- Taiwan

- /

- Commercial Services

- /

- TWSE:9917

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets approach record highs, with U.S. stock indexes climbing and small-cap stocks lagging behind their larger counterparts, investors are navigating a landscape marked by rising inflation and cautious monetary policies. In this environment, identifying undiscovered gems requires a focus on companies that demonstrate resilience and adaptability amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sunmax Biotechnology (TPEX:4728)

Simply Wall St Value Rating: ★★★★★★

Overview: Sunmax Biotechnology Co., Ltd. is a biomedical company that develops, manufactures, and markets collagen-based medical devices in Taiwan and Mainland China with a market capitalization of NT$15.96 billion.

Operations: Sunmax generates revenue primarily from its operations in Taiwan and Mainland China, with the latter contributing NT$1.59 billion. The Taiwan segment adds NT$828.98 million to the revenue stream.

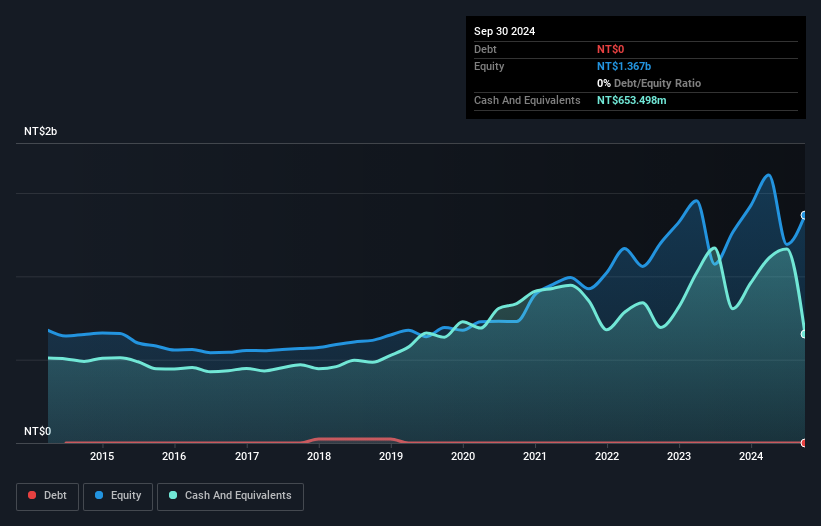

In the biotech sector, Sunmax Biotechnology stands out with its robust financial health and growth trajectory. The company is debt-free, which simplifies financial management and reduces risk. Its earnings growth of 20% last year outpaced the industry average of 8.8%, showcasing strong operational performance. This growth is supported by high-quality non-cash earnings, suggesting reliable profitability sources. Additionally, Sunmax's price-to-earnings ratio of 22.8x presents a good value compared to the industry average of 38.1x, indicating potential undervaluation in the market context for this small player in biotechnology.

Scientech (TWSE:3583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scientech Corporation focuses on the research, development, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$28.88 billion.

Operations: Scientech Corporation generates revenue primarily from its brokerage and manufacturing segments, with NT$6.01 billion and NT$3.10 billion respectively. The company's financial performance is notable for its focus on these two key areas, which drive its overall revenue streams.

Scientech, a nimble player in the electronics sector, has shown impressive earnings growth of 40.7% over the past year, outpacing the industry's 7.8%. This trajectory is supported by its positive free cash flow and high-quality earnings profile. Despite an increase in its debt to equity ratio from 0.4 to 37.1 over five years, Scientech holds more cash than total debt, suggesting financial resilience. The board's recent meeting on December 13th hinted at potential acquisitions, possibly positioning Scientech for future expansion as it forecasts a robust annual earnings growth of 50.43%.

- Click here to discover the nuances of Scientech with our detailed analytical health report.

Explore historical data to track Scientech's performance over time in our Past section.

Taiwan Secom (TWSE:9917)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Secom Co., Ltd. offers a range of security services in Taiwan and has a market capitalization of NT$55.21 billion.

Operations: The company generates revenue primarily from its Electronic Systems Department, which contributes NT$7.61 billion, followed by the Stay in Security Department at NT$2.62 billion. The Restaurant Services and Logistics Department add NT$1.79 billion and NT$1.09 billion, respectively, to the total revenue stream. The Banknote Service Department also plays a role with NT$1.62 billion in revenue while the Other Business Department adds NT$4.84 billion but is partially offset by adjustments and eliminations amounting to -NT$2.03 billion.

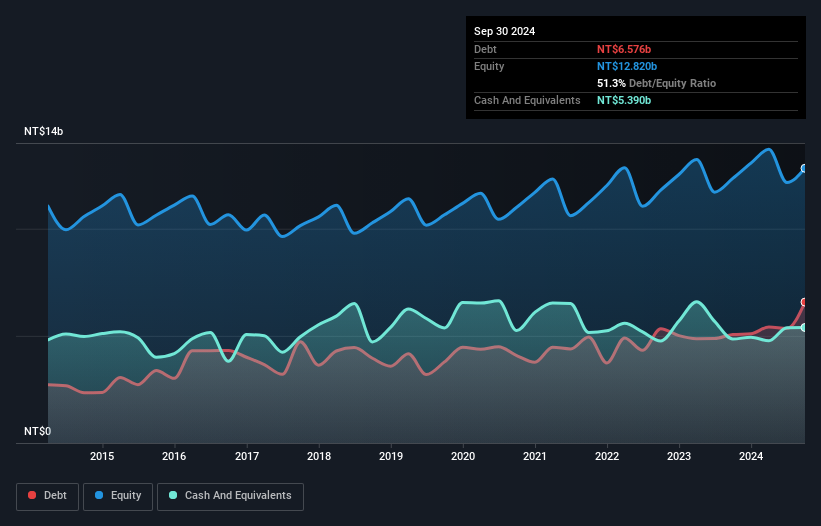

Taiwan Secom, a smaller player in its industry, has shown promising financial health with high-quality past earnings. Its net debt to equity ratio stands at 9.3%, which is satisfactory and indicates prudent financial management. The company's interest payments are well covered by EBIT at 32 times, reflecting strong operational efficiency. Over the past year, earnings grew by 8.9%, outpacing the Commercial Services industry average of -4.3%. With a price-to-earnings ratio of 19.6x below the Taiwan market average of 21.3x, it appears attractively valued for potential investors seeking growth opportunities within this sector.

- Dive into the specifics of Taiwan Secom here with our thorough health report.

Understand Taiwan Secom's track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4716 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taiwan Secom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9917

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion