- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3416

Winmate (TWSE:3416) Is Increasing Its Dividend To NT$5.20

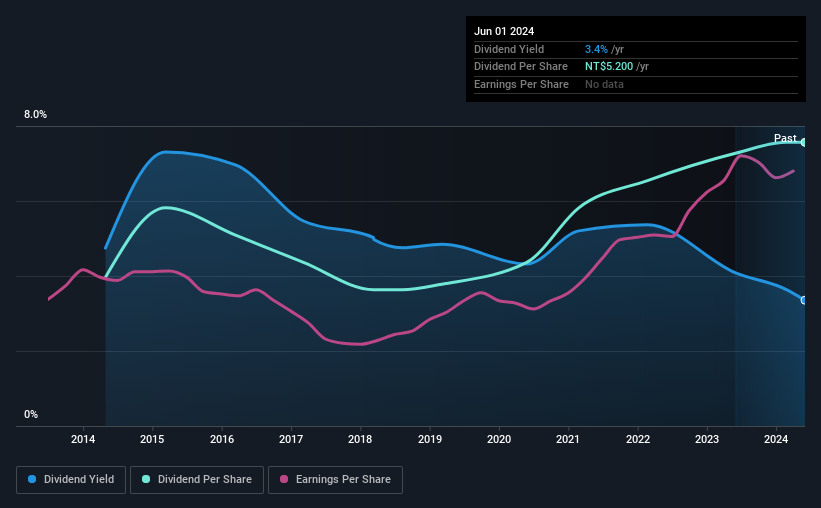

Winmate Inc.'s (TWSE:3416) dividend will be increasing from last year's payment of the same period to NT$5.20 on 26th of July. Based on this payment, the dividend yield for the company will be 3.4%, which is fairly typical for the industry.

View our latest analysis for Winmate

Winmate's Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. At the time of the last dividend payment, Winmate was paying out a very large proportion of what it was earning and 140% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Looking forward, earnings per share could rise by 17.4% over the next year if the trend from the last few years continues. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 69% which brings it into quite a comfortable range.

Winmate Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from NT$2.73 total annually to NT$5.20. This works out to be a compound annual growth rate (CAGR) of approximately 6.7% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Winmate Might Find It Hard To Grow Its Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Winmate has impressed us by growing EPS at 17% per year over the past five years. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Winmate's payments are rock solid. Although they have been consistent in the past, we think the payments are a little high to be sustained. We don't think Winmate is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Winmate that investors need to be conscious of moving forward. Is Winmate not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Winmate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3416

Winmate

Engages in the research and development, manufacture, and sales of rugged display equipment and rugged mobile computer in Europe, Asia, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.