- Taiwan

- /

- Tech Hardware

- /

- TPEX:3213

Global Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a mix of easing trade tensions and economic uncertainties, investors are navigating through fluctuating indices with cautious optimism. In this environment, dividend stocks can offer stability and potential income, making them an attractive consideration for portfolios seeking resilience amid market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.60% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.20% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.95% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.14% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.50% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.42% | ★★★★★★ |

Click here to see the full list of 1508 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

Mildef Crete (TPEX:3213)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mildef Crete Inc. operates in the research, design, manufacturing, and sale of computer software, hardware, and components across Taiwan and several international markets with a market cap of NT$5.70 billion.

Operations: Mildef Crete Inc. generates revenue primarily from its computer hardware segment, amounting to NT$2.85 billion.

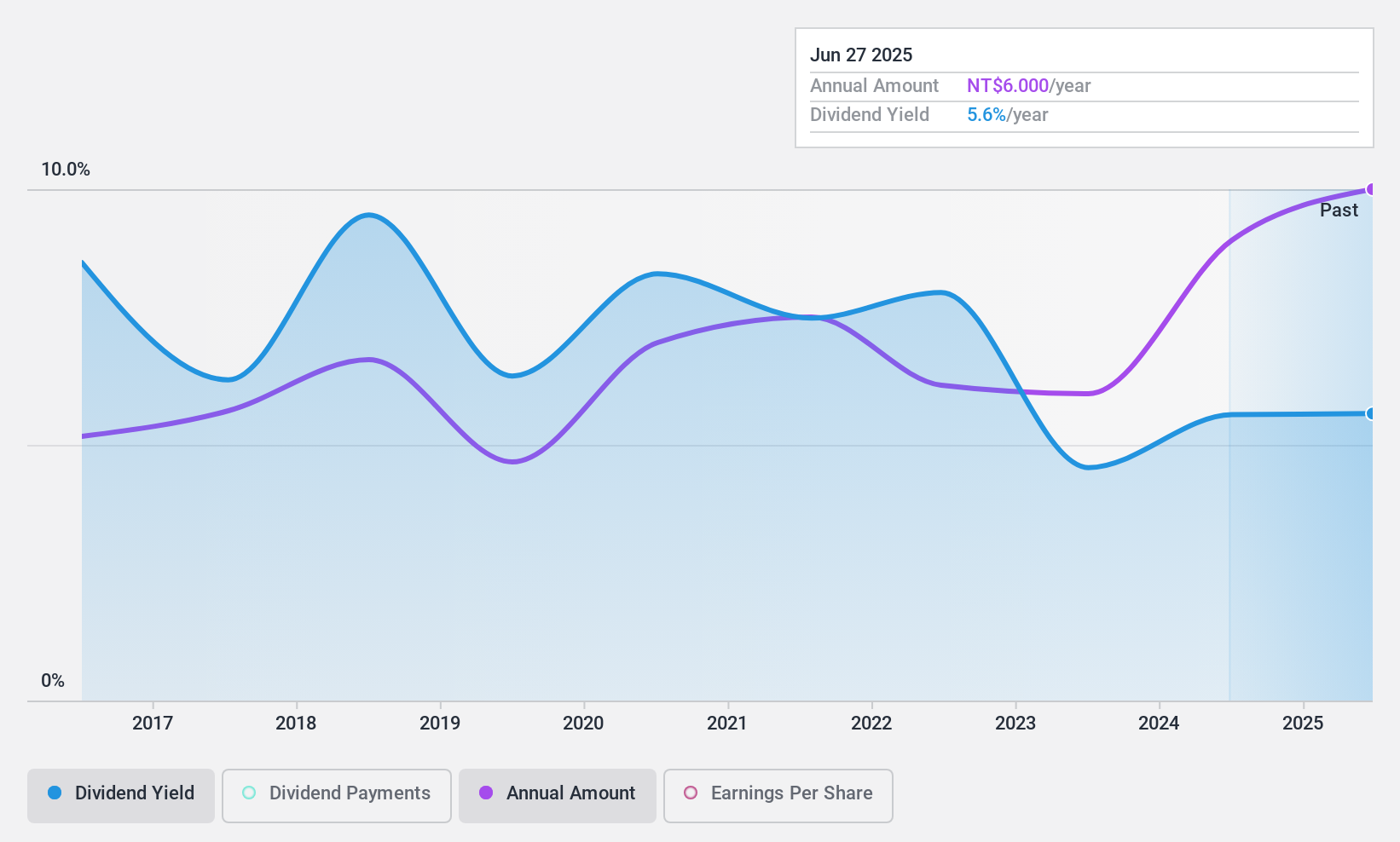

Dividend Yield: 5.7%

Mildef Crete's dividend payments have been volatile over the past decade, but they are currently covered by both earnings and cash flows with payout ratios of 71.1% and 73.1%, respectively. Despite a history of instability, dividends have increased over the past ten years and offer a yield in the top 25% of Taiwan's market. Recent earnings growth supports sustainability, with net income rising to TWD 495.22 million for 2024 despite a decline in sales.

- Dive into the specifics of Mildef Crete here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Mildef Crete is trading behind its estimated value.

Laser Tek TaiwanLtd (TPEX:6207)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Laser Tek Taiwan Co., Ltd. specializes in the processing of surface mounted devices, surface mount technology equipment, enterprise intelligent information systems, and laser precision solutions across Taiwan, China, and international markets with a market cap of NT$3.35 billion.

Operations: Laser Tek Taiwan Co., Ltd. generates its revenue primarily from the Equipment Segment, which accounts for NT$915.44 million, and the Surface Mounted Devices (SMD) Department, contributing NT$497.76 million.

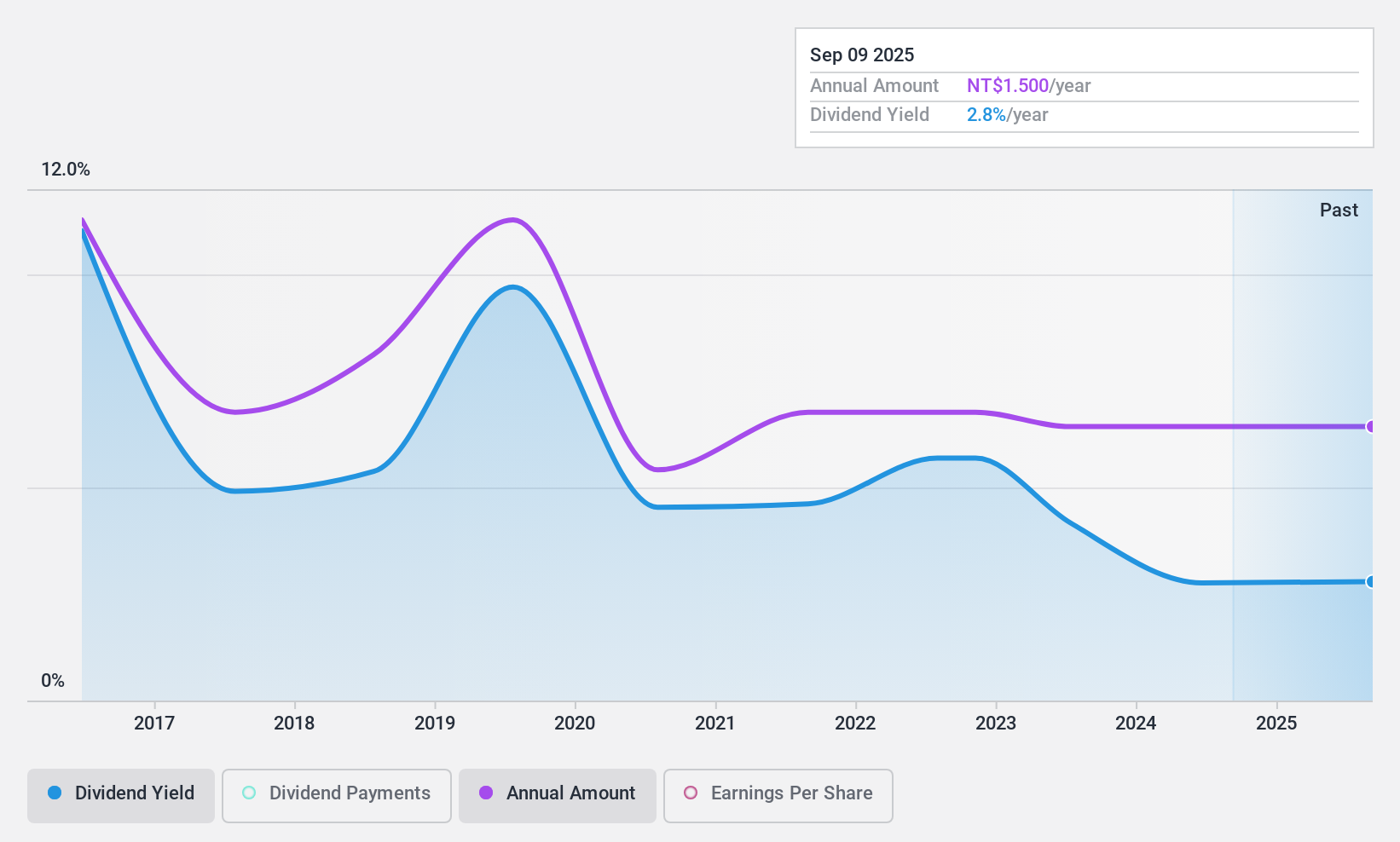

Dividend Yield: 3.4%

Laser Tek Taiwan Ltd.'s dividends have been inconsistent over the past decade, with a reasonable payout ratio of 72.5% supported by earnings and a cash payout ratio of 66.2%. Despite volatility, dividends have grown in the last ten years, though the yield remains below Taiwan's top dividend payers. Recent financial results show sales increased to TWD 1.36 billion and net income rose to TWD 164.76 million for 2024, indicating potential for continued dividend sustainability.

- Get an in-depth perspective on Laser Tek TaiwanLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report Laser Tek TaiwanLtd implies its share price may be too high.

Compucase Enterprise (TWSE:3032)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compucase Enterprise Co., Ltd. designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets globally, with a market cap of NT$7.19 billion.

Operations: Compucase Enterprise Co., Ltd.'s revenue is primarily derived from its Operation Headquarters segment at NT$5.70 billion, followed by the Server Casing Segment at NT$4.49 billion, Manufacturing at NT$3.93 billion, Channel at NT$440.85 million, and Medical Equipment Segment at NT$477.18 million.

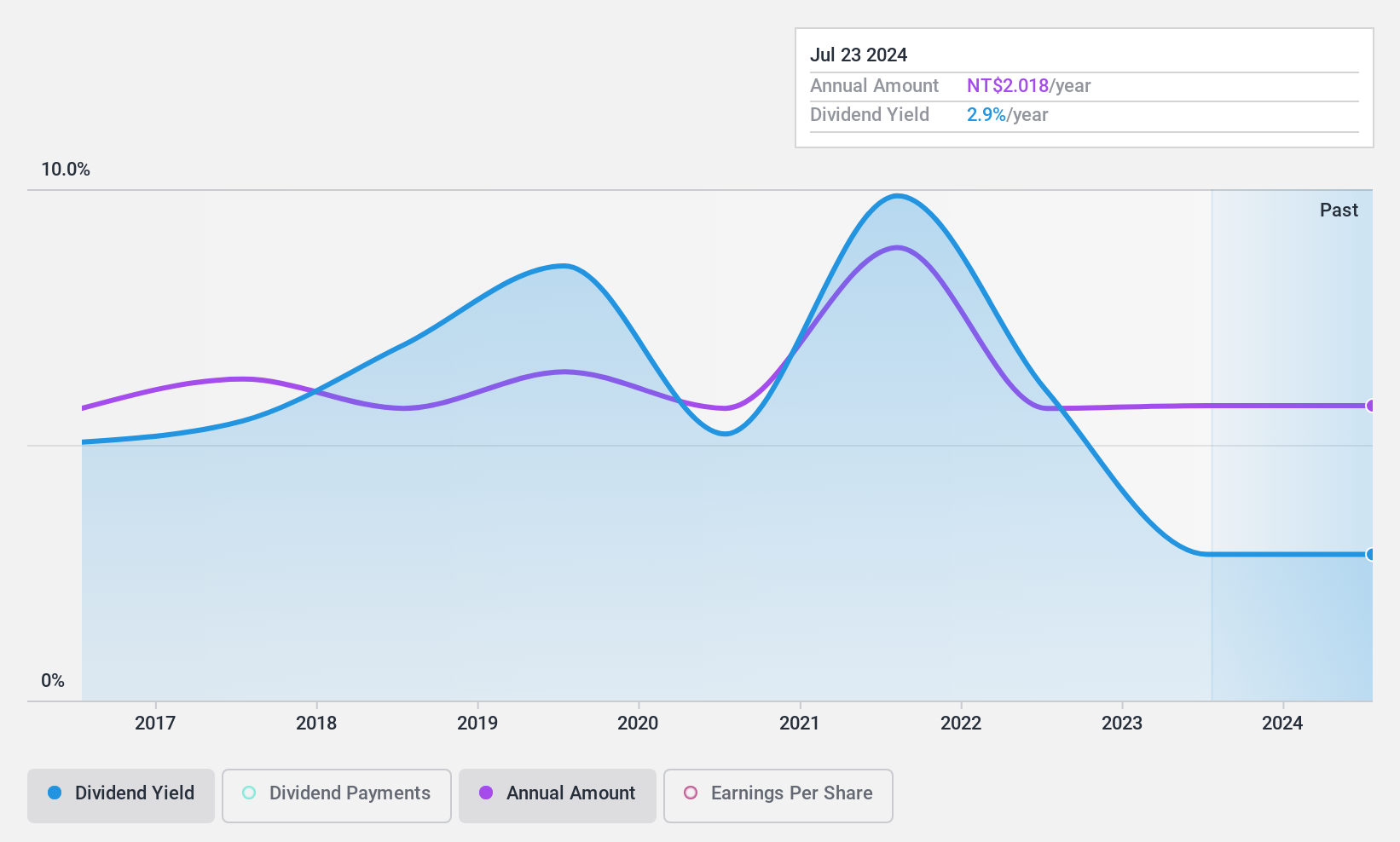

Dividend Yield: 4.1%

Compucase Enterprise's dividend payments have been unstable and volatile over the past decade, despite being covered by earnings and cash flows with a payout ratio of 59.6% and a cash payout ratio of 25.3%. The dividend yield is lower than Taiwan's top payers. Recent financials show mixed results; March 2025 revenue increased to TWD 869.92 million, yet full-year 2024 sales declined to TWD 7.40 billion, impacting net income at TWD 517.88 million.

- Click here to discover the nuances of Compucase Enterprise with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Compucase Enterprise shares in the market.

Turning Ideas Into Actions

- Access the full spectrum of 1508 Top Global Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3213

Mildef Crete

Research, designs, plans, manufactures, sell, imports, and exports computer software, hardware, and components in Taiwan, Germany, the United Kingdom, Sweden, the United States, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion