- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3042

TXC Corporation's (TWSE:3042) Share Price Not Quite Adding Up

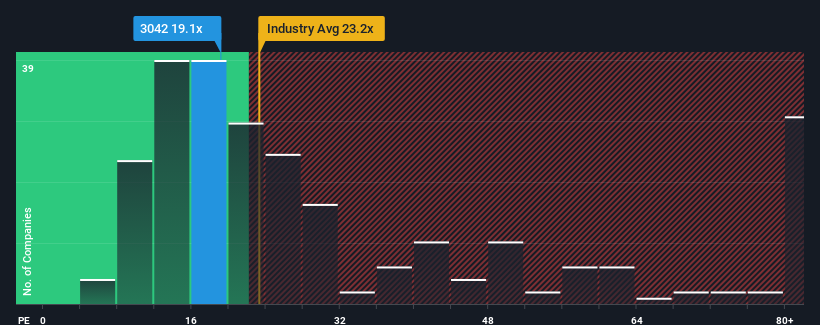

There wouldn't be many who think TXC Corporation's (TWSE:3042) price-to-earnings (or "P/E") ratio of 19.1x is worth a mention when the median P/E in Taiwan is similar at about 21x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for TXC as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for TXC

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like TXC's to be considered reasonable.

Retrospectively, the last year delivered a decent 3.0% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 21% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 8.1% over the next year. Meanwhile, the rest of the market is forecast to expand by 24%, which is noticeably more attractive.

With this information, we find it interesting that TXC is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On TXC's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that TXC currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for TXC that you should be aware of.

If these risks are making you reconsider your opinion on TXC, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TXC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3042

TXC

Engages in the research, design, development, production, and sale of crystal units and oscillator products in Taiwan and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives