- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3036

Exploring High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

The recent U.S. election results have sparked optimism in the markets, with major indices like the S&P 500 and Russell 2000 experiencing significant gains driven by expectations of economic growth and regulatory changes. In this environment, high-growth tech stocks can offer potential portfolio enhancement by capitalizing on technological advancements and favorable policy shifts that support innovation and expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Appier Group, Inc. is a software-as-a-service company that offers AI platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market capitalization of ¥172.89 billion.

Operations: Appier generates revenue primarily through its AI SaaS business, which reported earnings of ¥30.22 billion. The company's focus is on providing AI-driven platforms to assist enterprises in making informed decisions.

Appier Group's recent strategic moves underscore its commitment to leveraging advanced AI for market differentiation. With a remarkable 301.8% surge in earnings over the past year and an anticipated annual profit growth of 38.3%, the company is outpacing its industry peers significantly. The integration as an Apple Search Ads Partner enhances Appier's visibility and utility in digital marketing, capitalizing on generative AI to optimize keyword generation and campaign management—critical as brands increasingly seek precision in consumer engagement online. Furthermore, Appier’s share repurchase initiative, involving 86,600 shares for ¥145.26 million, reflects a proactive approach to shareholder value while maintaining investment in innovation, crucial for sustaining its trajectory in a competitive tech landscape.

- Navigate through the intricacies of Appier Group with our comprehensive health report here.

Assess Appier Group's past performance with our detailed historical performance reports.

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital Garage, Inc. is a context company operating in Japan and internationally, with a market cap of ¥157.02 billion.

Operations: Digital Garage focuses on creating and managing digital content and services, generating revenue through its diverse operations in Japan and internationally. The company leverages its expertise in technology to drive growth across various sectors.

Digital Garage is navigating a transformative phase, emphasizing security and strategic personnel adjustments to bolster its operations. Recently, the company has seen a promising revenue forecast growth of 16% per year, which aligns with broader market trends but remains below the high-growth threshold of 20% annually. Despite not being profitable currently, Digital Garage's earnings are expected to surge by an impressive 80.48% annually. This potential turnaround is supported by significant R&D investments that underscore its commitment to innovation and market adaptation in a competitive tech landscape. Moreover, their recent share repurchase of 1.5 million shares for ¥4 billion reflects a strong intent to enhance shareholder value amidst these strategic shifts.

- Unlock comprehensive insights into our analysis of Digital Garage stock in this health report.

Gain insights into Digital Garage's historical performance by reviewing our past performance report.

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WT Microelectronics Co., Ltd. and its subsidiaries focus on developing and selling electronic and communication components across Taiwan, China, and other international markets, with a market cap of NT$127.79 billion.

Operations: WT Microelectronics generates revenue primarily from the sale of electronic and communication components in Taiwan, China, and international markets. The company's business model focuses on leveraging its extensive distribution network to cater to diverse customer needs across these regions.

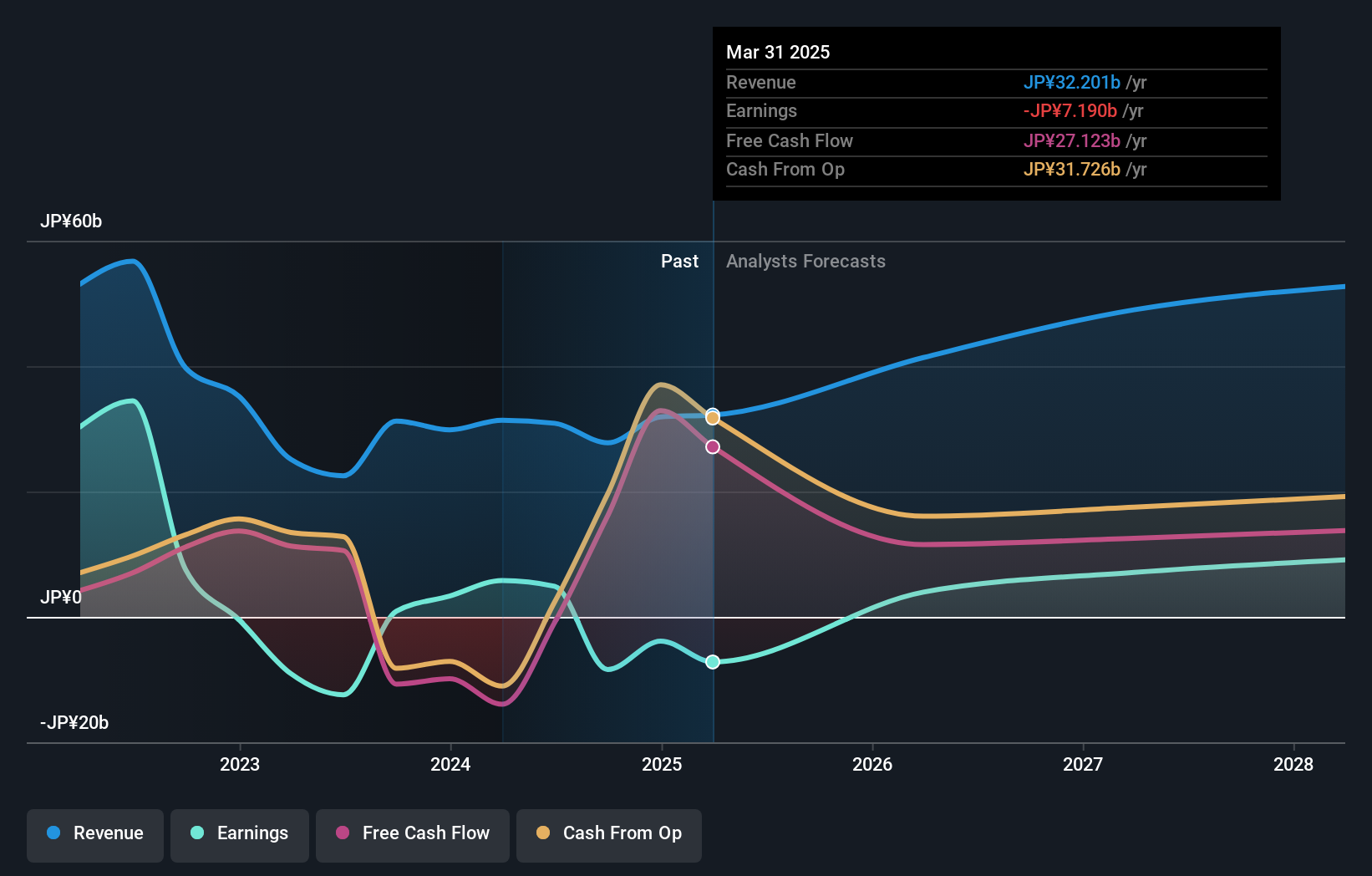

WT Microelectronics has demonstrated robust financial performance, with a notable 72% increase in year-to-date sales compared to the previous year, reaching approximately TWD 697.6 billion. This surge reflects a strong market demand and strategic positioning within the tech sector. The company's commitment to innovation is evident from its R&D spending, which has been strategically allocated to foster developments in cutting-edge technologies. With earnings growing at an impressive rate of 45.6% annually, WT Microelectronics is well-positioned for sustained growth, leveraging its enhanced product offerings and operational efficiencies to capitalize on expanding market opportunities.

- Click to explore a detailed breakdown of our findings in WT Microelectronics' health report.

Understand WT Microelectronics' track record by examining our Past report.

Turning Ideas Into Actions

- Access the full spectrum of 1283 High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WT Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3036

WT Microelectronics

Develops and sells electronic and communication components in Taiwan, China, and internationally.

Solid track record with excellent balance sheet.