- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3090

Don't Race Out To Buy Nichidenbo Corporation (TWSE:3090) Just Because It's Going Ex-Dividend

Nichidenbo Corporation (TWSE:3090) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Nichidenbo's shares before the 27th of June in order to receive the dividend, which the company will pay on the 31st of July.

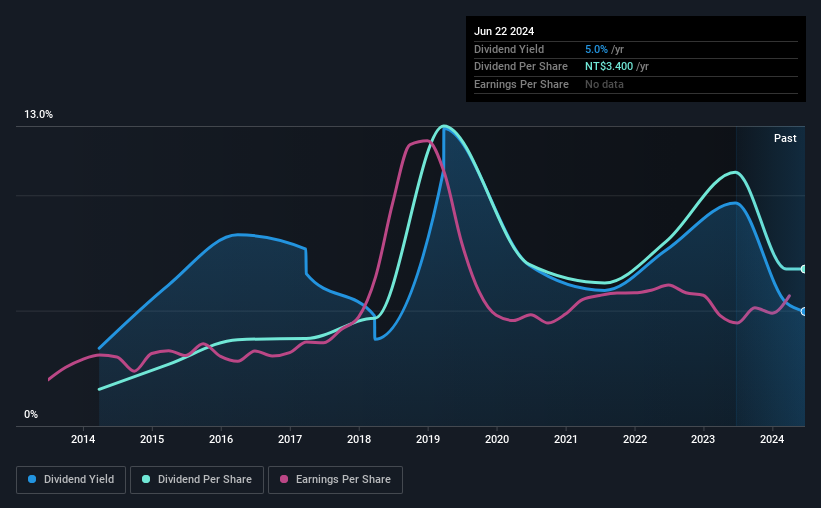

The company's next dividend payment will be NT$3.40 per share, on the back of last year when the company paid a total of NT$3.40 to shareholders. Based on the last year's worth of payments, Nichidenbo has a trailing yield of 5.0% on the current stock price of NT$68.50. If you buy this business for its dividend, you should have an idea of whether Nichidenbo's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Nichidenbo

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 87% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. We'd be worried about the risk of a drop in earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Nichidenbo paid out more free cash flow than it generated - 135%, to be precise - last year, which we think is concerningly high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

While Nichidenbo's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Nichidenbo to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit Nichidenbo paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Nichidenbo's earnings per share have fallen at approximately 15% a year over the previous five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

We'd also point out that Nichidenbo issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, Nichidenbo has lifted its dividend by approximately 16% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Nichidenbo is already paying out 87% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

To Sum It Up

Is Nichidenbo worth buying for its dividend? It's definitely not great to see earnings per share shrinking. The company paid out an acceptable percentage of its income, but an uncomfortably high percentage of its cash flow over the past year. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that being said, if you're still considering Nichidenbo as an investment, you'll find it beneficial to know what risks this stock is facing. For example - Nichidenbo has 1 warning sign we think you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nichidenbo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3090

Nichidenbo

Engages in the distribution of electronic components worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Robinhood Stock: Profitability Arrives, But Can Tokenization and Trading Growth Last?

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion