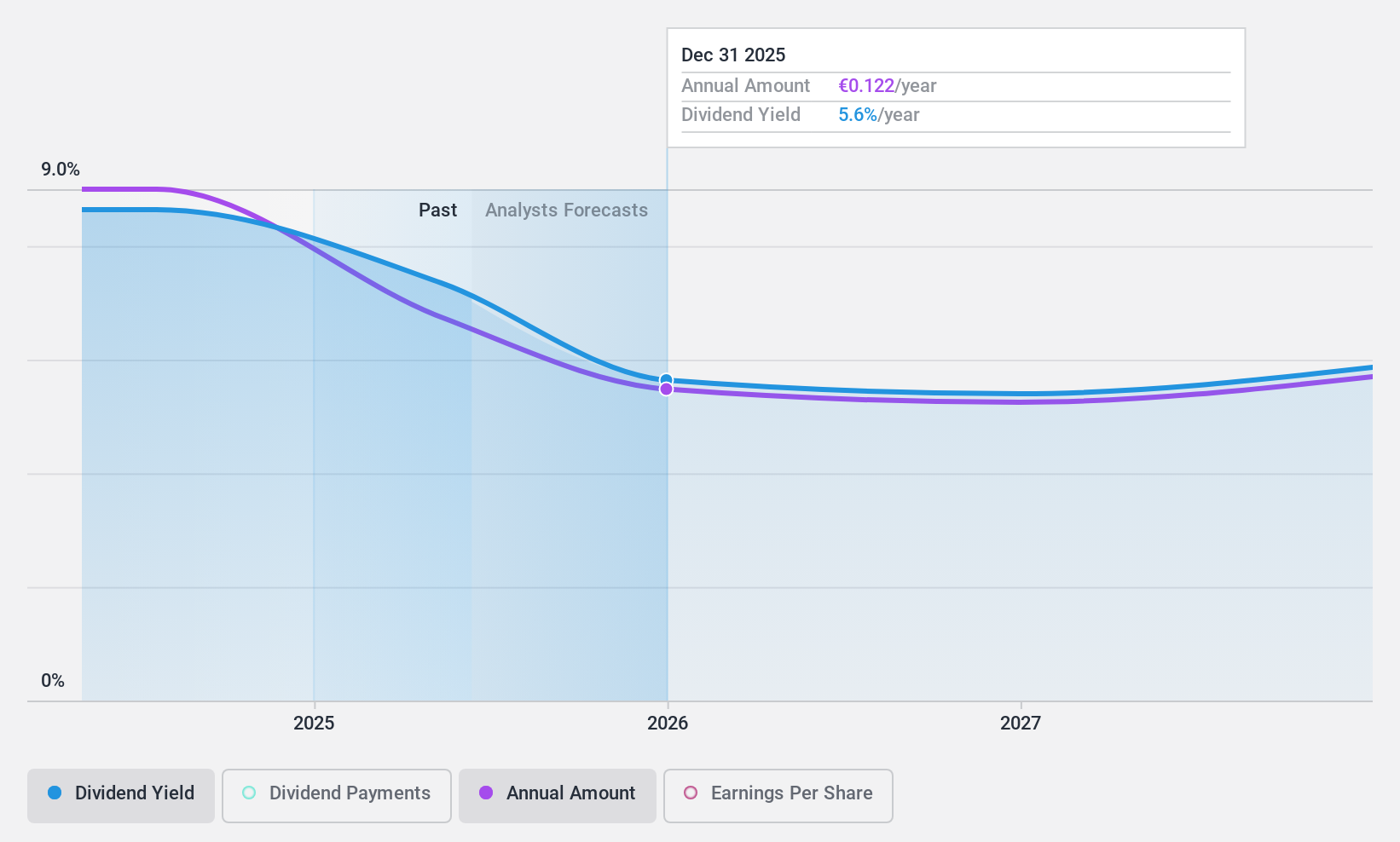

Sogefi (BIT:SGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sogefi S.p.A. is a company that designs, develops, and produces filtration systems, suspension components, air management products, and engine cooling systems for the automotive industry across Europe, South America, North America, and Asia with a market cap of €235.11 million.

Operations: Sogefi S.p.A.'s revenue primarily comes from its Suspensions segment, generating €546.31 million, and its Air and Cooling segment, contributing €479.15 million.

Dividend Yield: 10%

Sogefi's dividend, yielding 9.98%, ranks in the top 25% of Italian market payers. With a payout ratio of 33.2% and cash payout ratio of 39.9%, dividends are well-covered by earnings and cash flows, though it's too early to assess stability or growth since they recently initiated payouts. Despite trading at a discount to estimated fair value, earnings are forecasted to decline significantly over the next three years, which may impact future dividend sustainability.

- Navigate through the intricacies of Sogefi with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Sogefi's share price might be too pessimistic.

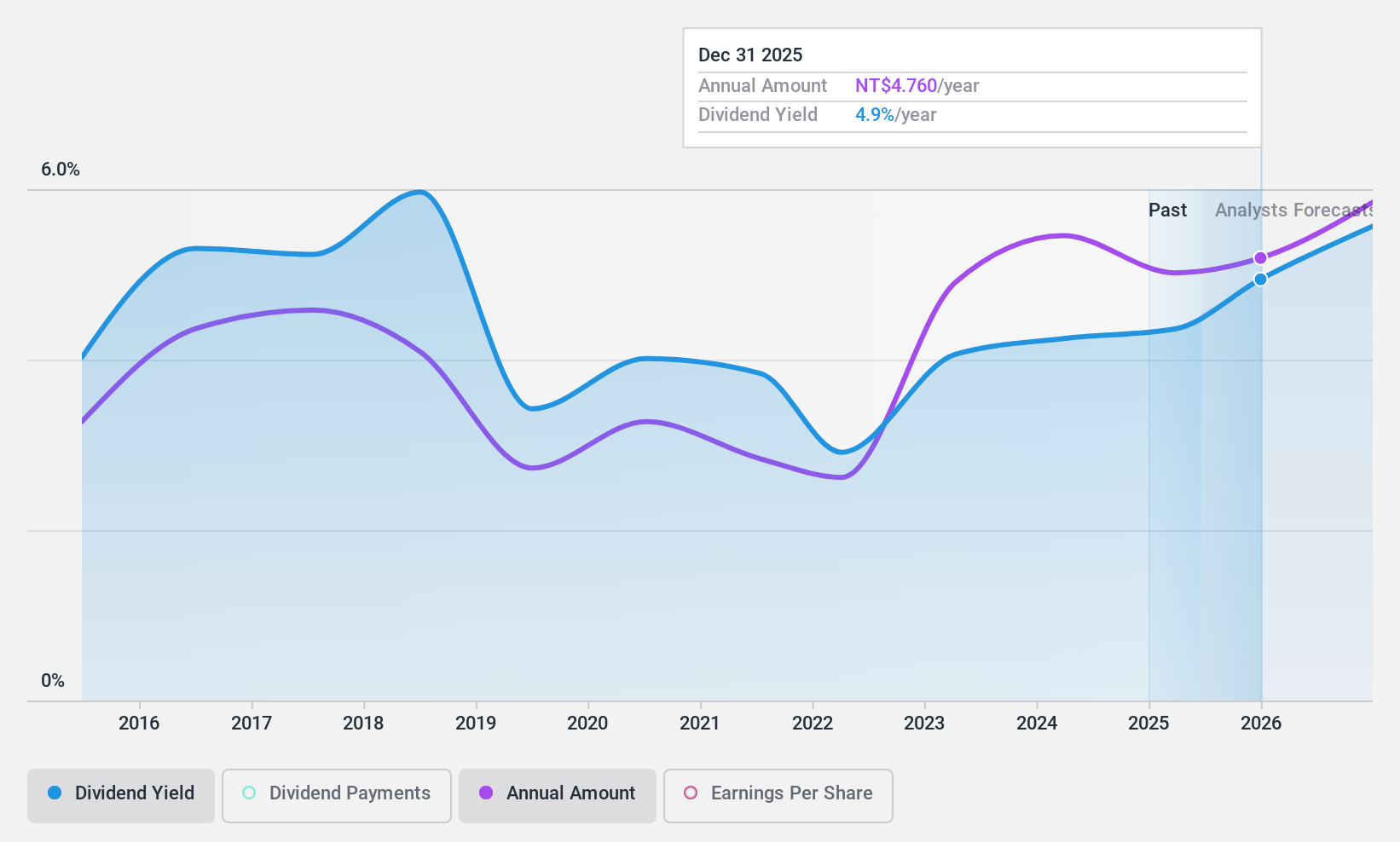

Sercomm (TWSE:5388)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sercomm Corporation engages in the research, development, manufacturing, and sale of networking communication software and equipment across North America, Europe, and the Asia Pacific, with a market cap of NT$39.11 billion.

Operations: Sercomm Corporation's revenue from its Computer Networks segment is NT$58.99 billion.

Dividend Yield: 3.8%

Sercomm's dividend yield of 3.82% is below the top quartile in Taiwan, with payments covered by earnings (58.2% payout ratio) and cash flows (56.9% cash payout ratio). Despite recent earnings growth of 7.1%, its dividend history is marked by volatility and unreliability, though there has been an increase over the past decade. The stock trades at a significant discount to its estimated fair value, suggesting potential value despite an unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Sercomm.

- The analysis detailed in our Sercomm valuation report hints at an deflated share price compared to its estimated value.

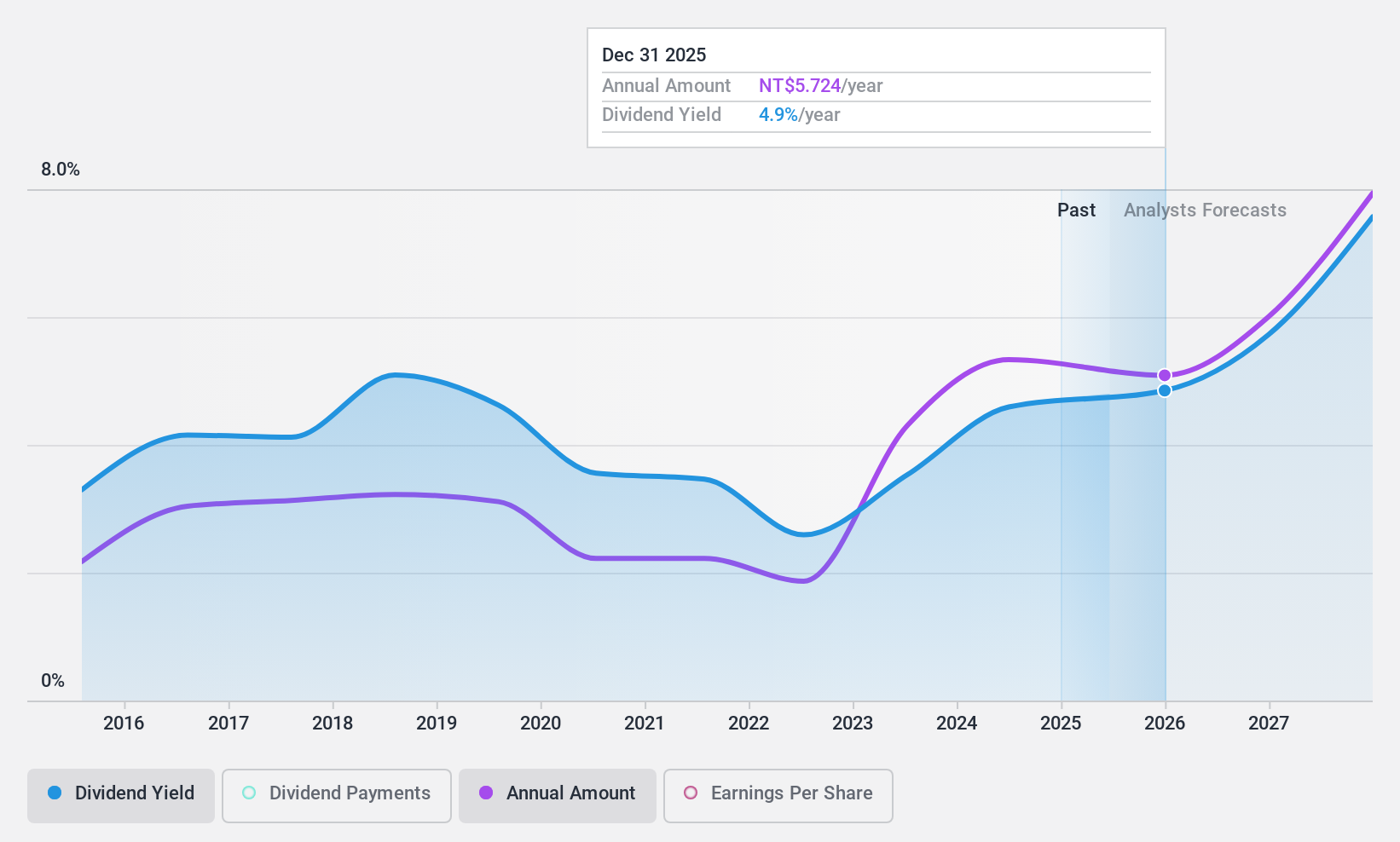

Wistron NeWeb (TWSE:6285)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wistron NeWeb Corporation focuses on the research, development, manufacturing, and sale of satellite communication systems and mobile and portable communication equipment across the Americas, Asia, Europe, and internationally with a market cap of NT$72.05 billion.

Operations: Wistron NeWeb Corporation's revenue from Wireless Communications Equipment amounts to NT$111.95 billion.

Dividend Yield: 4%

Wistron NeWeb's dividend yield of 4.04% falls short of Taiwan's top 25% payers, but payments are supported by earnings (85% payout ratio) and cash flows (70.5% cash payout ratio). Despite a history of volatility and unreliability in dividends, there has been growth over the past decade. Trading at a discount to its estimated fair value, recent earnings have declined, with Q3 net income dropping significantly year-over-year to TWD 519.9 million from TWD 1,411.97 million.

- Unlock comprehensive insights into our analysis of Wistron NeWeb stock in this dividend report.

- The valuation report we've compiled suggests that Wistron NeWeb's current price could be quite moderate.

Seize The Opportunity

- Investigate our full lineup of 1972 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5388

Sercomm

Researches, develops, manufactures, and sells networking communication software and equipment in North America, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026