- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6787

Exploring High Growth Tech Stocks with Potential for Expansion

Reviewed by Simply Wall St

In recent weeks, global markets have shown a mixed performance, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 Index experienced a decline following its previous outperformance. Amid this backdrop of diverging market trends and economic indicators such as job growth rebounding in November, investors are keenly observing high-growth tech stocks that demonstrate robust potential for expansion due to their innovative capabilities and alignment with sectors currently experiencing positive momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Meiko Electronics (TSE:6787)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meiko Electronics Co., Ltd. is involved in the design, manufacture, and sale of printed circuit boards and auxiliary electronics with operations spanning Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally; it has a market cap of ¥227.32 billion.

Operations: Meiko Electronics focuses on the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics across various international markets. The company operates in Japan, China, Vietnam, and other regions globally.

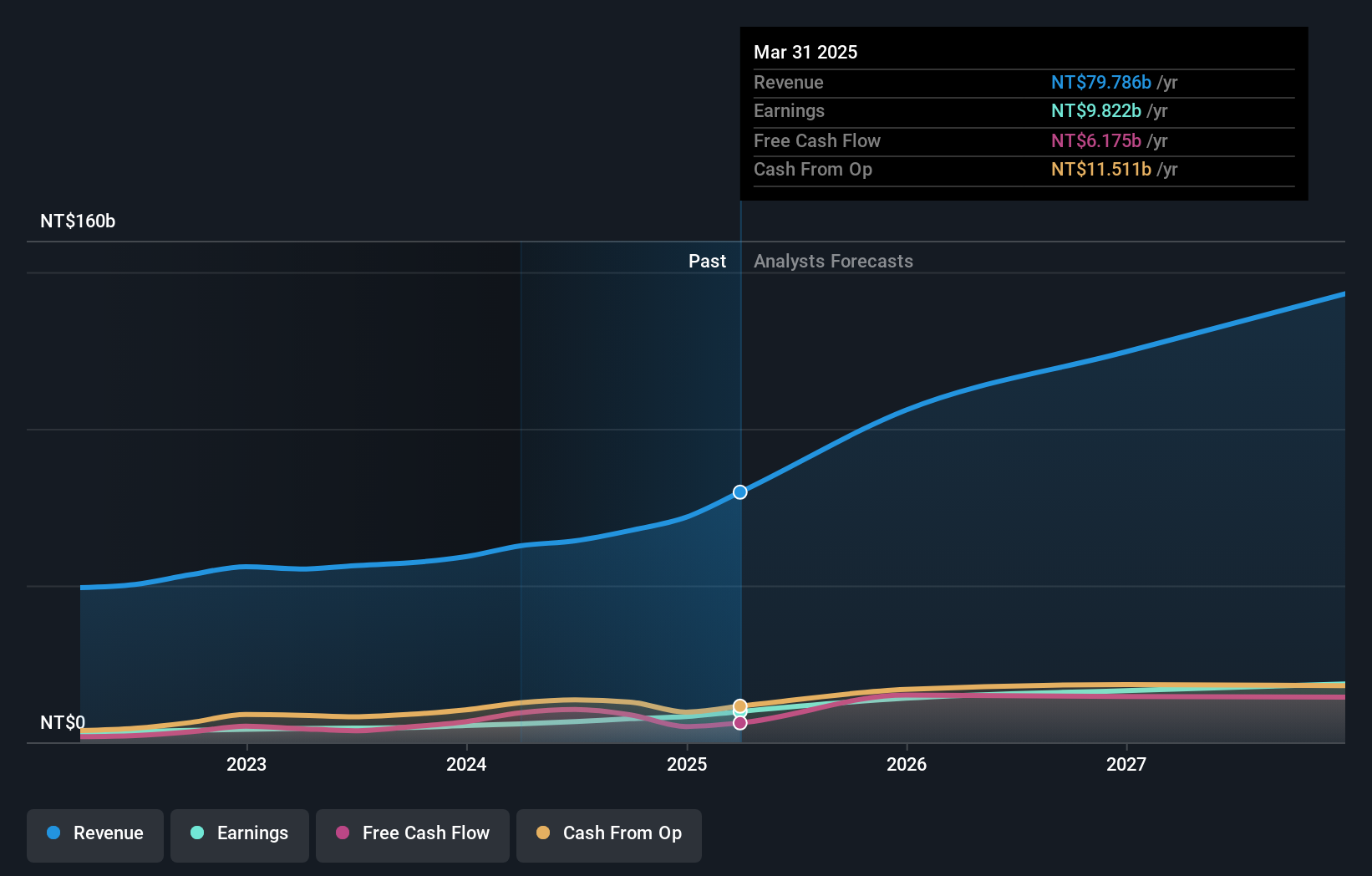

Meiko Electronics, amidst a volatile share price, has demonstrated robust growth with earnings surging by 67.1% over the past year, outpacing the electronic industry's decline of 2.3%. This growth trajectory is underpinned by significant R&D investment, aligning with an impressive forecast where earnings are expected to grow annually at 21.5%, substantially higher than Japan's market average of 7.9%. The company recently revised its fiscal projections upwards, indicating a positive outlook; operating income is now expected to reach JPY 19 billion from an earlier JPY 16 billion estimate. Furthermore, Meiko’s revenue growth forecast at 12.2% annually surpasses the broader Japanese market's expectation of just 4.1%, reflecting strategic adaptability and market capture efficacy in its operations. The firm’s commitment to innovation and expansion is evident from its increased dividend payout following a successful quarter which saw dividends rise from JPY 27 to JPY 40 per share, reinforcing confidence in its financial health and operational stability despite carrying a high level of debt.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

Overview: Asia Vital Components Co., Ltd. is a global provider of thermal solutions, with a market capitalization of NT$268.32 billion.

Operations: The company generates revenue primarily through its Overseas Operating Department and Integrated Management Division, contributing NT$72.11 billion and NT$51.58 billion, respectively.

Asia Vital Components has demonstrated a notable performance with a 59.2% surge in earnings over the past year, surpassing the tech industry's average growth of 10%. This robust growth trajectory is supported by substantial R&D investments, which have consistently accounted for a significant portion of revenue, emphasizing the company's commitment to innovation and technological advancement. Additionally, with an anticipated annual earnings growth rate of 30.3%, Asia Vital Components is poised to outperform the broader Taiwanese market forecast of 19.3%. The firm recently presented at an industry investment forum, underscoring its active engagement with investors and its strategic position within the tech sector.

- Navigate through the intricacies of Asia Vital Components with our comprehensive health report here.

Gain insights into Asia Vital Components' past trends and performance with our Past report.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Unimicron Technology Corp. specializes in developing, manufacturing, processing, and selling printed circuit boards and electronic products globally, with a market capitalization of NT$225.53 billion.

Operations: Unimicron Technology Corp. operates in the global market by developing and manufacturing printed circuit boards, electrical equipment, electronic products, and testing systems for integrated circuits. The company's revenue is primarily driven by the sale of these products worldwide.

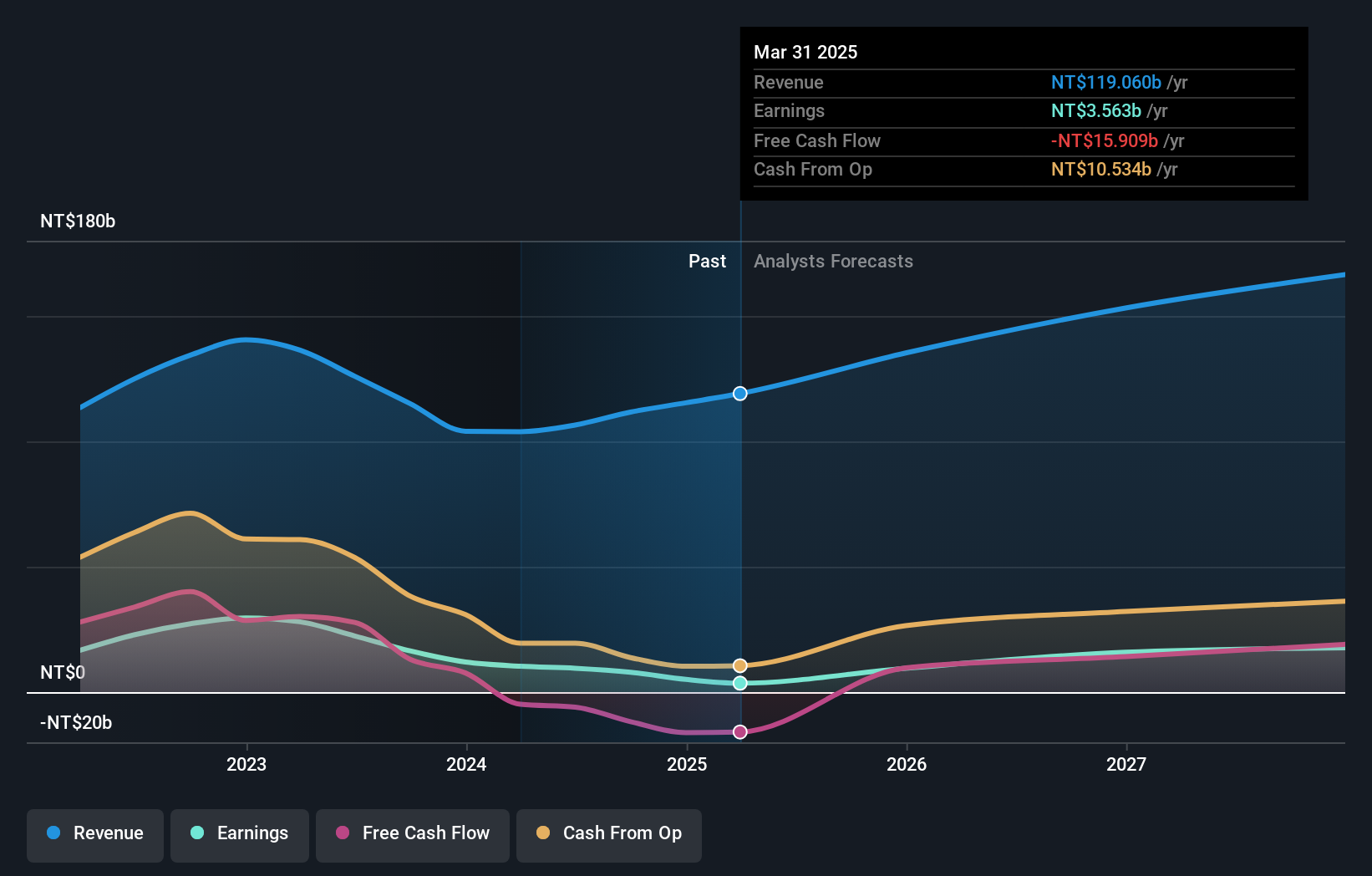

Unimicron Technology, despite a challenging year with a 51.7% dip in earnings, is set to rebound with an impressive forecast of 62.5% annual earnings growth over the next three years, outpacing the Taiwan market's projection of 19.3%. This optimism is bolstered by its substantial commitment to innovation, as evidenced by R&D expenses consistently aligning with strategic growth areas; last year alone, R&D investment constituted a significant portion of total expenditures. The firm also actively engages in high-profile industry forums, enhancing its visibility and potential for future collaborations within tech circles. Notably, recent presentations across multiple investment forums in Taipei underscore Unimicron's proactive approach to shaping industry perceptions and attracting global investor interest.

Where To Now?

- Dive into all 1292 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6787

Meiko Electronics

Engages in the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics in Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives