- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3030

Discovering Undiscovered Gems with Strong Potential January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher due to easing core inflation and strong bank earnings, investors are turning their attention to small-cap stocks in search of untapped potential. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and growth potential amidst shifting economic indicators and broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Amano (TSE:6436)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amano Corporation operates in the time information, parking, environmental, and cleaning systems sectors both in Japan and internationally with a market capitalization of ¥285.87 billion.

Operations: Amano generates revenue primarily from its Time Information System Business and Environment-Related Systems Business, with the former contributing ¥129.36 billion and the latter ¥37.57 billion.

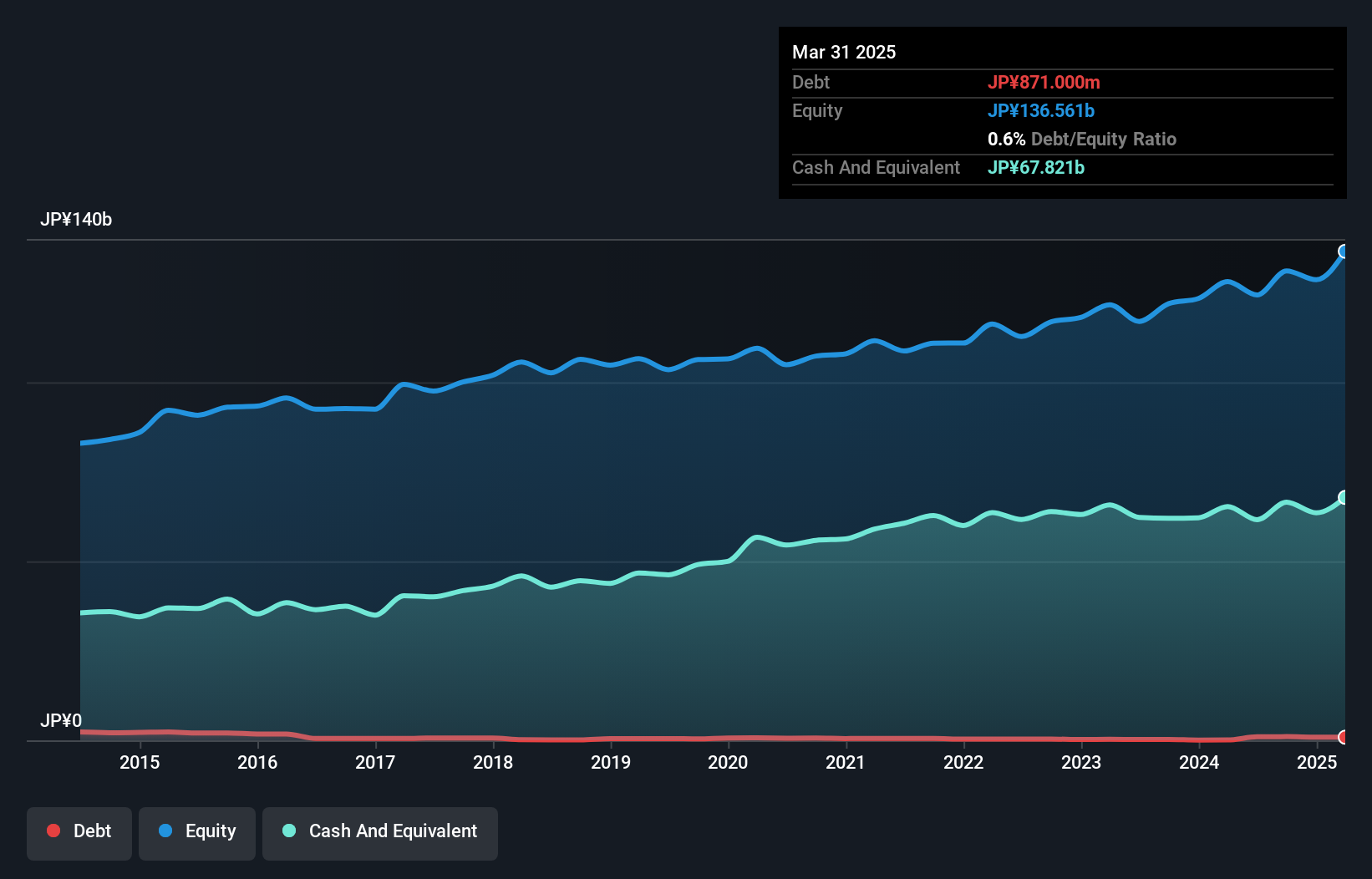

Amano stands out with its high-quality earnings and impressive growth, surpassing the Electronic industry's average by 12.2% over the past year. The company is trading at a slight discount of 0.7% below its estimated fair value, suggesting potential for appreciation. Despite an increase in its debt to equity ratio from 0.4% to 0.8% over five years, Amano's financial health seems robust as it holds more cash than total debt and generates positive free cash flow, with US$19,380 million in levered free cash flow recently reported. Earnings are projected to grow by 11.51% annually, indicating promising future prospects.

- Delve into the full analysis health report here for a deeper understanding of Amano.

Gain insights into Amano's past trends and performance with our Past report.

Shiny Chemical Industrial (TWSE:1773)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shiny Chemical Industrial Co., Ltd. is involved in the manufacturing, processing, and trading of chemical solvents in Taiwan with a market capitalization of NT$38.75 billion.

Operations: Shiny Chemical Industrial generates revenue primarily from its Yongan Factory and Zhangbin Plant, with the Yongan Factory contributing NT$9.90 billion and the Zhangbin Plant adding NT$1.54 billion.

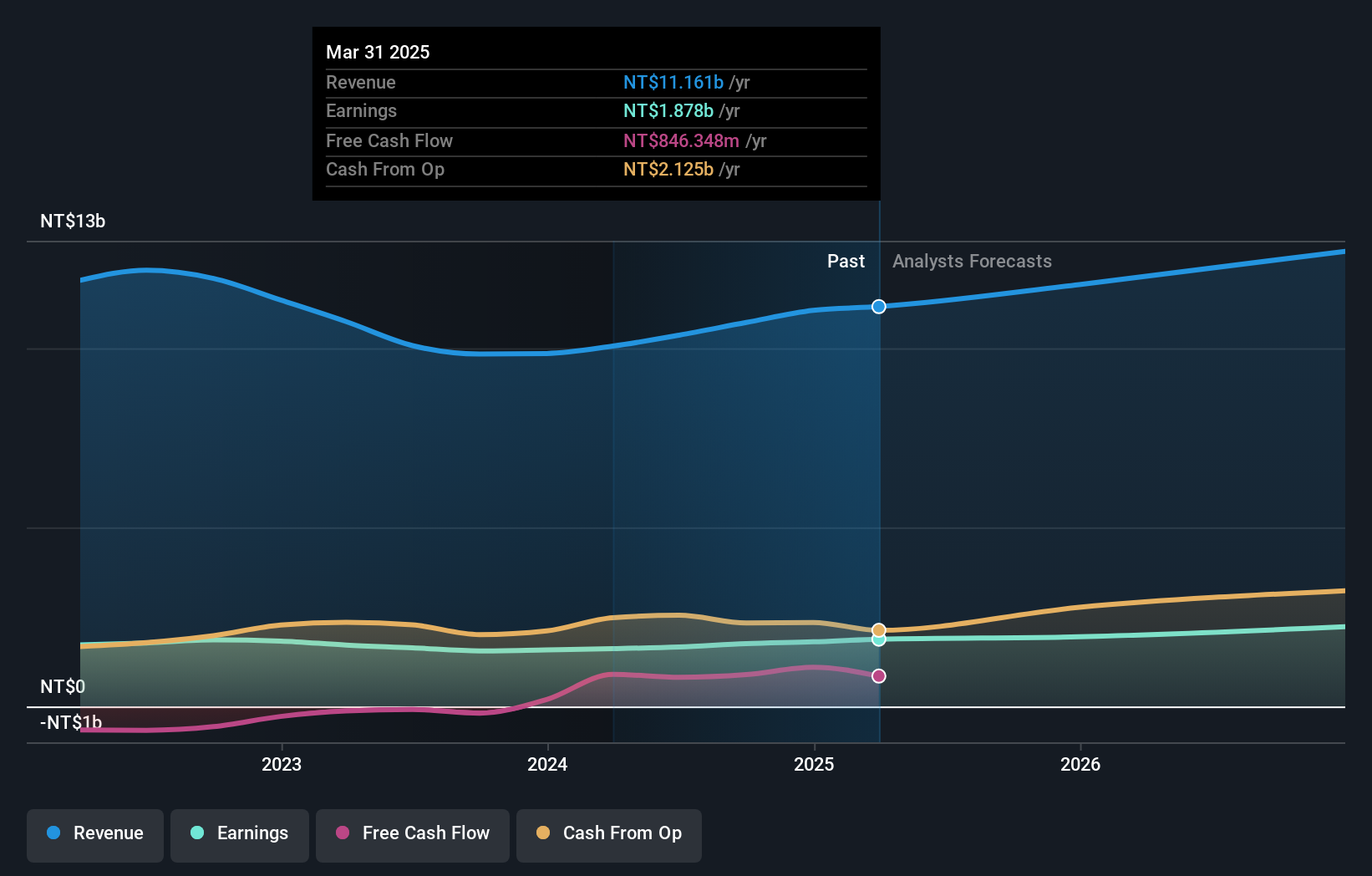

Shiny Chemical Industrial, a smaller player in the chemicals sector, has shown solid financial performance recently. Over the past five years, earnings have grown at an annual rate of 11.9%, reflecting its robust market position. The company reported third-quarter sales of TWD 2.88 billion and net income of TWD 477.91 million, up from TWD 387.54 million last year, indicating healthy growth momentum with basic earnings per share rising to TWD 1.91 from TWD 1.55 previously. Despite a high net debt to equity ratio of 40.8%, interest payments are well covered by EBIT at a multiple of 45x, underscoring financial resilience amidst industry challenges.

Test Research (TWSE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Test Research, Inc. operates globally, designing, assembling, manufacturing, selling, and maintaining automated inspection and testing equipment with a market cap of NT$29.41 billion.

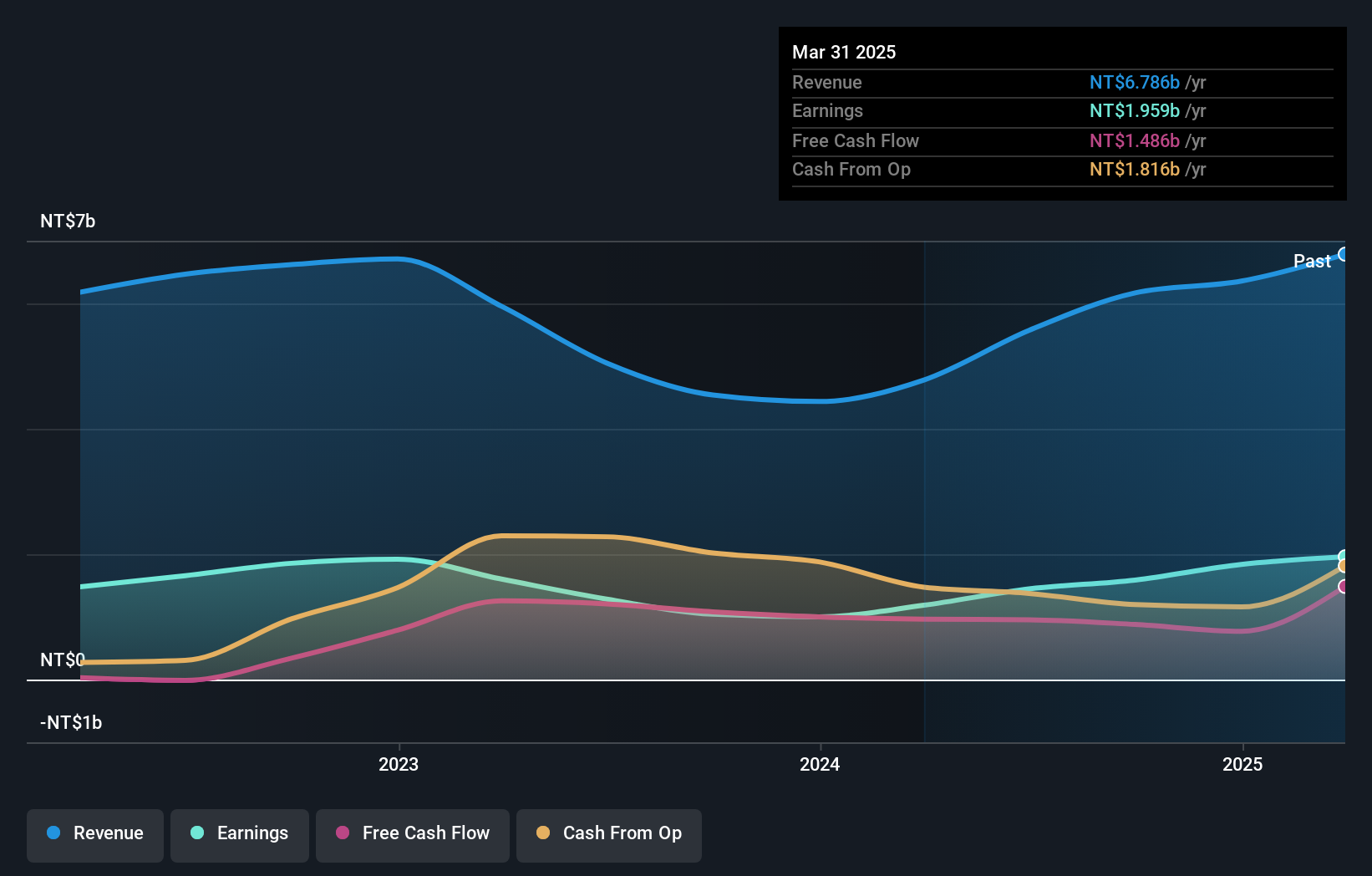

Operations: The primary revenue stream for Test Research, Inc. comes from the design, assembly, manufacture, sale, and maintenance of automatic testing equipment, generating NT$6.17 billion. The company has a market cap of NT$29.41 billion.

Test Research has been making waves with its impressive financial performance, showcasing a 52% earnings growth over the last year, outpacing the electronic industry’s 6.6%. The company is debt-free for five years, eliminating concerns about interest coverage and boosting investor confidence. Its price-to-earnings ratio of 18.6x remains attractive compared to the TW market's 20.5x. Recent results highlight robust sales of TWD 1.63 billion in Q3 2024, up from TWD 1.03 billion a year ago, while net income jumped to TWD 388 million from TWD 246 million, reflecting strong operational efficiency and potential for continued success.

- Take a closer look at Test Research's potential here in our health report.

Assess Test Research's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Embark on your investment journey to our 4659 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Test Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3030

Test Research

Designs, assembles, manufactures, sells, and maintains automated inspection and testing equipment in Asia, the United States, Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives