- Philippines

- /

- Food

- /

- PSE:URC

Discover 3 Global Dividend Stocks Yielding Up To 7.1%

Reviewed by Simply Wall St

In a week marked by mixed performances across major global indices, with smaller-cap indexes outperforming their larger counterparts and ongoing trade tensions impacting market sentiment, investors are increasingly looking for stability and income in the form of dividend stocks. As central banks around the world adjust monetary policies amid economic uncertainties, dividend-paying stocks can offer a reliable income stream and potential buffer against market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.66% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.23% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.96% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.02% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.08% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.52% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.41% | ★★★★★★ |

Click here to see the full list of 1494 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Universal Robina (PSE:URC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Universal Robina Corporation is a branded food product company with operations in the Philippines and internationally, and it has a market capitalization of ₱161.32 billion.

Operations: Universal Robina Corporation generates revenue from its Branded Consumer Food segment, which accounts for ₱135.40 billion, and its Agro-Industrial and Commodity Food segment, contributing ₱62.84 billion.

Dividend Yield: 7.1%

Universal Robina Corporation's dividend yield of 7.14% is among the top quartile in the Philippine market, yet it faces sustainability challenges due to a high payout ratio of 104.1% and cash payout ratio of 94.1%, indicating dividends are not well covered by earnings or free cash flows. Despite this, dividends have been stable and growing over the past decade. Recent leadership changes and amendments to company bylaws suggest strategic shifts that could impact future financial performance.

- Dive into the specifics of Universal Robina here with our thorough dividend report.

- The analysis detailed in our Universal Robina valuation report hints at an deflated share price compared to its estimated value.

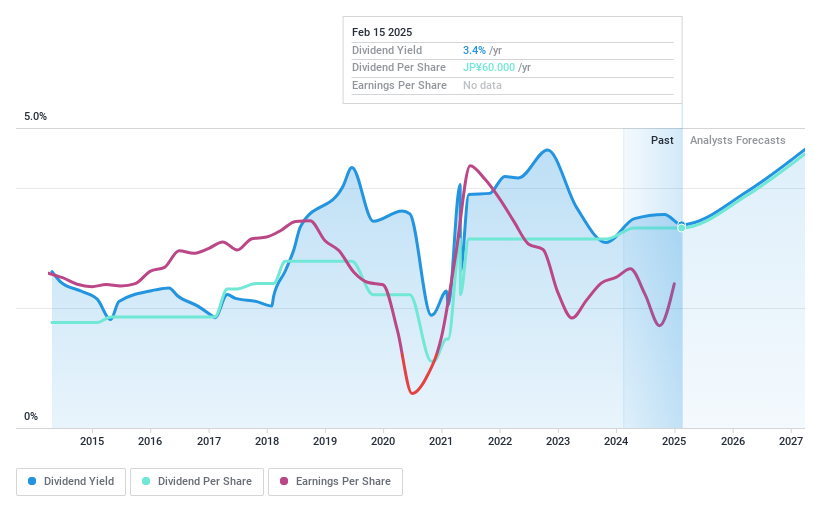

Aisin (TSE:7259)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aisin Corporation manufactures and sells automotive parts, as well as energy and lifestyle-related products, with a market cap of ¥1.20 trillion.

Operations: Aisin Corporation's revenue is primarily derived from Japan (¥3.09 billion), North America (¥1.06 billion), China (¥590.47 million), ASEAN India (¥514.99 million), and Europe (¥310.67 million).

Dividend Yield: 3.5%

Aisin's dividend payments are covered by earnings and cash flows, with payout ratios of 72.3% and 56.8%, respectively. However, the dividends have been volatile over the past decade, making them unreliable despite growth in payments during this period. The current yield of 3.46% is below Japan's top quartile dividend payers' average of 3.96%. Aisin trades at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors.

- Navigate through the intricacies of Aisin with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Aisin is trading beyond its estimated value.

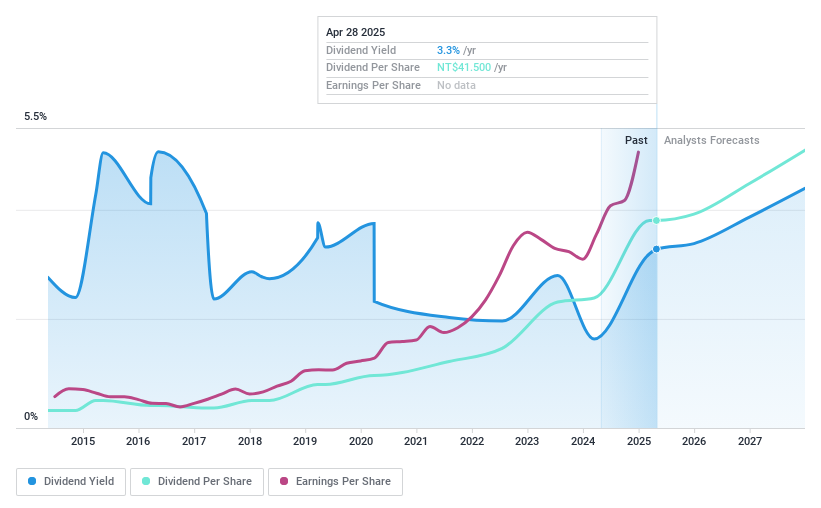

Lotes (TWSE:3533)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lotes Co., Ltd is a company that designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$131.10 billion.

Operations: Lotes Co., Ltd generates its revenue primarily from the Electronic Components & Parts segment, which accounted for NT$30.09 billion.

Dividend Yield: 3.3%

Lotes' dividend payments, covered by earnings and cash flows with payout ratios of 50.1% and 75.5%, have been volatile over the past decade despite growth. The yield is below Taiwan's top quartile average, but the stock trades at a significant discount to its fair value. Recent strong earnings growth and a share buyback program worth TWD 28.65 billion may support future stability, though dividend reliability remains a concern for investors seeking consistent income.

- Click here and access our complete dividend analysis report to understand the dynamics of Lotes.

- Our expertly prepared valuation report Lotes implies its share price may be lower than expected.

Seize The Opportunity

- Unlock our comprehensive list of 1494 Top Global Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:URC

Universal Robina

Operates as a branded food product company in the Philippines and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives