- Taiwan

- /

- Tech Hardware

- /

- TWSE:3032

Top Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

As global markets show signs of recovery, particularly in the U.S. where hopes for a "soft landing" are growing, investors are increasingly looking to dividend stocks as a stable source of income amid economic uncertainties. With positive news on inflation and growth bolstering market sentiment, now is an opportune time to consider dividend-paying stocks that offer both potential returns and resilience in fluctuating markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.16% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.10% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.74% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.19% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.50% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.07% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.67% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 2092 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

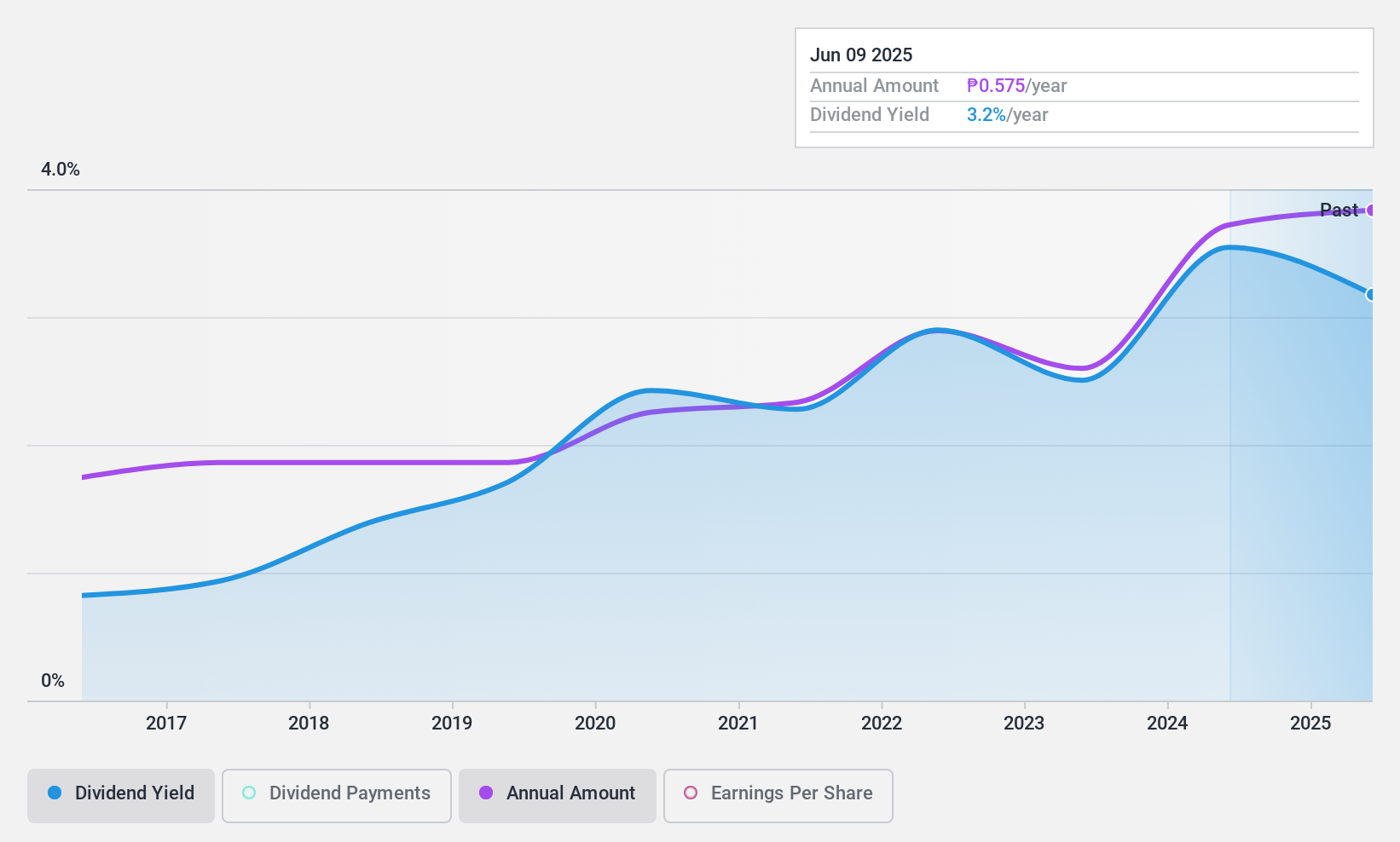

Vivant (PSE:VVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vivant Corporation, with a market cap of ₱16.38 billion, operates through its subsidiaries to generate, distribute, and retail electric power in the Philippines.

Operations: Vivant Corporation's revenue segments include the generation, distribution, and retailing of electric power in the Philippines.

Dividend Yield: 3.5%

Vivant Corporation's dividend yield of 3.49% is below the top 25% of dividend payers in the Philippine market, but its payout ratio of 33.7% indicates dividends are well covered by earnings. Despite stable and growing dividends over the past decade, recent earnings reports show a decline in net income from PHP 888.5 million to PHP 652.18 million year-over-year for Q2, raising concerns about sustainability given that dividends are not covered by free cash flows.

- Navigate through the intricacies of Vivant with our comprehensive dividend report here.

- The analysis detailed in our Vivant valuation report hints at an inflated share price compared to its estimated value.

Iriso Electronics (TSE:6908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iriso Electronics Co., Ltd. develops, manufactures, and sells connectors across Japan, the rest of Asia, Europe, and North America with a market cap of ¥59.10 billion.

Operations: Iriso Electronics Co., Ltd. generates revenue from various regions with ¥54.68 billion from Asia, ¥41.24 billion from Japan, ¥9.58 billion from Europe, and ¥6.51 billion from North America.

Dividend Yield: 3.6%

Iriso Electronics' dividend payments are well covered by earnings (payout ratio: 44.9%) and cash flows (cash payout ratio: 59%). Despite an unstable dividend track record, the company has increased its dividends over the past decade. Recent buyback activity, totaling ¥1.03 billion for 340,000 shares, indicates a commitment to shareholder value. However, the dividend yield of 3.65% is slightly below the top quartile in Japan's market (3.73%).

- Click here and access our complete dividend analysis report to understand the dynamics of Iriso Electronics.

- Our valuation report unveils the possibility Iriso Electronics' shares may be trading at a discount.

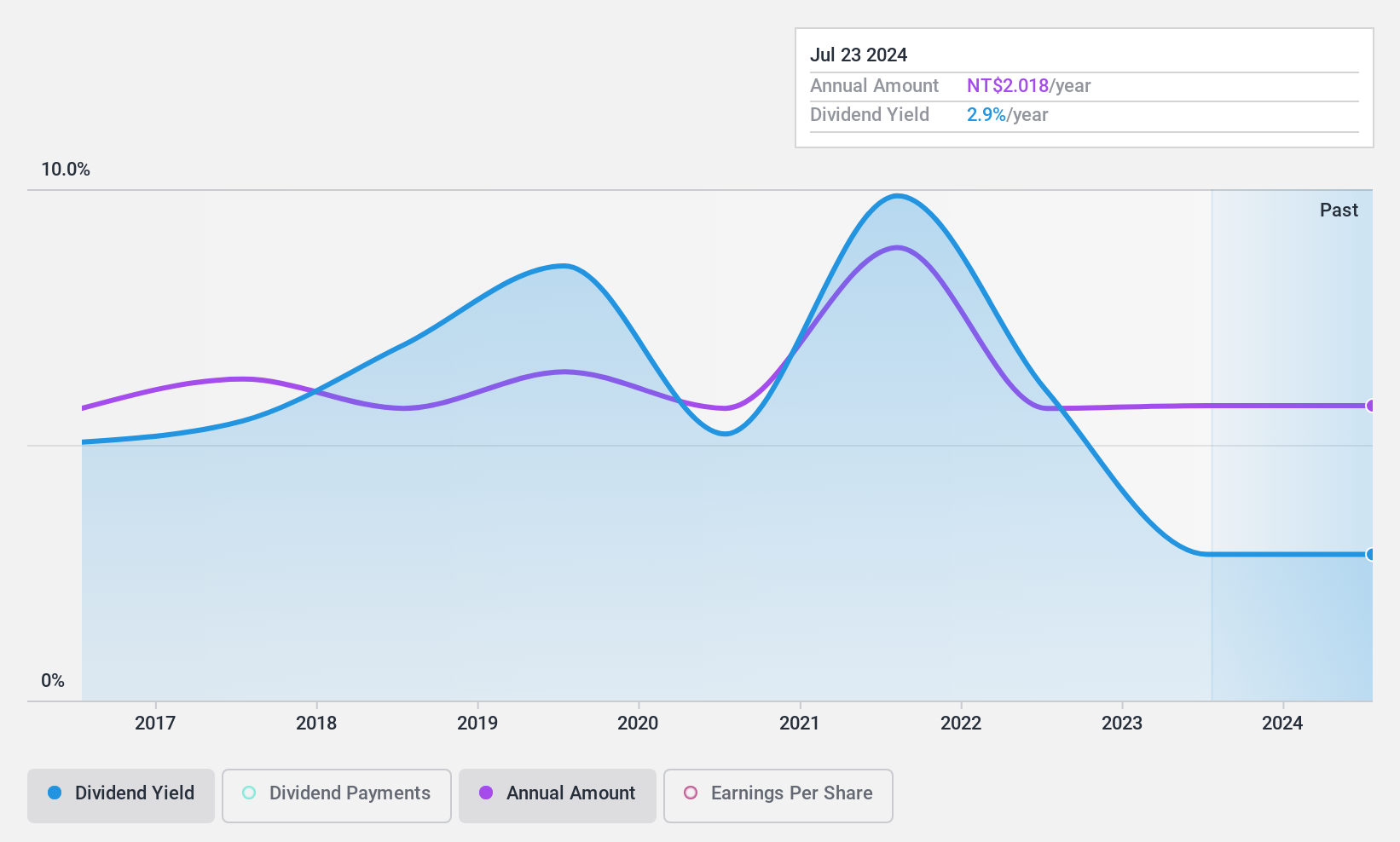

Compucase Enterprise (TWSE:3032)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compucase Enterprise Co., Ltd. designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets worldwide with a market cap of NT$7.93 billion.

Operations: Compucase Enterprise Co., Ltd.'s revenue segments include PC cases, power supplies, rackmount chassis, and cabinets.

Dividend Yield: 5%

Compucase Enterprise's dividend payments are covered by earnings (payout ratio: 57.2%) and cash flows (cash payout ratio: 60.9%). Despite a volatile dividend history, the company has increased payouts over the past decade. Recent earnings showed growth with net income rising to TWD 215.74 million in Q2 2024 from TWD 195.37 million a year ago, supporting its dividend sustainability. The current yield of 4.95% places it in the top quartile of Taiwan’s market for dividends.

- Dive into the specifics of Compucase Enterprise here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Compucase Enterprise is trading beyond its estimated value.

Taking Advantage

- Embark on your investment journey to our 2092 Top Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3032

Compucase Enterprise

Designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets worldwide.

Flawless balance sheet with solid track record and pays a dividend.