- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:5484

EverFocus Electronics (TWSE:5484) delivers shareholders incredible 39% CAGR over 5 years, surging 16% in the last week alone

While EverFocus Electronics Corporation (TWSE:5484) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 405% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Since it's been a strong week for EverFocus Electronics shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for EverFocus Electronics

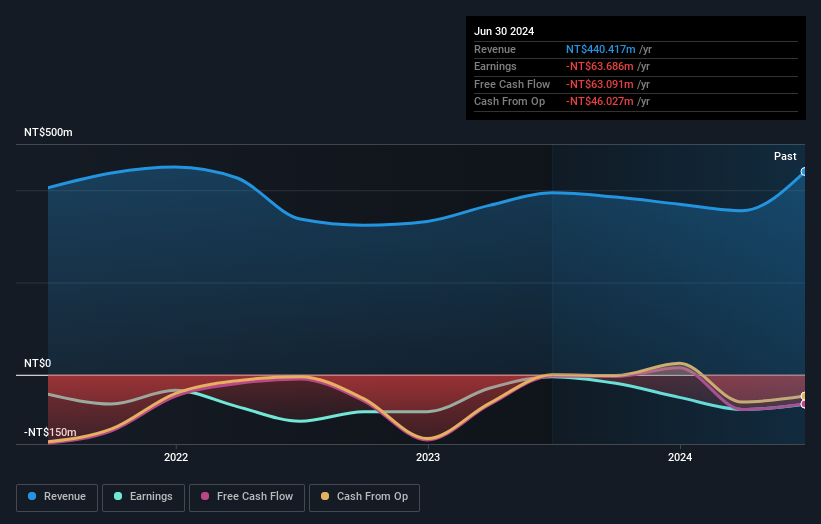

Given that EverFocus Electronics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years EverFocus Electronics saw its revenue grow at 5.4% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 38% increase per year, in that time. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling EverFocus Electronics stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered EverFocus Electronics' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that EverFocus Electronics' TSR, at 418% is higher than its share price return of 405%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that EverFocus Electronics shareholders have received a total shareholder return of 211% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 39% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that EverFocus Electronics is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EverFocus Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:5484

EverFocus Electronics

Engages in the design, production, sale, installation, import, and export of electronic surveillance products and equipment in Taiwan, Asia, the United States, Europe, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives