- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6213

ITEQ (TWSE:6213) earnings and shareholder returns have been trending downwards for the last five years, but the stock increases 6.2% this past week

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in ITEQ Corporation (TWSE:6213), since the last five years saw the share price fall 50%. The falls have accelerated recently, with the share price down 19% in the last three months.

On a more encouraging note the company has added NT$1.7b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Check out our latest analysis for ITEQ

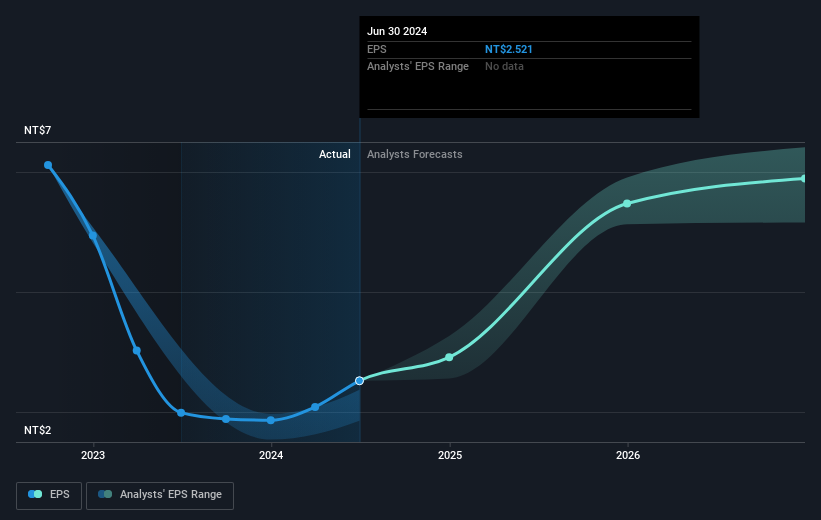

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, ITEQ's earnings per share (EPS) dropped by 18% each year. This fall in the EPS is worse than the 13% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that ITEQ has improved its bottom line lately, but is it going to grow revenue? Check if analysts think ITEQ will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, ITEQ's TSR for the last 5 years was -39%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

ITEQ shareholders are down 3.7% for the year (even including dividends), but the market itself is up 46%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with ITEQ , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6213

ITEQ

Engages in the manufacture and sale of copper clad laminate materials used for fabrication of printed circuit boards in Taiwan, Asia, Europe, and internationally.

Flawless balance sheet with proven track record.