- Japan

- /

- Auto Components

- /

- TSE:7250

3 Global Dividend Stocks To Watch With Up To 3.8% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, with consumer inflation heating up in the U.S. and solid corporate earnings supporting stock indices like the S&P 500 and Nasdaq Composite, investors are keenly observing opportunities for stable returns. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option to consider amidst fluctuating market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.13% | ★★★★★★ |

| NCD (TSE:4783) | 4.12% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.07% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.57% | ★★★★★★ |

Click here to see the full list of 1481 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

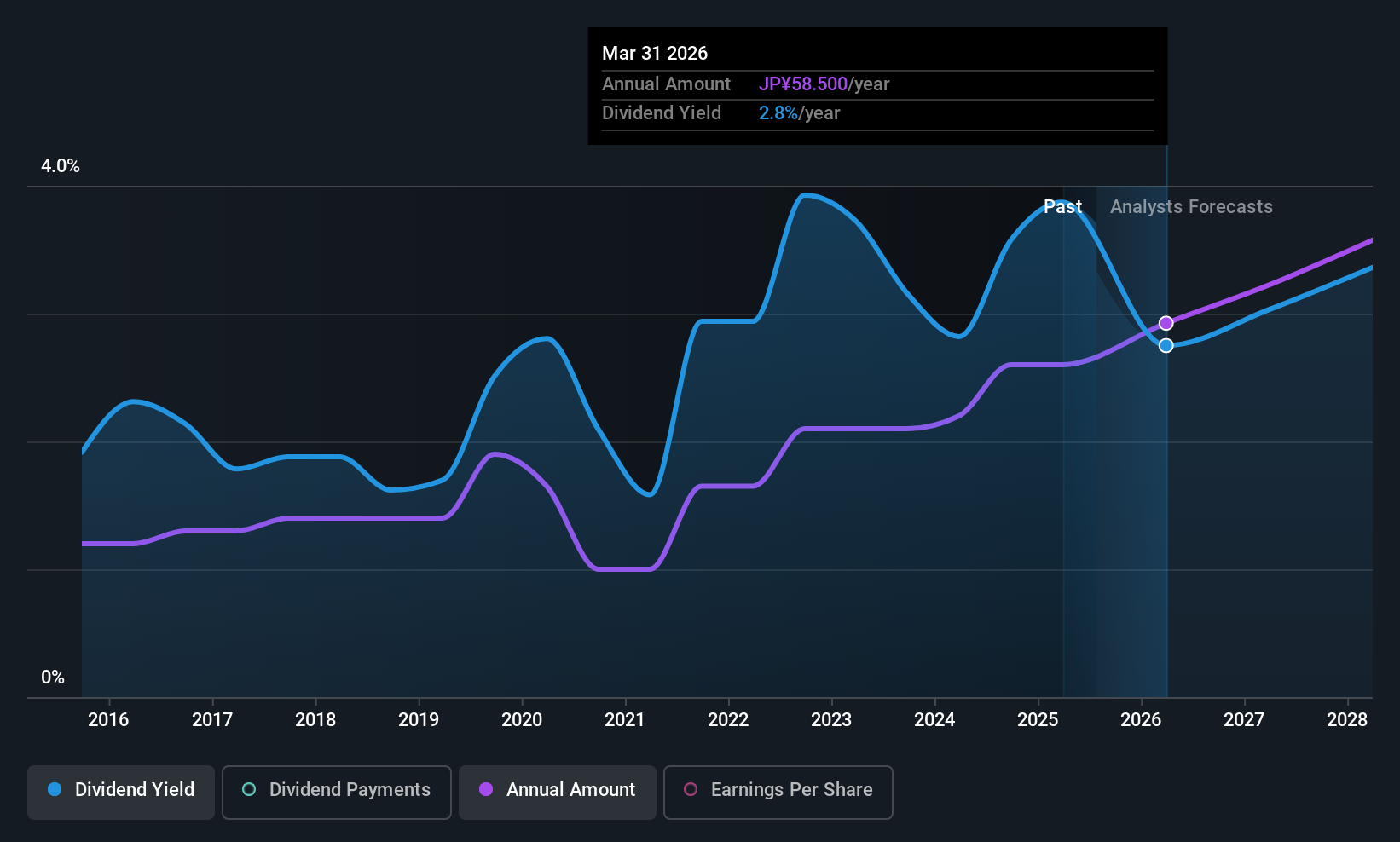

Pacific Industrial (TSE:7250)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Industrial Co., Ltd. manufactures and sells automotive and electronic equipment parts in Japan and internationally, with a market cap of ¥83.58 billion.

Operations: Pacific Industrial Co., Ltd.'s revenue is primarily derived from its Valve Products Business, which generated ¥57.25 billion, and its Press and Resin Products Business, which contributed ¥148.64 billion.

Dividend Yield: 3.3%

Pacific Industrial's dividend payments have been volatile over the past decade, with recent increases bringing the annual dividend to JPY 58 per share for fiscal year ending March 2025. Despite a low payout ratio of 25.3%, dividends are not covered by free cash flows, raising sustainability concerns. The company trades at a significant discount to its estimated fair value, but earnings are forecasted to decline by an average of 1.2% annually over the next three years.

- Click here to discover the nuances of Pacific Industrial with our detailed analytical dividend report.

- Our expertly prepared valuation report Pacific Industrial implies its share price may be lower than expected.

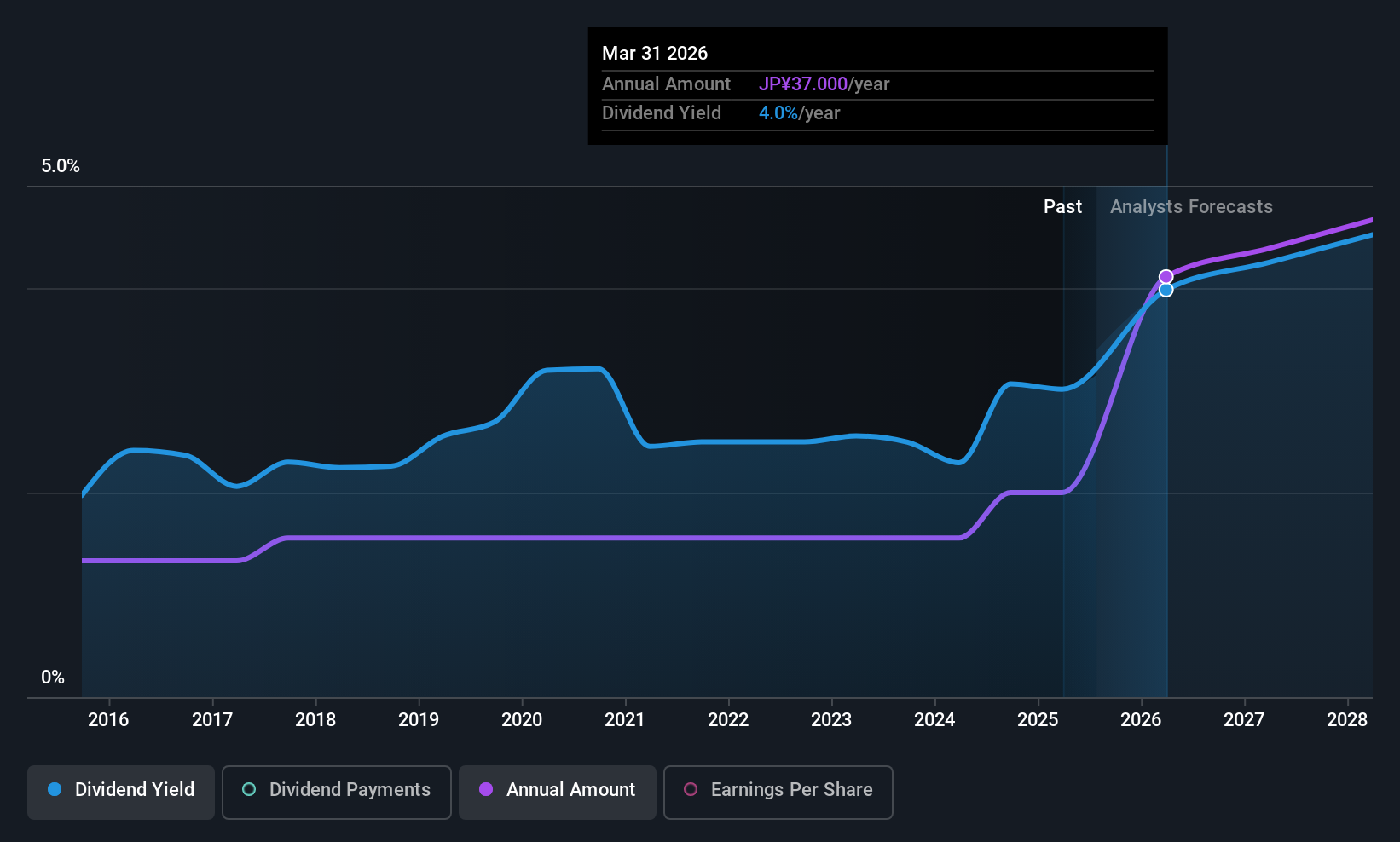

Airport Facilities (TSE:8864)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Airport Facilities Co., Ltd. operates in Japan, focusing on real estate, area heating and cooling, water supply and drainage services, with a market cap of ¥46.82 billion.

Operations: Airport Facilities Co., Ltd. generates revenue through its operations in real estate, area heating and cooling, and water supply and drainage services within Japan.

Dividend Yield: 3.9%

Airport Facilities Co., Ltd. has consistently increased its dividends over the past decade, with a recent hike to JPY 12 per share for fiscal year ending March 2025. Despite a reasonable payout ratio of 50.9%, the dividend is not well covered by cash flows, posing sustainability concerns due to a high cash payout ratio of 137.8%. The company’s dividend yield is competitive within Japan's top tier, but large one-off items affect earnings quality.

- Navigate through the intricacies of Airport Facilities with our comprehensive dividend report here.

- Our valuation report here indicates Airport Facilities may be overvalued.

Arcadyan Technology (TWSE:3596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions with a market cap of NT$46.49 billion.

Operations: Arcadyan Technology Corporation generates its revenue from three main segments: broadband access, multimedia, and wireless infrastructure solutions.

Dividend Yield: 3.4%

Arcadyan Technology's dividend payments have been volatile over the past decade, with a current yield of 3.55%, below Taiwan's top 25% benchmark. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 65% and 30.5%, respectively. Recent earnings reports show steady growth, with net income for Q2 at TWD 665.79 million and improved EPS figures year-over-year, supporting dividend sustainability amid fluctuating historical payouts.

- Unlock comprehensive insights into our analysis of Arcadyan Technology stock in this dividend report.

- Our valuation report unveils the possibility Arcadyan Technology's shares may be trading at a premium.

Next Steps

- Gain an insight into the universe of 1481 Top Global Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7250

Pacific Industrial

Manufactures and sells compressor-related products and electronic equipment in Japan and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion