- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3694

Undiscovered Gems Featuring 3 Promising Stocks On None Exchange

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, major U.S. indices experienced declines despite early gains, reflecting broader market apprehensions about economic stability. Amidst this backdrop of uncertainty, small-cap stocks have faced their own challenges, with the S&P MidCap 400 and Russell 2000 both showing negative performance year-to-date. In such an environment, identifying promising stocks often involves looking for companies that demonstrate resilience through strong fundamentals or innovative potential—qualities that can help them thrive even when broader market sentiment is less favorable.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.20% | 3.31% | 9.07% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| GENOVA | 0.46% | 25.48% | 27.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hangzhou Greenda Electronic Materials (SHSE:603931)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Greenda Electronic Materials Co., Ltd. operates in the electronic materials industry with a market cap of approximately CN¥4.78 billion.

Operations: The company generates revenue primarily from its electronic materials segment. The net profit margin has shown fluctuations, reaching 15% in the most recent period.

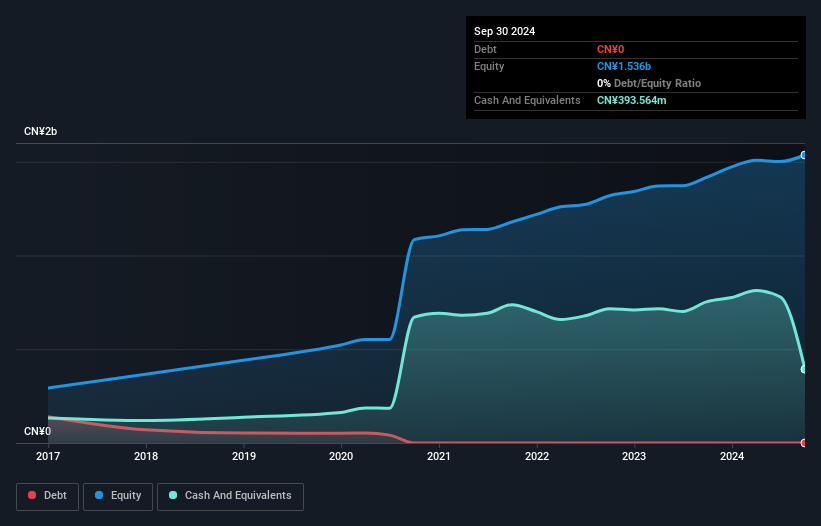

Hangzhou Greenda Electronic Materials, a smaller player in the market, is showing promising signs with its earnings growth of 11.6% over the past year, outpacing the Chemicals industry which saw a -5.4% change. The company boasts high-quality earnings and remains debt-free, having reduced its debt from a 10.5% debt-to-equity ratio five years ago to zero today. Its price-to-earnings ratio stands at 29x, below the CN market average of 38x, suggesting potential value for investors seeking opportunities in this sector. Additionally, positive free cash flow further supports its financial health and operational efficiency in recent quarters.

AzureWave Technologies (TWSE:3694)

Simply Wall St Value Rating: ★★★★★★

Overview: AzureWave Technologies, Inc. specializes in producing and distributing wireless connectivity and image processing solutions globally, with a market capitalization of NT$9.60 billion.

Operations: AzureWave Technologies generates revenue primarily from its Wireless Network and Computer Peripheral Product segment, totaling NT$9.24 billion.

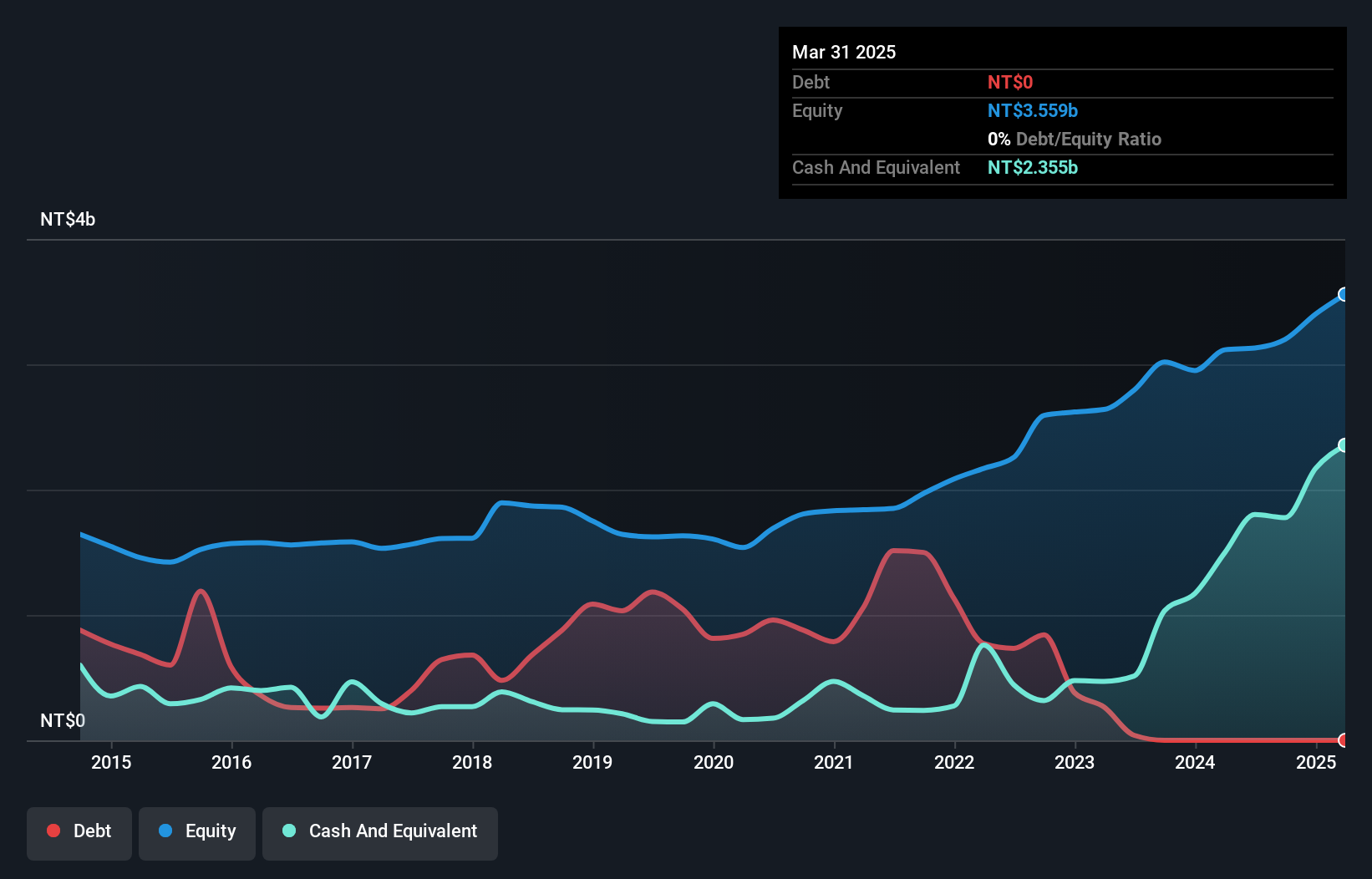

AzureWave Technologies, a nimble player in the electronics sector, has shown impressive financial health with zero debt and a significant reduction from a 64.2% debt-to-equity ratio five years ago. The company boasts high-quality earnings and has seen its profits grow at an annual rate of 29.5% over the past five years, although recent growth of 6.6% slightly trails the industry average of 7.8%. Despite its volatile share price recently, AzureWave remains free cash flow positive as evidenced by its latest levered free cash flow figure of US$1.01 billion for September 2024, suggesting robust operational efficiency and potential for future growth in a competitive market landscape.

Newag (WSE:NWG)

Simply Wall St Value Rating: ★★★★★★

Overview: Newag S.A. is a Polish company involved in the production and sale of railway locomotives and rolling stock, with a market capitalization of PLN2.47 billion.

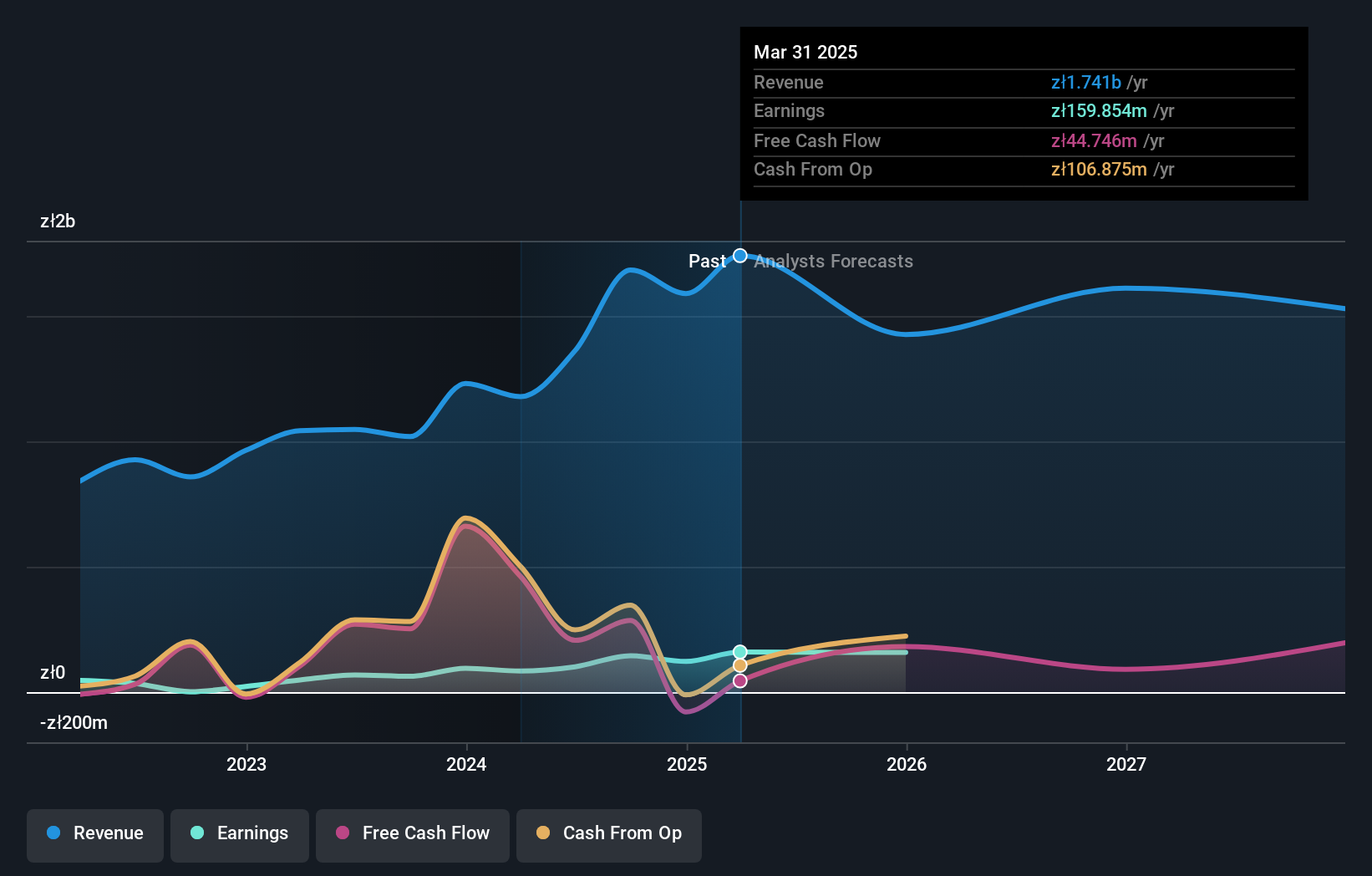

Operations: Newag generates revenue primarily from repair services, modernization of rolling stock, and production of rolling stock and control systems, amounting to PLN1.77 billion. Activities of financial holdings contribute an additional PLN85.93 million to the revenue stream.

Newag's financial health paints a robust picture with earnings surging 130.9% last year, outpacing the Machinery industry's 7.6%. The company's debt to equity ratio has impressively reduced from 82% to 13.2% over five years, indicating prudent financial management. With high-quality earnings and interest payments well covered by EBIT at a multiple of 34.8x, Newag seems poised for steady growth in the coming years, forecasted at an annual rate of 15.87%. This profitability and positive free cash flow position it as a promising player in its sector, offering potential value for investors seeking growth opportunities.

- Click here to discover the nuances of Newag with our detailed analytical health report.

Examine Newag's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Dive into all 4749 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3694

AzureWave Technologies

Engages in the manufacture and sale of wireless connectivity and image processing solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in