Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3036

Exploring Three High Growth Tech Stocks For Potential Expansion

Reviewed by Simply Wall St

In recent weeks, the global markets have shown mixed results, with major U.S. stock indexes like the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks in the Russell 2000 Index experienced a decline. Amidst this backdrop, growth shares have notably outperformed value stocks, particularly in sectors such as technology and consumer discretionary. In this environment of varied performance across sectors and indices, identifying high-growth tech stocks with solid fundamentals can be key to capitalizing on potential expansion opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK15.95 billion.

Operations: The company generates revenue primarily from its operations in Norway (NOK8.28 billion), Sweden (NOK12.44 billion), Denmark (NOK7.37 billion), Finland (NOK3.62 billion), and the Baltics (NOK1.76 billion). Group Shared Services contribute NOK9.20 billion, while Group Costs amount to NOK9.30 billion, impacting overall profitability.

Atea ASA, amidst a challenging market backdrop, is demonstrating resilience with strategic initiatives like share repurchases and consistent earnings growth. Recently, Atea reported a modest increase in quarterly sales to NOK 7.98 billion and net income rising to NOK 192 million, reflecting an upward trajectory in profitability with an 8.3% forecasted annual revenue growth outpacing the Norwegian market's 2.1%. This performance is underpinned by substantial R&D investments that bolster its competitive edge in the tech sector. Moreover, with earnings expected to surge by 18.9% annually, Atea is positioning itself robustly against industry norms. These financial maneuvers not only reflect Atea's proactive approach in shareholder value maximization but also highlight its agility in adapting to dynamic market conditions while maintaining a strong focus on innovation and operational excellence.

- Click to explore a detailed breakdown of our findings in Atea's health report.

Review our historical performance report to gain insights into Atea's's past performance.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on developing and commercializing monoclonal antibodies and other drug assets for various diseases in China, with a market cap of approximately HK$64.04 billion.

Operations: Innovent Biologics generates revenue primarily from its biotechnology segment, amounting to CN¥7.46 billion. The company focuses on developing and commercializing treatments in oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases within China.

Innovent Biologics is making significant strides in the biotech sector, primarily driven by its robust R&D investments and promising clinical trial outcomes. The company's dedication to innovation is reflected in its R&D expenses, which have consistently accounted for a substantial portion of its revenue, aligning with industry trends where successful biotech firms typically reinvest heavily into research to fuel growth. Recently, Innovent announced encouraging Phase 1 results for IBI343 at the ESMO Asia Congress 2024, showcasing strong efficacy and safety profiles in treating pancreatic cancer—a field that desperately needs advancements due to low survival rates. This progress is underpinned by a strategic focus on developing next-generation biologics, evidenced by a 58.7% forecasted annual earnings growth and an aggressive expansion into new therapeutic areas such as cardiovascular diseases with recent NDRL inclusion of SINTBILO for cholesterol management. These developments not only highlight Innovent's potential impact on improving patient outcomes but also position it well for future growth in diverse medical fields.

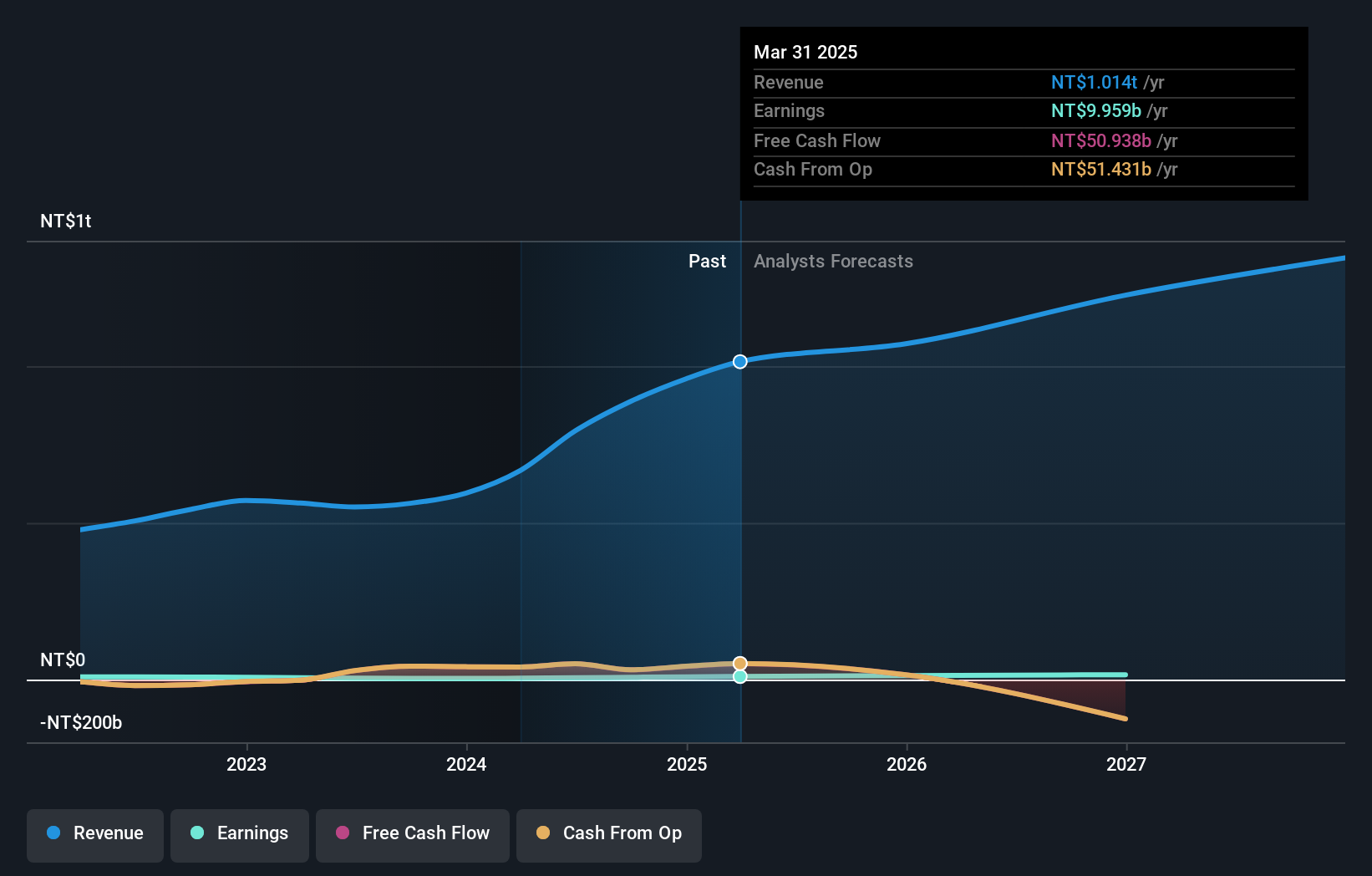

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WT Microelectronics Co., Ltd. and its subsidiaries are engaged in the development and sale of electronic and communication components across Taiwan, China, and international markets, with a market cap of NT$123.89 billion.

Operations: WT Microelectronics focuses on developing and selling electronic and communication components in Taiwan, China, and globally. The company operates with a market capitalization of NT$123.89 billion, emphasizing its significant presence in the electronics distribution industry.

WT Microelectronics has demonstrated a robust trajectory in the tech sector, marked by a significant 69% year-over-year sales increase to TWD 796.2 billion from January to October 2024. This growth is underpinned by substantial R&D investments, which are crucial as they represent a strategic commitment to innovation—evidenced by an impressive forecast of earnings growth at 45.6% annually. These financial dynamics are complemented by the company's ability to enhance its product offerings continuously, ensuring it remains competitive in rapidly evolving markets such as semiconductor and microelectronics technology. The firm's recent performance and strategic R&D focus suggest a promising outlook, though challenges such as market competition and technological shifts remain critical considerations.

- Dive into the specifics of WT Microelectronics here with our thorough health report.

Explore historical data to track WT Microelectronics' performance over time in our Past section.

Seize The Opportunity

- Unlock our comprehensive list of 1287 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WT Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3036

WT Microelectronics

Develops and sells electronic and communication components in Taiwan, China, and internationally.