- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6230

Nidec Chaun-Choung Technology's (TWSE:6230 five-year decrease in earnings delivers investors with a 28% loss

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Nidec Chaun-Choung Technology Corporation (TWSE:6230) shareholders for doubting their decision to hold, with the stock down 32% over a half decade. Furthermore, it's down 26% in about a quarter. That's not much fun for holders.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Nidec Chaun-Choung Technology

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

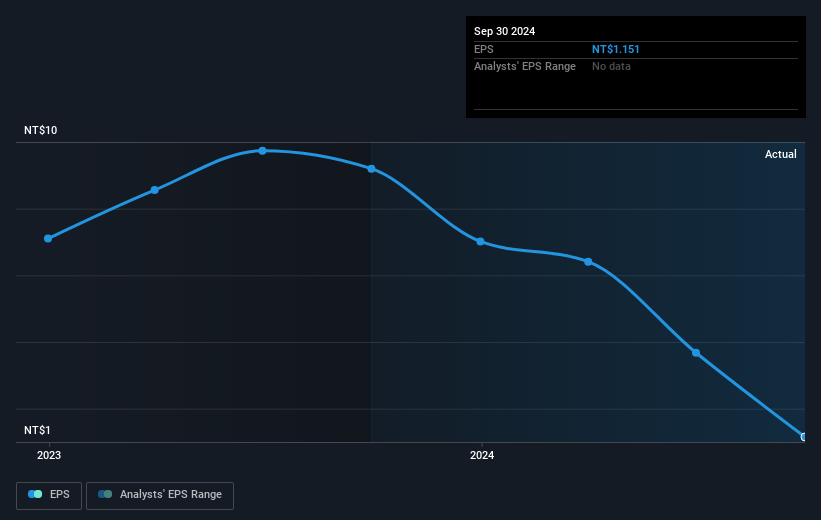

During the five years over which the share price declined, Nidec Chaun-Choung Technology's earnings per share (EPS) dropped by 34% each year. The share price decline of 7% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. With a P/E ratio of 136.80, it's fair to say the market sees a brighter future for the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Nidec Chaun-Choung Technology, it has a TSR of -28% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Nidec Chaun-Choung Technology shareholders gained a total return of 6.5% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Nidec Chaun-Choung Technology (of which 1 is concerning!) you should know about.

Of course Nidec Chaun-Choung Technology may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nidec Chaun-Choung Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6230

Nidec Chaun-Choung Technology

Processes, manufactures, and trades heat dissipation components for computer industry and related peripheral products in Taiwan, Mainland China, Singapore, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Parker-Hannifin Corp (PH): The "Industrial Compounder" Navigating Geopolitical Headwinds and Aerospace Records.

Samsung Electronics (005930): The HBM4 Counter-Offensive – Reclaiming AI Relevance Amidst Global Macro Chaos.

SK Hynix (000660): The AI Memory Vanguard – Navigating the "Iran War" Rout and HBM4 Readiness.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026