Amid recent global market volatility, particularly influenced by trade policy uncertainties and economic data revisions, Asian tech stocks have shown resilience and potential for growth despite broader challenges. In this environment, a good stock often demonstrates strong fundamentals and adaptability to changing market conditions, making it well-positioned to navigate the complexities of the current economic landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 31.29% | 38.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.08% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Naruida Technology | 47.72% | 54.38% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hunan Sundy Science and Technology (SZSE:300515)

Simply Wall St Growth Rating: ★★★★☆☆

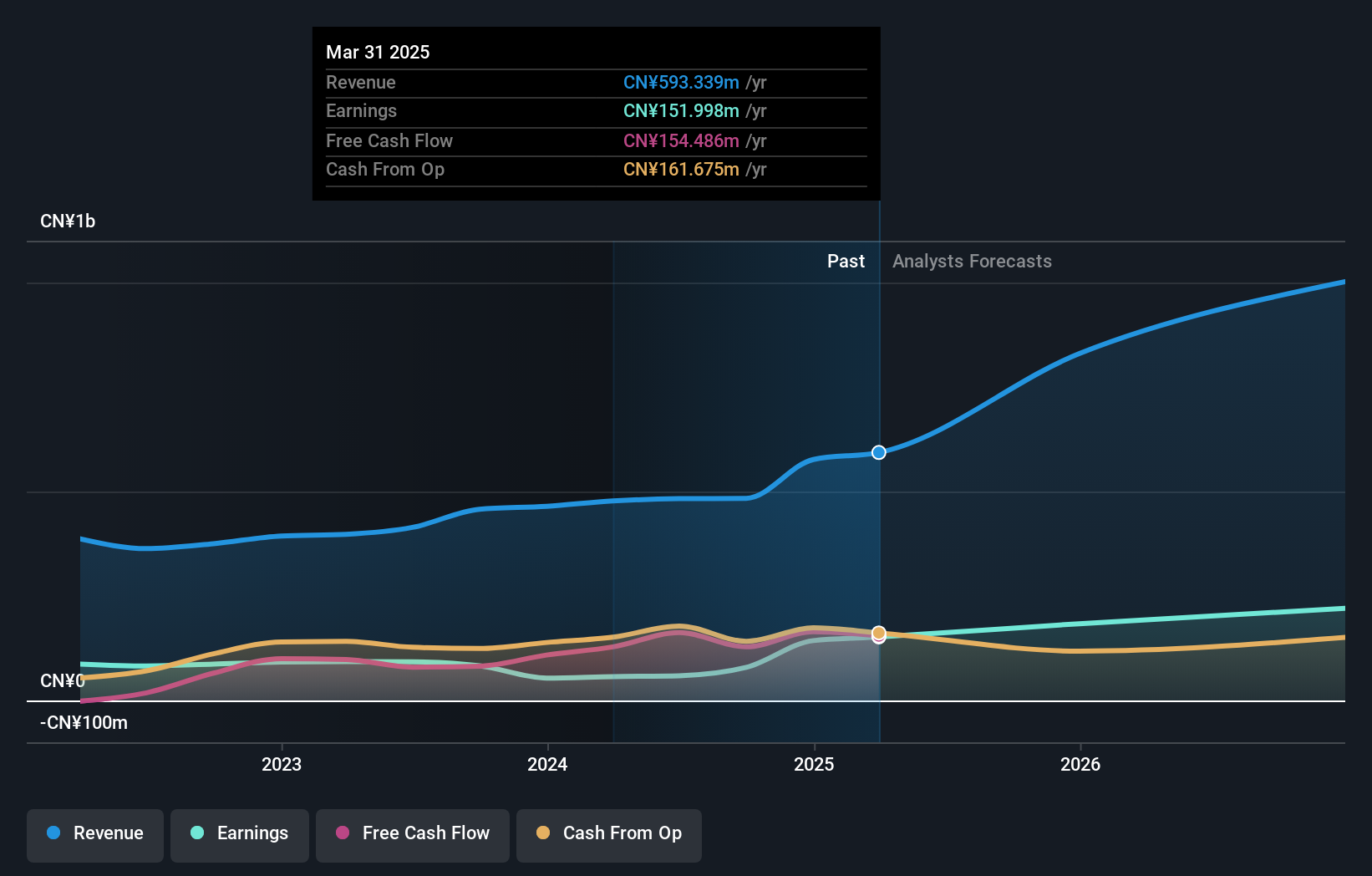

Overview: Hunan Sundy Science and Technology Co., Ltd provides coal analysis solutions both domestically in China and internationally, with a market cap of CN¥5.23 billion.

Operations: Sundy Science and Technology focuses on the instrumentation industry, generating revenue of CN¥593.34 million from coal analysis solutions.

Hunan Sundy Science and Technology has demonstrated robust growth, with earnings surging by 165.8% over the past year, significantly outpacing the electronic industry's average of 2.8%. This performance is underpinned by a projected annual revenue increase of 28.4%, which exceeds both the sector and Chinese market forecasts of 20% and 12.6%, respectively. The company also maintains a positive free cash flow, enhancing its financial stability amid a volatile share price environment. Additionally, at its recent AGM, it declared a dividend payout of CNY 3 per 10 A shares for fiscal year 2024, signaling confidence in its financial health and commitment to shareholder returns.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that specializes in the planning, development, and sale of cloud-based solutions with a market capitalization of ¥246.05 billion.

Operations: Sansan, Inc. generates revenue primarily through its Sansan/Bill One Business segment, which accounts for ¥37.79 billion, and the Eight Business segment, contributing ¥5.05 billion. The company focuses on cloud-based solutions in Japan.

Sansan, a player in the high-growth tech sector in Asia, is navigating through unique challenges and opportunities. Despite a significant one-off loss of ¥2.3 billion impacting its financial results up to May 2025, the company is poised for substantial growth with an expected annual earnings increase of 36.4% and revenue growth forecast at 15.2%. This performance outstrips the broader Japanese market projections of 8% for earnings and 4.3% for revenue growth respectively. The recent strategic decision during their July board meeting to issue stock acquisition rights underscores a commitment to aligning the interests of its team with corporate goals, potentially fostering greater innovation and dedication as Sansan continues to expand its market footprint amidst evolving digital landscapes.

- Delve into the full analysis health report here for a deeper understanding of Sansan.

Review our historical performance report to gain insights into Sansan's's past performance.

Zero One Technology (TWSE:3029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zero One Technology Co., Ltd. offers enterprise information technology solutions in Taiwan and has a market capitalization of NT$19.79 billion.

Operations: The company generates revenue primarily through its Brand Agency Business Group, which contributes NT$18.09 billion.

Zero One Technology, amidst a dynamic Asian tech landscape, has demonstrated robust financial performance with an annualized revenue growth of 22.9% and earnings increase of 24.2%. The company significantly outpaces the broader market's growth rates, which stand at 9.9% for revenue and 13.2% for earnings respectively. Notably, its commitment to innovation is underscored by substantial R&D investments totaling $120 million last year, representing a strategic allocation of approximately 15% of its total revenue towards enhancing technological capabilities and securing competitive advantage in critical sectors such as cloud computing and cybersecurity solutions.

- Click to explore a detailed breakdown of our findings in Zero One Technology's health report.

Evaluate Zero One Technology's historical performance by accessing our past performance report.

Next Steps

- Investigate our full lineup of 166 Asian High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud-based solutions in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives