As Asian markets react positively to hopes of a tariff truce between China and the U.S., investors are increasingly looking towards stable income-generating opportunities amid this evolving trade landscape. In such an environment, dividend stocks can offer appealing yields and potential resilience, making them attractive options for those seeking steady returns in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.22% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.13% | ★★★★★★ |

| NCD (TSE:4783) | 4.06% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.18% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.98% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

Click here to see the full list of 1163 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

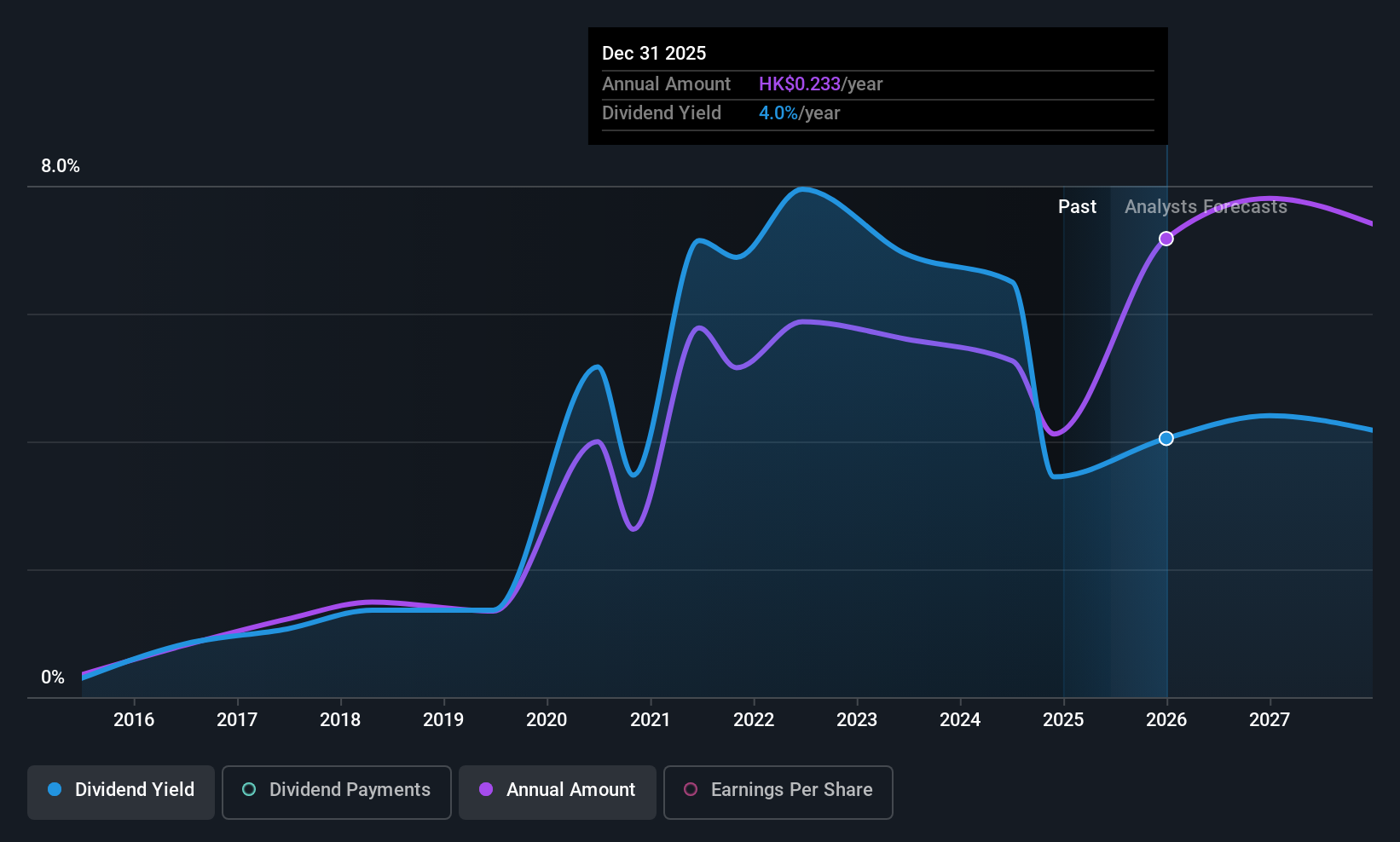

People's Insurance Company (Group) of China (SEHK:1339)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The People's Insurance Company (Group) of China Limited is an investment holding company offering insurance products and services in the People’s Republic of China and Hong Kong, with a market cap of HK$387.40 billion.

Operations: The People's Insurance Company (Group) of China Limited generates revenue through its diverse range of insurance products and services offered across the People’s Republic of China and Hong Kong.

Dividend Yield: 4.1%

The People's Insurance Company (Group) of China offers a mixed picture for dividend investors. While its dividend yield is lower than the top 25% of Hong Kong market payers, dividends are supported by a low payout ratio of 17.2% and cash flow coverage at 11.9%. Recent earnings growth strengthens this position, with net income reaching CNY 12.85 billion in Q1 2025. However, the company's dividends have been volatile over the past decade, raising concerns about reliability.

- Take a closer look at People's Insurance Company (Group) of China's potential here in our dividend report.

- The valuation report we've compiled suggests that People's Insurance Company (Group) of China's current price could be quite moderate.

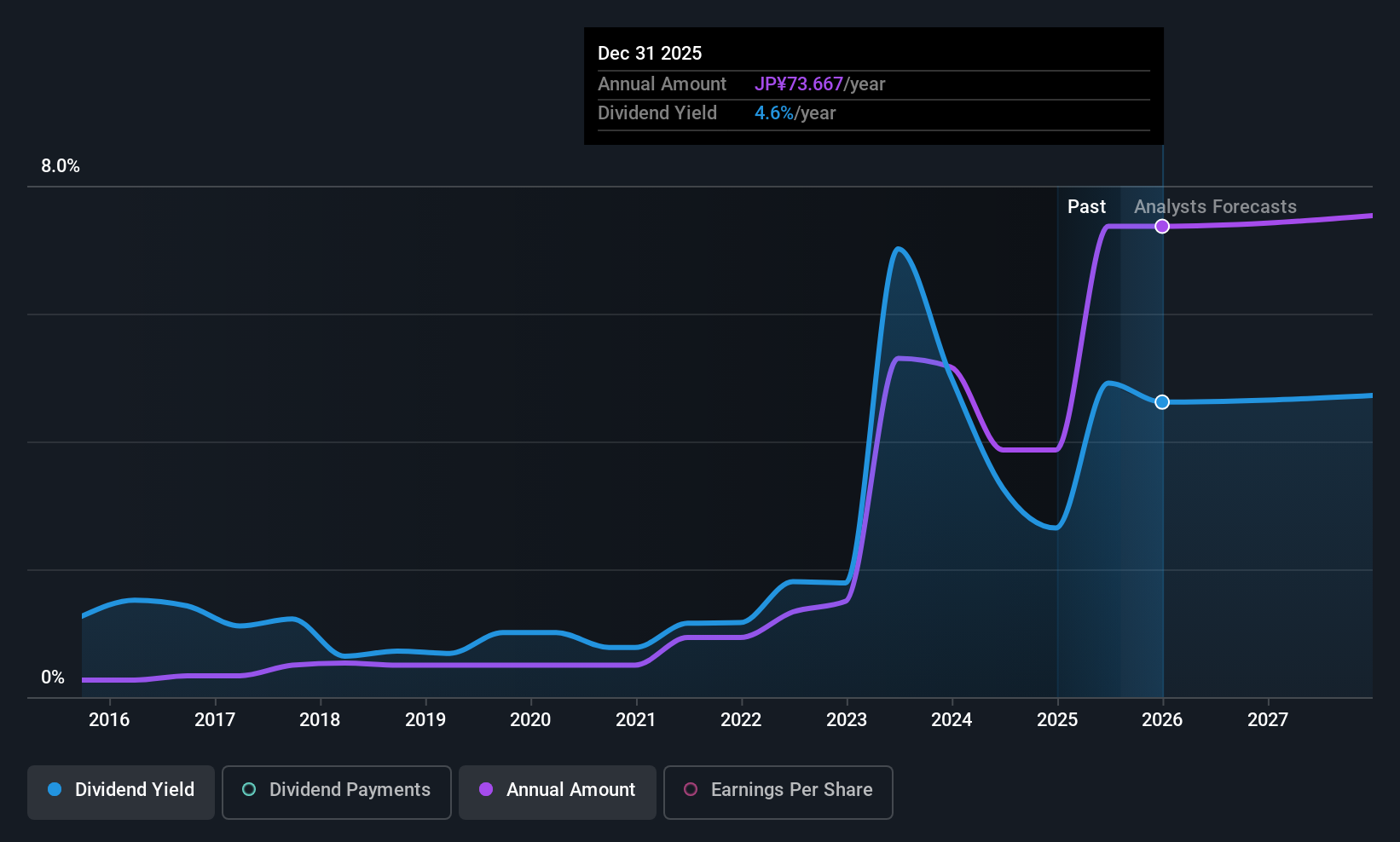

Noritsu Koki (TSE:7744)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Noritsu Koki Co., Ltd. is a company that manufactures and sells audio equipment and peripheral products across various international markets, with a market cap of ¥167.78 billion.

Operations: Noritsu Koki Co., Ltd.'s revenue is generated from the manufacturing and sale of audio equipment and peripheral products across diverse global regions, including Japan, China, the United States, Europe, Central and South America, the Middle East, and Africa.

Dividend Yield: 4.6%

Noritsu Koki's dividend yield is competitive within Japan's market, but its history of volatility and unreliability over the past decade poses concerns. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 54.6% and 33.2%, respectively. Recent events include a completed share buyback totaling ¥1.41 billion and revised earnings guidance for fiscal year 2025, reflecting adjustments in revenue expectations while maintaining stable profit forecasts.

- Get an in-depth perspective on Noritsu Koki's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Noritsu Koki is trading behind its estimated value.

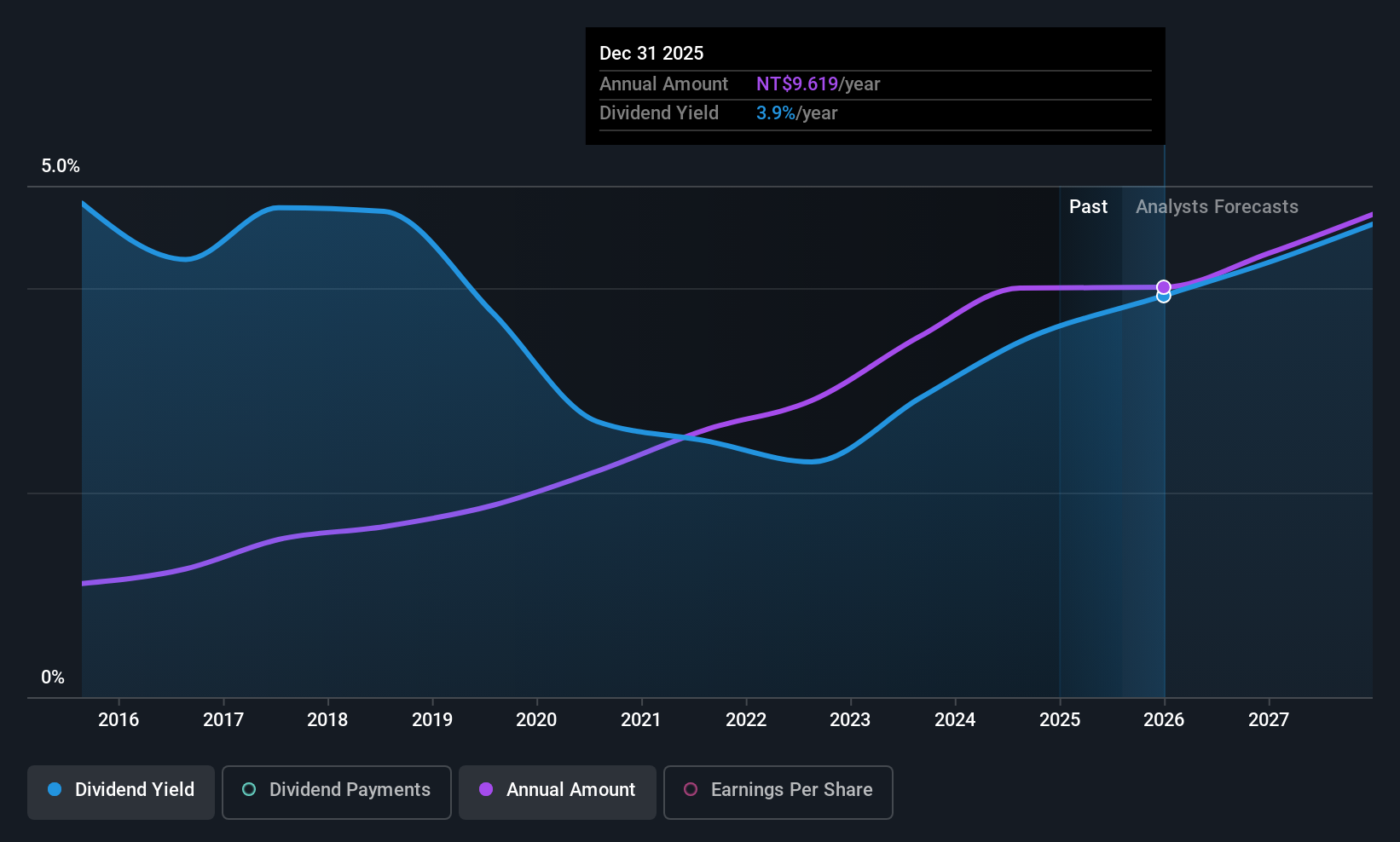

SINBON Electronics (TWSE:3023)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SINBON Electronics Co., Ltd. manufactures and sells computer peripherals, connectors, wires, and other parts in various international markets with a market cap of NT$57.62 billion.

Operations: SINBON Electronics Co., Ltd. generates revenue through the production and sale of computer peripherals, connectors, and wires across Mainland China, Hong Kong, the United States, Taiwan, and other international markets.

Dividend Yield: 4.3%

SINBON Electronics offers a stable dividend history, with consistent payments over the past decade. However, its 4.27% yield is below Taiwan's top 25% of dividend payers and not well-covered by free cash flows due to a high cash payout ratio of 93.5%. Despite recent declines in earnings and sales, the company's innovative strides in EV charging solutions could bolster future growth prospects, as evidenced by securing UL certification for their liquid cooling system.

- Click here and access our complete dividend analysis report to understand the dynamics of SINBON Electronics.

- Our expertly prepared valuation report SINBON Electronics implies its share price may be lower than expected.

Turning Ideas Into Actions

- Reveal the 1163 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Noritsu Koki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7744

Noritsu Koki

Manufactures and sells audio equipment and peripheral products in Japan, China, the United States, Europe, Central and South America, the Middle East, Africa, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion