- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6230

Nidec Chaun-Choung Technology Corporation (TWSE:6230) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Nidec Chaun-Choung Technology Corporation (TWSE:6230) shares have continued their recent momentum with a 29% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

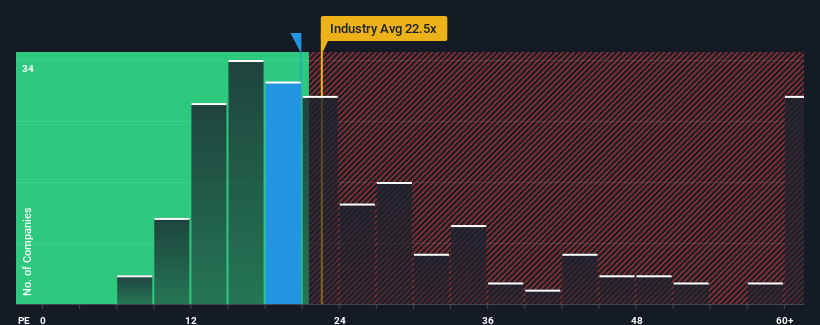

Although its price has surged higher, there still wouldn't be many who think Nidec Chaun-Choung Technology's price-to-earnings (or "P/E") ratio of 20.8x is worth a mention when the median P/E in Taiwan is similar at about 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Nidec Chaun-Choung Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Nidec Chaun-Choung Technology

Is There Some Growth For Nidec Chaun-Choung Technology?

The only time you'd be comfortable seeing a P/E like Nidec Chaun-Choung Technology's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 99% last year. The latest three year period has also seen a 19% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 25% over the next year. That's not great when the rest of the market is expected to grow by 23%.

In light of this, it's somewhat alarming that Nidec Chaun-Choung Technology's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Nidec Chaun-Choung Technology's P/E?

Nidec Chaun-Choung Technology appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Nidec Chaun-Choung Technology's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Nidec Chaun-Choung Technology has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nidec Chaun-Choung Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6230

Nidec Chaun-Choung Technology

Processes, manufactures, and trades heat dissipation components for computer industry and related peripheral products in Taiwan, Mainland China, Singapore, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)