- Taiwan

- /

- Communications

- /

- TWSE:3596

Asian Dividend Stocks Yielding Up To 6.4%

Reviewed by Simply Wall St

As global markets respond to potential interest rate cuts and shifting economic conditions, Asian equities have shown resilience, with China's recent stock market rally highlighting renewed investor optimism. In this climate, dividend stocks in Asia are gaining attention for their potential to provide steady income streams amidst fluctuating market dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.89% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.52% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.73% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.76% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

Click here to see the full list of 1046 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

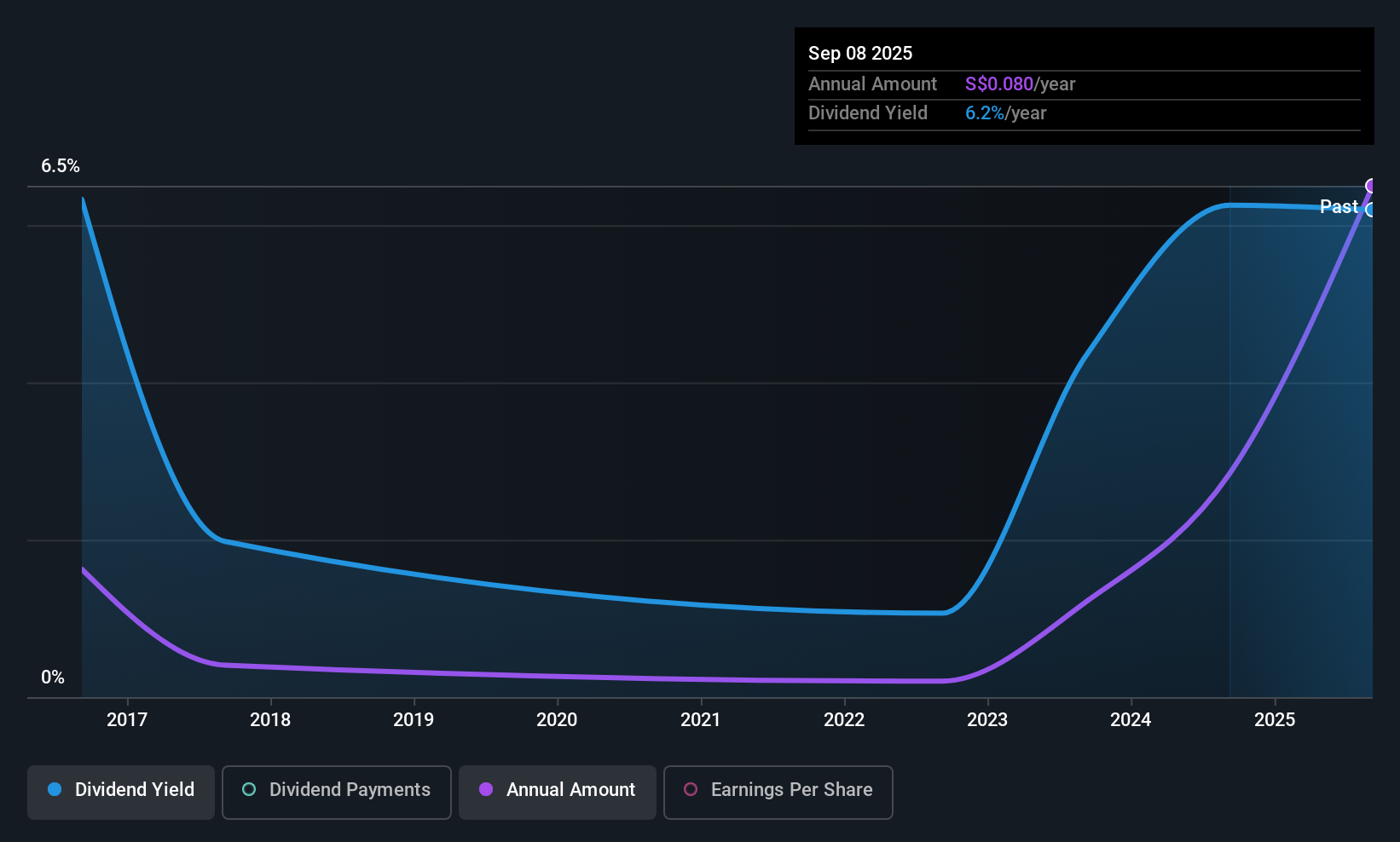

XMH Holdings (SGX:BQF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: XMH Holdings Ltd. is an investment holding company that offers diesel engine, propulsion, and power generating solutions for the marine and industrial sectors across Singapore, Indonesia, Malaysia, Vietnam, and internationally with a market cap of SGD137.05 million.

Operations: XMH Holdings Ltd. generates revenue through three main segments: Projects (SGD65.48 million), After-Sales (SGD25.77 million), and Distribution (SGD138.88 million).

Dividend Yield: 6.4%

XMH Holdings proposes a final dividend of 0.25 Singapore cents and a special dividend of 7.75 Singapore cents per share, pending approval at the AGM on August 28, 2025. Despite strong earnings growth and a low payout ratio indicating dividends are covered by earnings, cash flow coverage is weak with a high cash payout ratio. Dividend payments have been volatile over the past decade, impacting reliability despite being in the top tier for yield in Singapore's market.

- Click to explore a detailed breakdown of our findings in XMH Holdings' dividend report.

- Upon reviewing our latest valuation report, XMH Holdings' share price might be too optimistic.

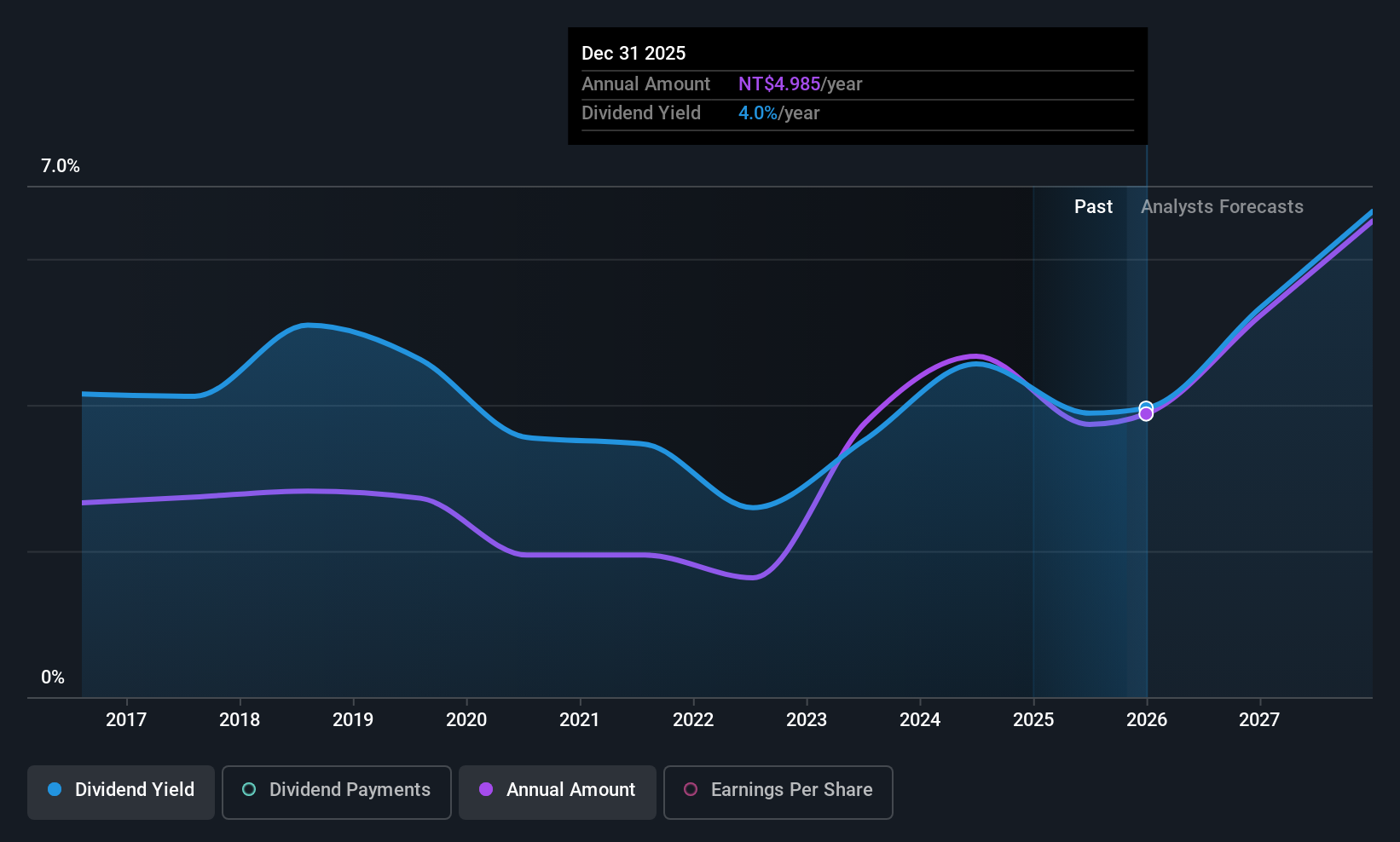

Arcadyan Technology (TWSE:3596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions and has a market cap of NT$54.98 billion.

Operations: Arcadyan Technology Corporation generates revenue primarily from its Communication Network segment, which accounts for NT$50.42 billion.

Dividend Yield: 3%

Arcadyan Technology's recent earnings report shows a solid performance, with net income rising to TWD 665.79 million in Q2 2025. The company's dividend payout ratio of 63% suggests dividends are well-covered by earnings and cash flows, given the low cash payout ratio of 29.3%. However, its dividend yield of 3.01% is below the top tier in Taiwan's market, and past dividend payments have been volatile and unreliable despite growth over the last decade.

- Get an in-depth perspective on Arcadyan Technology's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Arcadyan Technology is priced higher than what may be justified by its financials.

WNC (TWSE:6285)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WNC Corporation focuses on the research, development, manufacture, and sale of satellite communication systems and mobile communication equipment across the Americas, Asia, Europe, and globally with a market cap of NT$62.94 billion.

Operations: WNC Corporation's revenue primarily comes from its Wireless Communications Equipment segment, which generated NT$109.77 billion.

Dividend Yield: 3.7%

WNC Corporation's recent earnings show a decline, with Q2 2025 net income at TWD 493.17 million. Despite this, its dividend payments are well-covered by cash flows, reflected in a low cash payout ratio of 27.3%. However, the dividend yield of 3.69% is below Taiwan's top tier and has been volatile over the past decade despite growth. A strategic collaboration with EigenQ may bolster future prospects but doesn't directly impact current dividends.

- Delve into the full analysis dividend report here for a deeper understanding of WNC.

- In light of our recent valuation report, it seems possible that WNC is trading behind its estimated value.

Key Takeaways

- Dive into all 1046 of the Top Asian Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3596

Arcadyan Technology

Primarily engages in the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion