Undiscovered Gems Three Promising Small Caps on None Exchange

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced heightened volatility, with indexes like the S&P 600 experiencing notable declines amid cautious Federal Reserve commentary and political uncertainties. Despite these challenges, economic indicators such as robust consumer spending and positive jobs data suggest underlying resilience that could benefit smaller companies poised for growth. Identifying promising small-cap stocks often involves looking for those with strong fundamentals and potential to thrive in turbulent markets. In this article, we explore three lesser-known small caps on None Exchange that may offer intriguing opportunities amidst today's complex economic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

TK Group (Holdings) (SEHK:2283)

Simply Wall St Value Rating: ★★★★★★

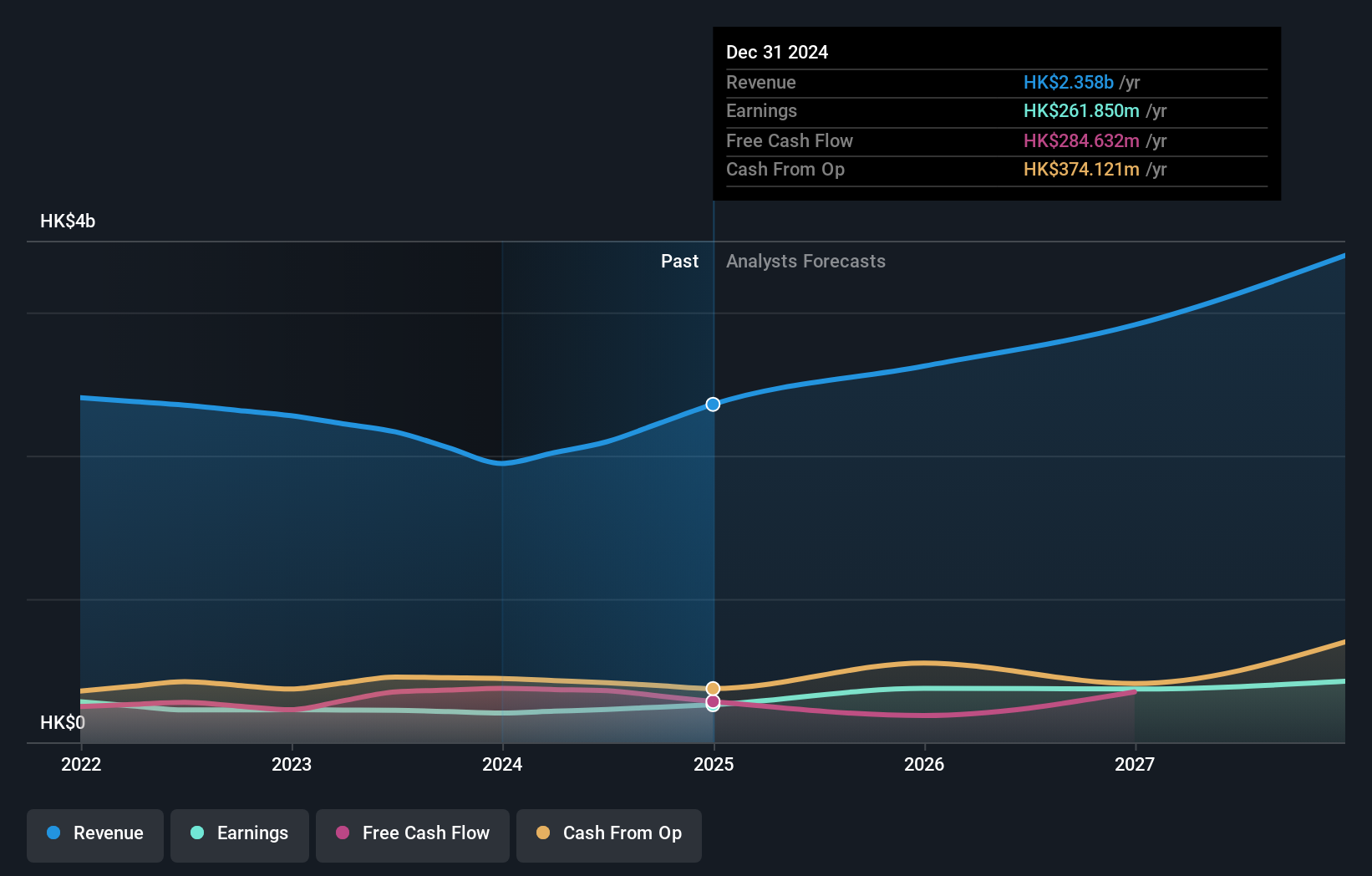

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components with a market cap of HK$2.09 billion.

Operations: TK Group generates revenue primarily from mold fabrication and plastic components manufacturing, with the latter contributing HK$1.47 billion. The net profit margin is a key financial metric to consider when evaluating its profitability.

TK Group, a nimble player in the machinery sector, stands out with its debt-free status and high-quality earnings. Despite a modest 2.7% earnings growth over the past year, trailing the industry's 7.8%, it has significantly reduced its debt from a 52.2% debt-to-equity ratio five years ago to none today. The company is trading at 68.2% below our fair value estimate, suggesting potential undervaluation in the market's eyes. With forecasted earnings growth of 19.11% annually, TK Group seems poised for future expansion while maintaining robust financial health through positive free cash flow generation (A$376 million as of December).

- Navigate through the intricacies of TK Group (Holdings) with our comprehensive health report here.

Gain insights into TK Group (Holdings)'s past trends and performance with our Past report.

APT Electronics (SEHK:2551)

Simply Wall St Value Rating: ★★★★★★

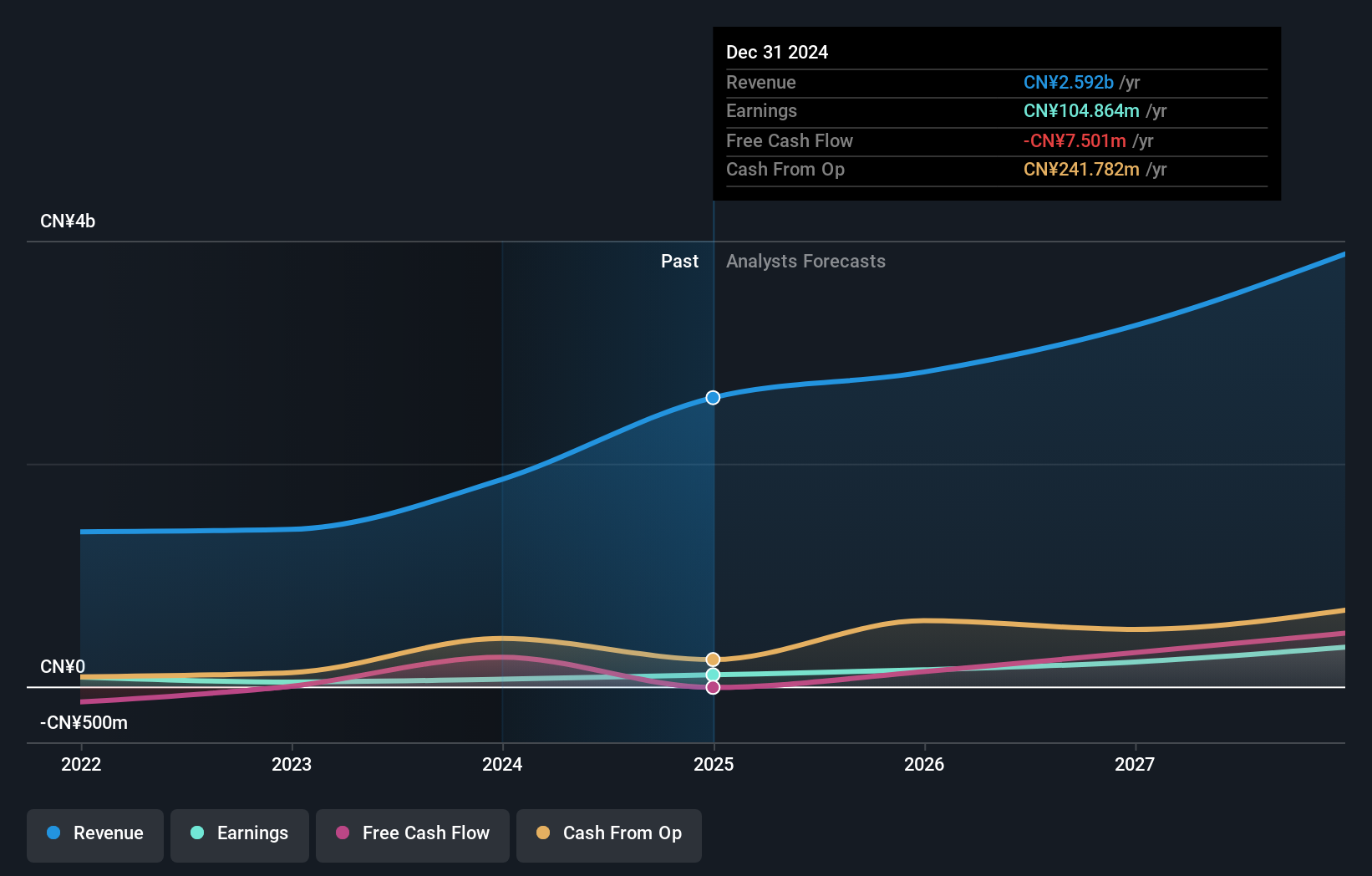

Overview: APT Electronics Co., Ltd. is engaged in the provision of intelligent vision products and system solutions, with a market capitalization of approximately HK$2.02 billion.

Operations: APT Electronics generates revenue primarily from its Electric Lighting & Other Fixtures segment, amounting to CN¥1858.03 million.

Recently, APT Electronics completed an IPO raising HKD 139.49 million, offering shares at HKD 3.61 each with a discount of HKD 0.33 per share. This move likely bolsters their capital structure, aligning with their impressive earnings growth of 62.7% over the past year—far outpacing the electrical industry's average of 7.7%. The company's strong financial health is underscored by its debt to equity ratio improvement from 12.3% to 7.8% over five years and having more cash than total debt, indicating robust management and potential for future expansion in the competitive market landscape.

- Click here and access our complete health analysis report to understand the dynamics of APT Electronics.

Gain insights into APT Electronics' historical performance by reviewing our past performance report.

AzureWave Technologies (TWSE:3694)

Simply Wall St Value Rating: ★★★★★★

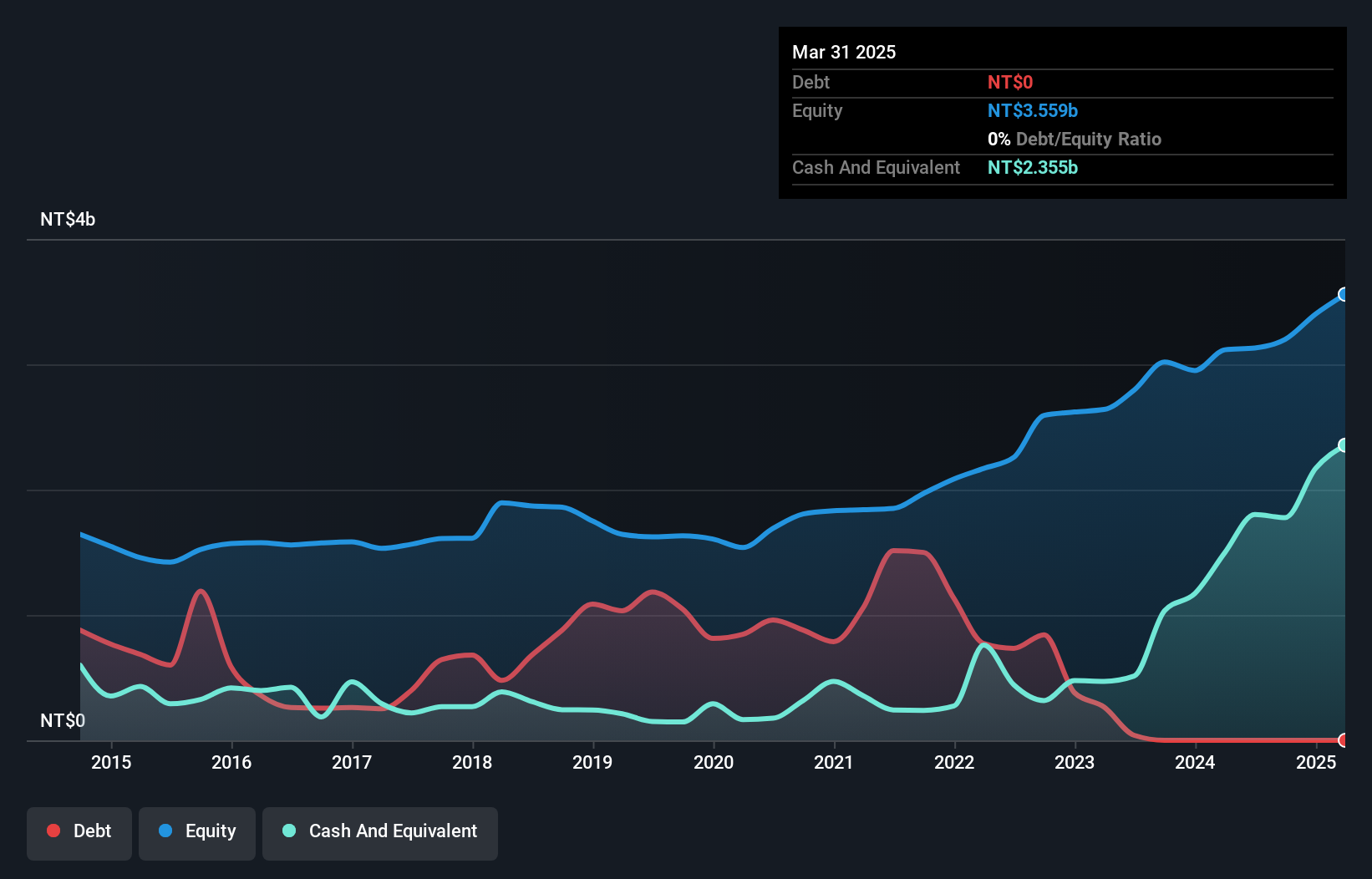

Overview: AzureWave Technologies, Inc. focuses on the manufacture and sale of wireless connectivity and image processing solutions globally, with a market cap of NT$8.21 billion.

Operations: AzureWave Technologies generates revenue primarily from its Wireless Network and Computer Peripheral Product segment, totaling NT$9.24 billion. The company operates within a market cap of approximately NT$8.21 billion.

AzureWave Technologies, a notable player in the electronics sector, showcases a robust financial profile with no debt compared to five years ago when its debt-to-equity ratio was 64.2%. Over the past five years, earnings have surged at an impressive rate of 29.5% annually, indicating strong growth potential despite recent volatility in share prices. The company reported third-quarter net income of TWD 140.64 million, up from TWD 133.8 million last year, with basic earnings per share rising to TWD 0.93 from TWD 0.87. Trading at about 13% below estimated fair value suggests potential undervaluation opportunities for investors eyeing this gem in the market landscape.

- Unlock comprehensive insights into our analysis of AzureWave Technologies stock in this health report.

Evaluate AzureWave Technologies' historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4611 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TK Group (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2283

TK Group (Holdings)

An investment holding company, engages in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion