- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

Exploring 3 Promising High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of political developments and economic indicators, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI investments, with major indexes like the S&P 500 reaching new highs. In this dynamic environment, identifying high-growth tech stocks that can capitalize on emerging trends such as artificial intelligence infrastructure becomes crucial for investors looking to enhance their portfolios amidst evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1224 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Shenzhen Anche Technologies (SZSE:300572)

Simply Wall St Growth Rating: ★★★★★☆

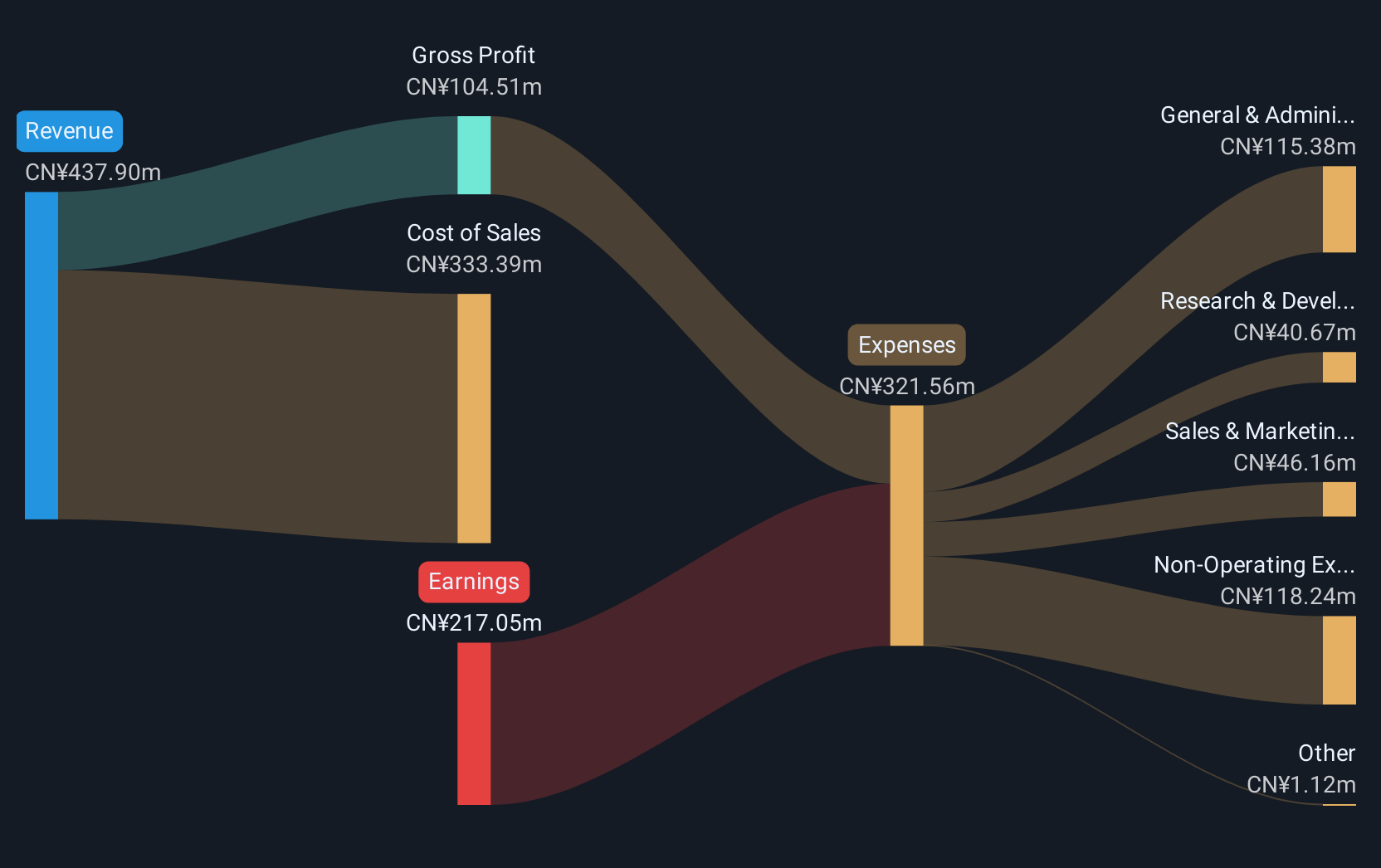

Overview: Shenzhen Anche Technologies Co., Ltd. offers motor vehicle inspection solutions in China and has a market cap of CN¥3.34 billion.

Operations: Anche Technologies specializes in motor vehicle inspection solutions within China. The company's revenue streams are primarily derived from the sale of inspection equipment and related services.

Shenzhen Anche Technologies, amidst a volatile market, exhibits promising growth with its revenue forecast to surge by 43.3% annually. This performance is significantly higher than the CN market's average of 13.3%. The company has also demonstrated proactive capital management through a recent share buyback, repurchasing 3.21 million shares for CNY 40.08 million and acquiring a strategic 5.07% stake from He Xianning for CNY 210 million, enhancing shareholder value. With earnings expected to grow by an impressive 105.41% annually over the next three years and transitioning towards profitability, Shenzhen Anche is positioning itself strongly within the tech sector despite current unprofitability challenges.

- Navigate through the intricacies of Shenzhen Anche Technologies with our comprehensive health report here.

Gain insights into Shenzhen Anche Technologies' past trends and performance with our Past report.

All Ring Tech (TPEX:6187)

Simply Wall St Growth Rating: ★★★★★★

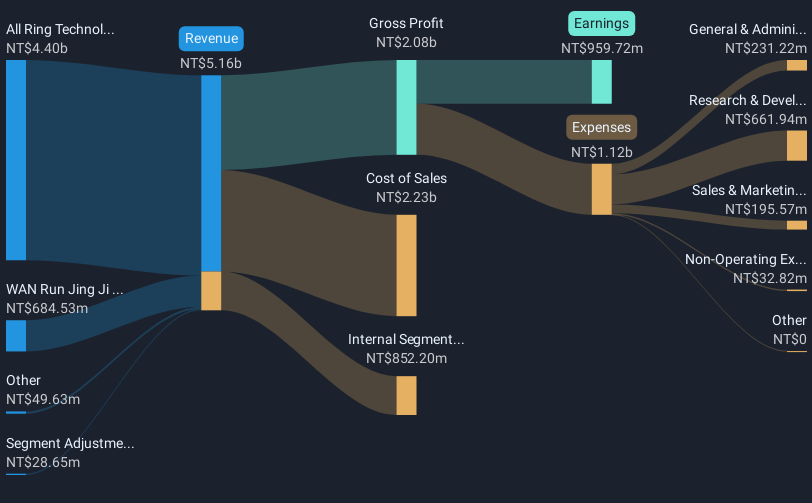

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market capitalization of NT$40.91 billion.

Operations: All Ring Tech Co., Ltd. generates revenue primarily through its subsidiaries, with All Ring Technology Co., Ltd. contributing NT$4.40 billion and WAN Run Jing Ji Co., Ltd. adding NT$684.53 million to the total revenue stream. The company operates in Taiwan and China, focusing on automation machine design, manufacturing, and assembly processes.

All Ring Tech, amid a series of high-profile industry conferences, has demonstrated robust financial performance with third-quarter sales skyrocketing to TWD 1.94 billion from TWD 331.65 million year-over-year. This surge in revenue is complemented by a net income leap to TWD 452.23 million, up from TWD 28.76 million, reflecting an annualized earnings growth of approximately 31.3%. The company's commitment to innovation is evident in its R&D spending trends which align closely with its revenue growth, ensuring sustained technological advancement and market competitiveness. These figures underscore All Ring Tech's strong foothold and potential for continued expansion in the tech sector.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★★☆

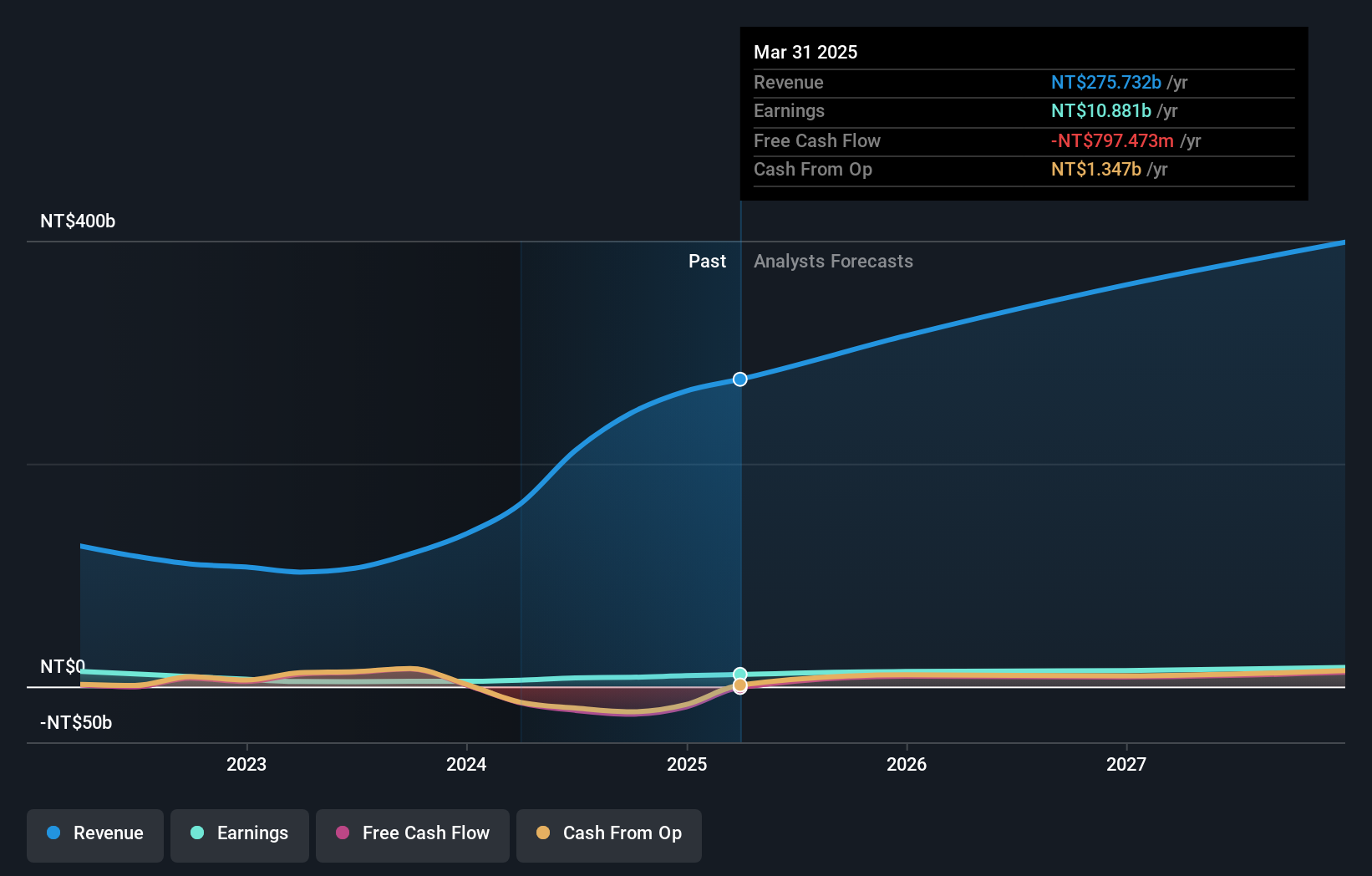

Overview: Giga-Byte Technology Co., Ltd. is involved in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of NT$169.82 billion.

Operations: The Brand Business Division is the primary revenue driver for Giga-Byte Technology Co., Ltd., contributing NT$244.47 billion, while the Other Business Group adds NT$658.17 million.

Giga-Byte Technology's recent showcase at CES 2025 highlighted its innovative strides in AI-powered computing, particularly with the GiMATE AI agent and advanced cooling technologies in its new PC lineups. This innovation surge is backed by a robust financial growth, as evidenced by a year-over-year revenue jump to TWD 70.45 billion in Q3 2024 from TWD 37.01 billion, complemented by an increase in net income to TWD 1.93 billion from TWD 1.48 billion. These figures underscore Giga-Byte's effective R&D investment and its potential to redefine tech standards across multiple sectors, positioning it well for sustained market relevance and growth.

Key Takeaways

- Click here to access our complete index of 1224 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives