- South Korea

- /

- IT

- /

- KOSDAQ:A042000

High Growth Tech Opportunities Featuring Three Promising Stocks

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history, with mixed performances across major indices and small-cap stocks under pressure from interest rate sensitivities, investors are closely monitoring economic indicators and Federal Reserve commentary for clues on future market directions. In this environment, identifying high growth tech opportunities requires careful consideration of companies that demonstrate resilience amid elevated valuations and evolving spending trends in sectors like artificial intelligence.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 25.30% | 31.13% | ★★★★★★ |

| Pharma Mar | 22.94% | 42.63% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 25.08% | 25.14% | ★★★★★★ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩770.07 billion.

Operations: Cafe24 Corp. generates revenue by providing a comprehensive e-commerce platform that facilitates online business operations globally. The company focuses on offering tools and services that support online store creation, marketing, and management for businesses of various sizes.

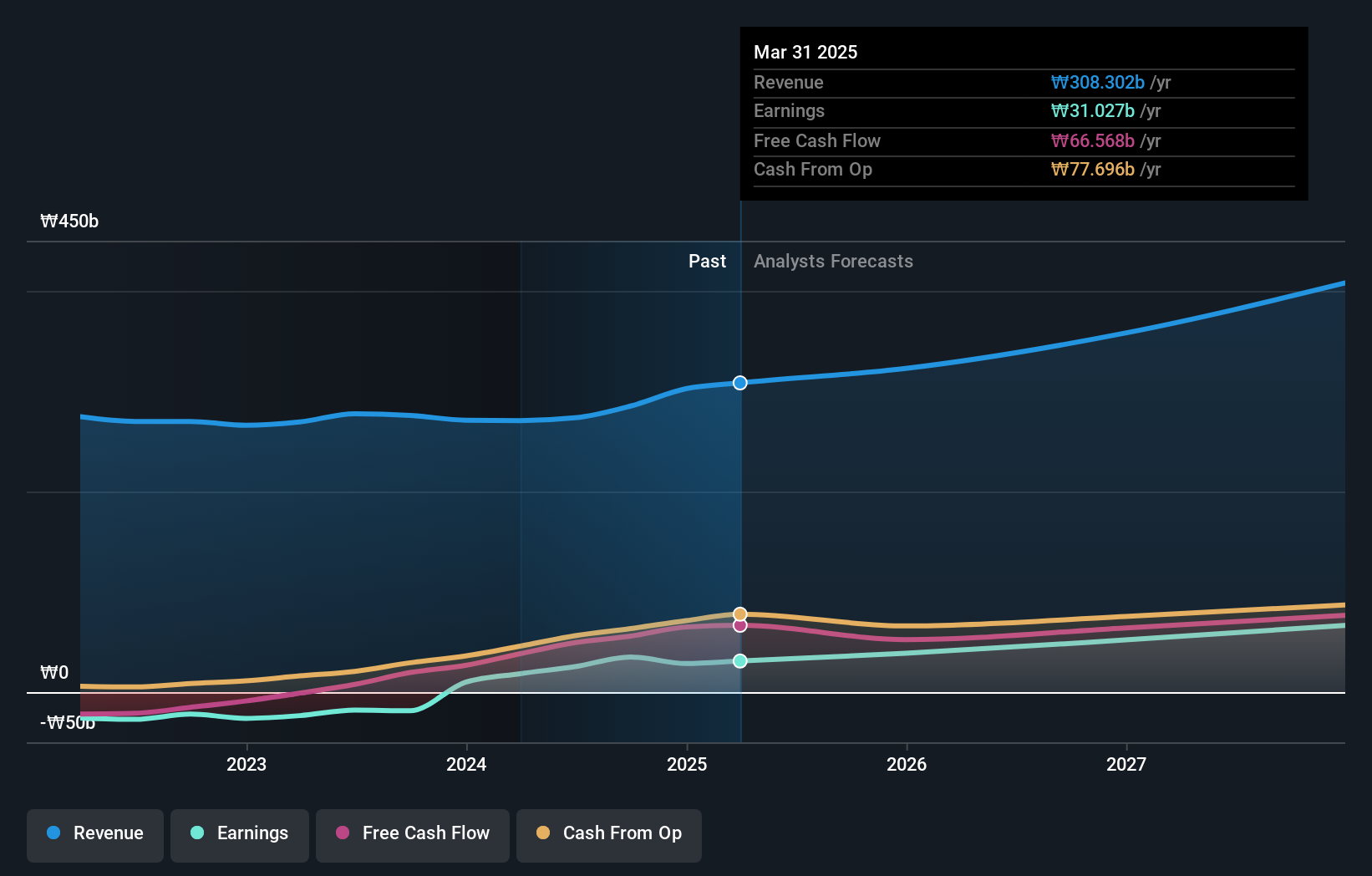

Cafe24 has demonstrated robust growth metrics, with earnings escalating by 38.1% over the past year, surpassing the IT industry's average of 8.1%. This performance is underpinned by a significant commitment to innovation, as evidenced by its R&D investments which are integral to sustaining its competitive edge in e-commerce solutions. Looking ahead, Cafe24's revenue and earnings are projected to grow annually at 13.9% and 32.7%, respectively, outpacing the broader Korean market forecasts of 11.8% for revenue and 28.5% for earnings growth. The company's strategic focus on expanding its digital commerce platforms is likely to further enhance its market position and attract additional high-profile clients.

- Click to explore a detailed breakdown of our findings in Cafe24's health report.

Examine Cafe24's past performance report to understand how it has performed in the past.

AsiaInfo Technologies (SEHK:1675)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AsiaInfo Technologies Limited is an investment holding company that provides telecom software products and related services in the People’s Republic of China, with a market capitalization of HK$7.50 billion.

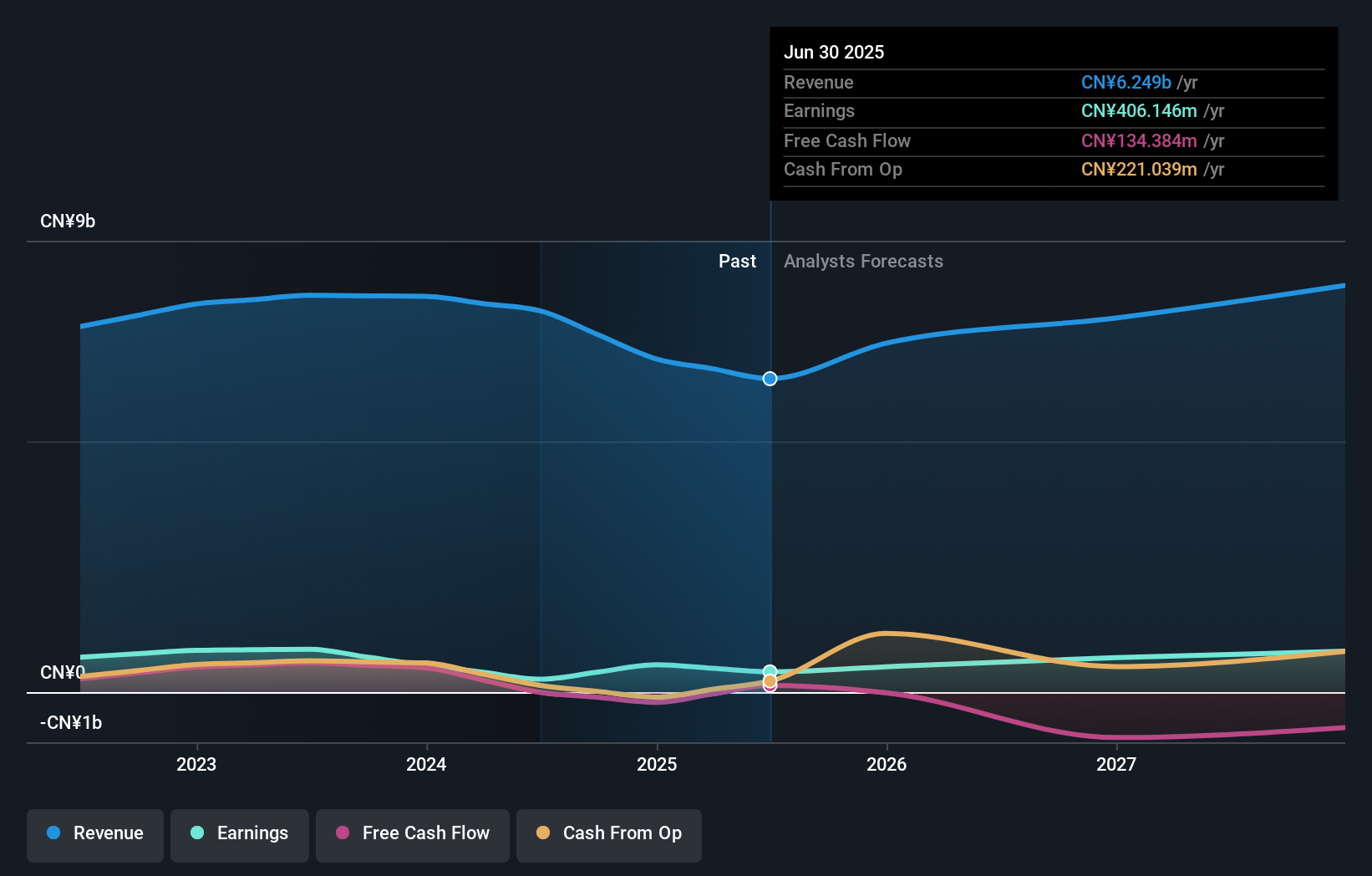

Operations: AsiaInfo Technologies derives its revenue primarily from communications software, amounting to CN¥6.25 billion. The company's focus is on delivering telecom software products and services within China.

AsiaInfo Technologies has recently fortified its strategic position through a collaboration with Alibaba Cloud, aiming to enhance AI application delivery. This alliance underscores AsiaInfo's capability in cloud computing and AI technologies, pivotal for its growth trajectory in a highly competitive sector. Despite a revenue increase of 9.7% annually, which surpasses the Hong Kong market's 8.5%, earnings are expected to surge by 21.5% yearly—outstripping the market forecast of 11.8%. The company’s focus on integrating advanced AI into cloud services not only diversifies its offerings but also solidifies its role as an innovator in tech solutions, potentially boosting future performance in both domestic and broader Asian markets.

- Dive into the specifics of AsiaInfo Technologies here with our thorough health report.

Assess AsiaInfo Technologies' past performance with our detailed historical performance reports.

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★☆☆

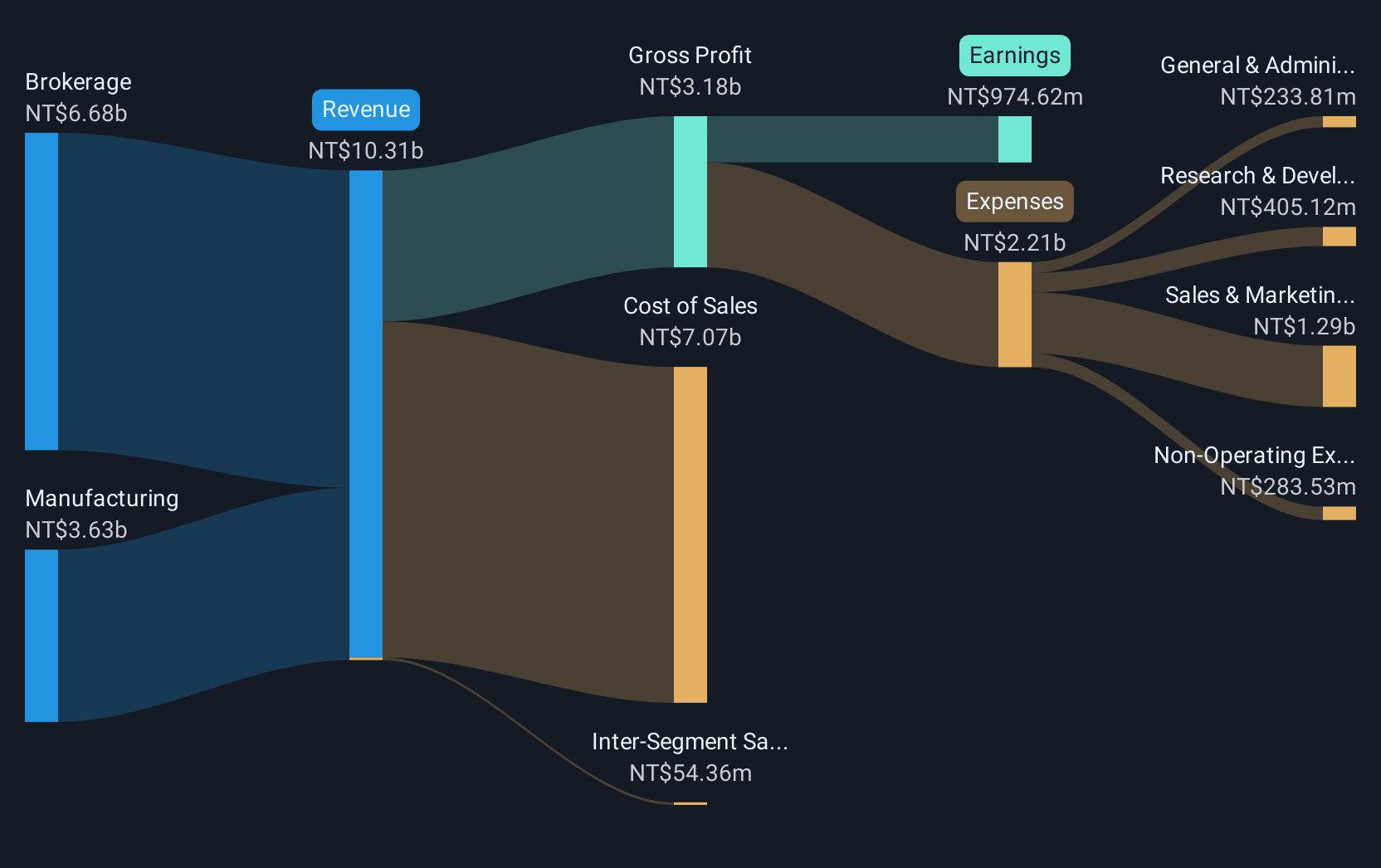

Overview: Scientech Corporation focuses on the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$24.10 billion.

Operations: Scientech Corporation specializes in developing and servicing process equipment across the semiconductor, LCD, LED, and solar power sectors. With a market capitalization of NT$24.10 billion, the company generates revenue through its diversified product offerings tailored to these high-tech industries.

Scientech's recent financial performance demonstrates robust growth, with third-quarter revenues climbing to TWD 2.83 billion, up from TWD 2.50 billion the previous year, and net income increasing to TWD 293.91 million from TWD 240.92 million. This upward trajectory is reflected in an earnings growth of 24% annually, surpassing the Taiwanese market's average of 20.3%. Despite revenue growth trailing the broader market expectation of 13.3%, Scientech's strategic presentations at key tech conferences suggest a strong focus on leveraging industry trends and innovations to sustain its competitive edge in electronics and technology sectors.

- Get an in-depth perspective on Scientech's performance by reading our health report here.

Explore historical data to track Scientech's performance over time in our Past section.

Where To Now?

- Gain an insight into the universe of 245 Global High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives