- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3036

High Growth Tech In Asia Featuring Three Prominent Stocks

Reviewed by Simply Wall St

The Asian tech market is currently experiencing a notable shift, driven by the recent de-escalation of trade tensions between the U.S. and China, which has brought renewed optimism to global markets. As investors navigate these evolving conditions, identifying stocks with strong growth potential in this region requires careful consideration of factors such as innovation capacity, market adaptability, and resilience against economic fluctuations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.38% | 30.19% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| PharmaEssentia | 31.42% | 57.71% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.10% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| PharmaResearch | 25.33% | 28.36% | ★★★★★★ |

| HFR | 33.91% | 111.76% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

BrainAurora Medical Technology (SEHK:6681)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BrainAurora Medical Technology Limited specializes in delivering system integral software solutions for hospitals and research projects across Mainland China, with a market capitalization of HK$8.59 billion.

Operations: The company generates revenue primarily through the provision of system integral software solutions, contributing CN¥106.11 million, and research projects, adding CN¥15.94 million.

BrainAurora Medical Technology, despite its current unprofitability, is on a trajectory to reverse this trend with expected profitability within three years. In the past year alone, revenue surged by 82% to CNY 122.31 million, outpacing the industry's growth rate significantly. The company's commitment to innovation is evident from its R&D spending trends which align with its strategic focus on enhancing medical technology solutions. This aggressive investment in R&D not only underscores their dedication to growth but also positions them favorably for future technological advancements in healthcare. With earnings projected to grow by an impressive 76% annually and revenue forecasted at 36% per year—substantially above Hong Kong's market average of 8.4%—BrainAurora stands out as a dynamic player poised for significant advancements in Asia’s high-tech landscape.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★★☆

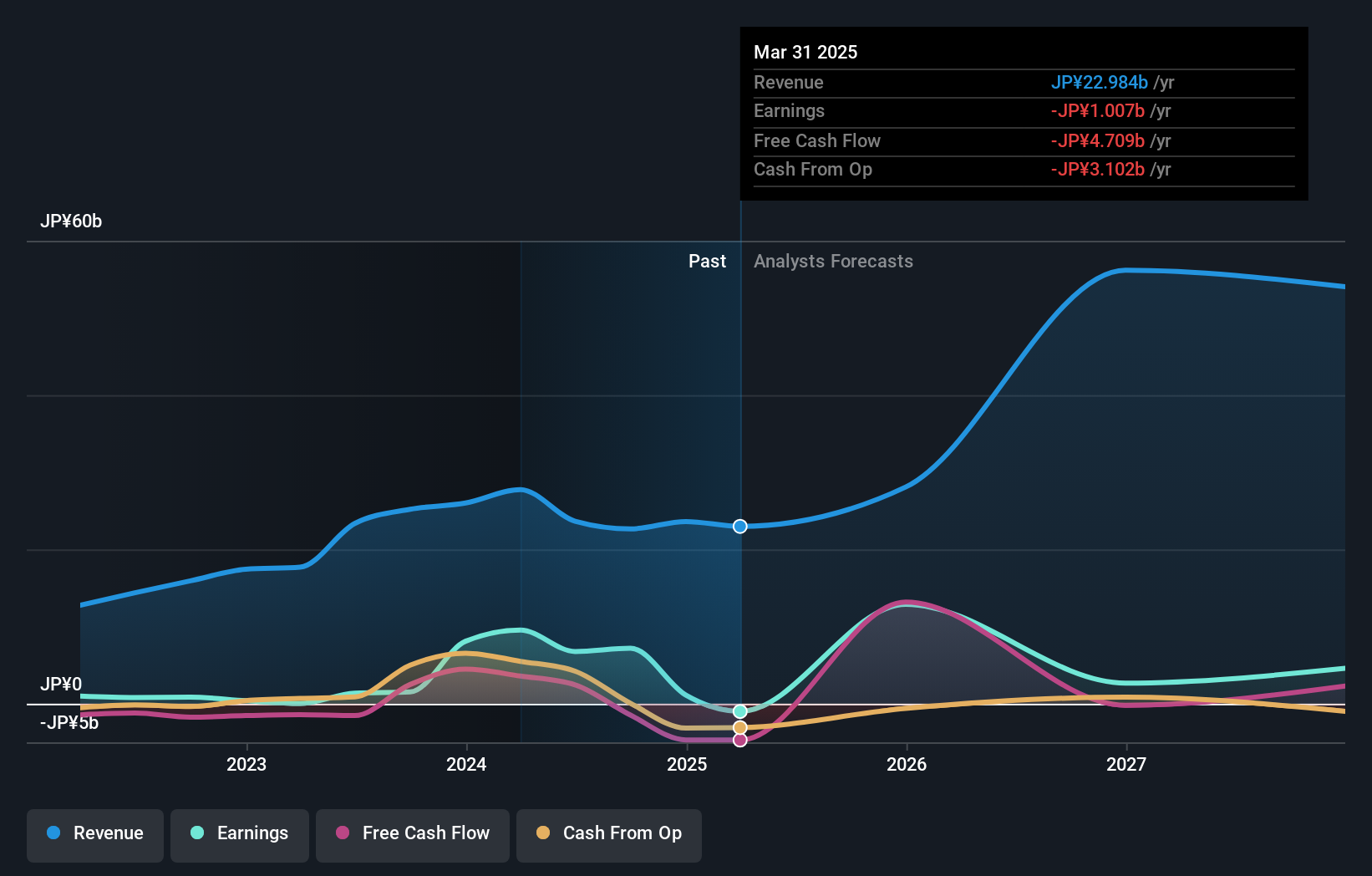

Overview: GNI Group Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally, with a market cap of ¥135.88 billion.

Operations: GNI Group Ltd. generates revenue primarily through the sale of pharmaceutical drugs developed from its research and manufacturing activities. The company's operations span both domestic and international markets, focusing on innovative treatments in the healthcare sector.

GNI Group, amidst a dynamic tech landscape in Asia, is navigating through challenging yet promising avenues. With an annual revenue growth forecast at 26.9%, the company outpaces the Japanese market's average of 3.7%. Despite current unprofitability, GNI's strategic R&D investments—totaling JPY 2 billion last year—underscore its commitment to innovation, particularly in software development for healthcare applications. Recent corporate guidance anticipates substantial gains with expected revenues reaching JPY 28.73 billion and profits forecasted at JPY 15.87 billion by year-end, reflecting robust future prospects and a clear trajectory towards profitability within three years.

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★☆☆

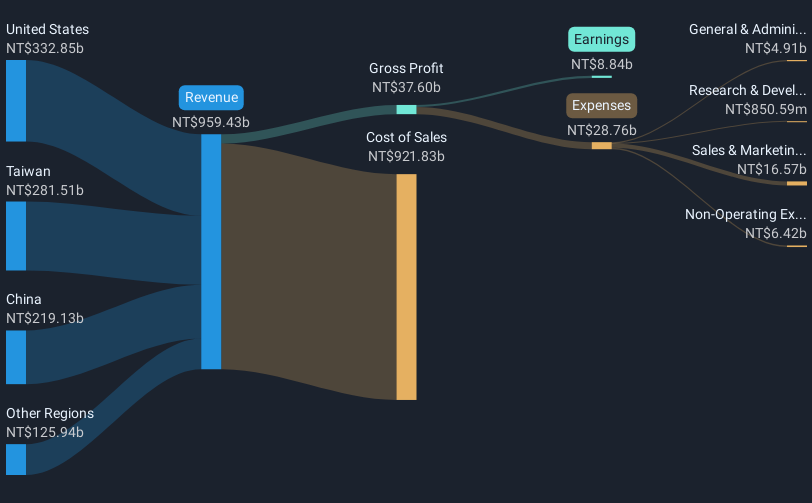

Overview: WT Microelectronics Co., Ltd. is engaged in the development and sale of electronic and communication components across Taiwan, China, and international markets, with a market cap of NT$135.17 billion.

Operations: WT Microelectronics focuses on the development and sale of electronic and communication components, serving markets in Taiwan, China, and internationally. The company operates with a market capitalization of NT$135.17 billion.

WT Microelectronics has demonstrated a robust performance with its Q1 2025 earnings, showcasing a significant jump in net income to TWD 2.71 billion from TWD 1.59 billion year-over-year, and an increase in sales by about 28% to TWD 247.4 billion. This growth trajectory is supported by strategic R&D investments that are evidently paying off, positioning the company well within Asia's competitive tech sector. Moreover, recent sales data from April confirms a sustained demand surge, with monthly sales climbing by 35%, hinting at strong market confidence and operational efficiency. This upward trend is further complemented by the company’s proactive dividend policies and corporate governance adjustments aimed at maintaining its competitive edge and shareholder value.

- Dive into the specifics of WT Microelectronics here with our thorough health report.

Gain insights into WT Microelectronics' past trends and performance with our Past report.

Where To Now?

- Click through to start exploring the rest of the 483 Asian High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WT Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3036

WT Microelectronics

Develops and sells electronic and communication components in the United States, Taiwan, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion