- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3694

AzureWave Technologies, Inc. (TWSE:3694) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

AzureWave Technologies, Inc. (TWSE:3694) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last month tops off a massive increase of 107% in the last year.

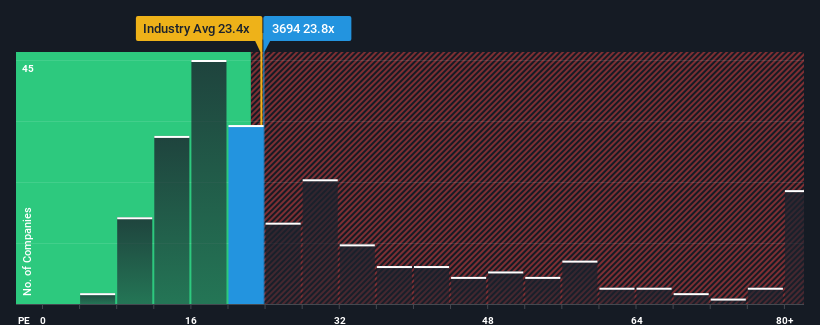

Although its price has surged higher, you could still be forgiven for feeling indifferent about AzureWave Technologies' P/E ratio of 23.8x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 22x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen firmly for AzureWave Technologies recently, which is pleasing to see. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for AzureWave Technologies

How Is AzureWave Technologies' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like AzureWave Technologies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. Still, lamentably EPS has fallen 8.7% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 25% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that AzureWave Technologies is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On AzureWave Technologies' P/E

AzureWave Technologies appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that AzureWave Technologies currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for AzureWave Technologies that you should be aware of.

If you're unsure about the strength of AzureWave Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3694

AzureWave Technologies

Engages in the manufacture and sale of wireless connectivity and image processing solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion