- China

- /

- Paper and Forestry Products

- /

- SZSE:000833

Exploring Undiscovered Gems in Asia May 2025

Reviewed by Simply Wall St

As Asia's markets navigate a complex landscape of trade negotiations and economic shifts, small-cap indexes have emerged as leaders, posting gains amid broader market fluctuations. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and adaptability to changing economic conditions while capitalizing on regional growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Philippine Savings Bank | NA | 6.09% | 23.58% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors in China, with a market capitalization of CN¥8.83 billion.

Operations: Shenzhen Kingkey Smart Agriculture Times Co., Ltd generates revenue primarily from its real estate and breeding operations in China. The company's financial performance is influenced by these two sectors, with specific cost structures impacting its profitability.

Shenzhen Kingkey Smart Agriculture Times Ltd, a company with a market cap on the smaller side, has shown impressive earnings growth of 32.9% over the past year, outpacing the broader real estate industry. The firm's net income for Q1 2025 was CNY 112.03 million, up from CNY 54.13 million in the same period last year, highlighting its robust performance despite sales dipping to CNY 1,108.08 million from CNY 1,257.76 million previously. With a satisfactory net debt to equity ratio of 26.7%, it seems well-positioned financially and offers an attractive value proposition at trading levels significantly below its estimated fair value by about 80%.

Guangxi Yuegui Guangye Holdings (SZSE:000833)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Yuegui Guangye Holdings Co., Ltd. operates in various industries and has a market capitalization of CN¥10.56 billion.

Operations: The company generates revenue primarily from its operations across multiple industries. It has a market capitalization of CN¥10.56 billion, indicating its significant presence in the market.

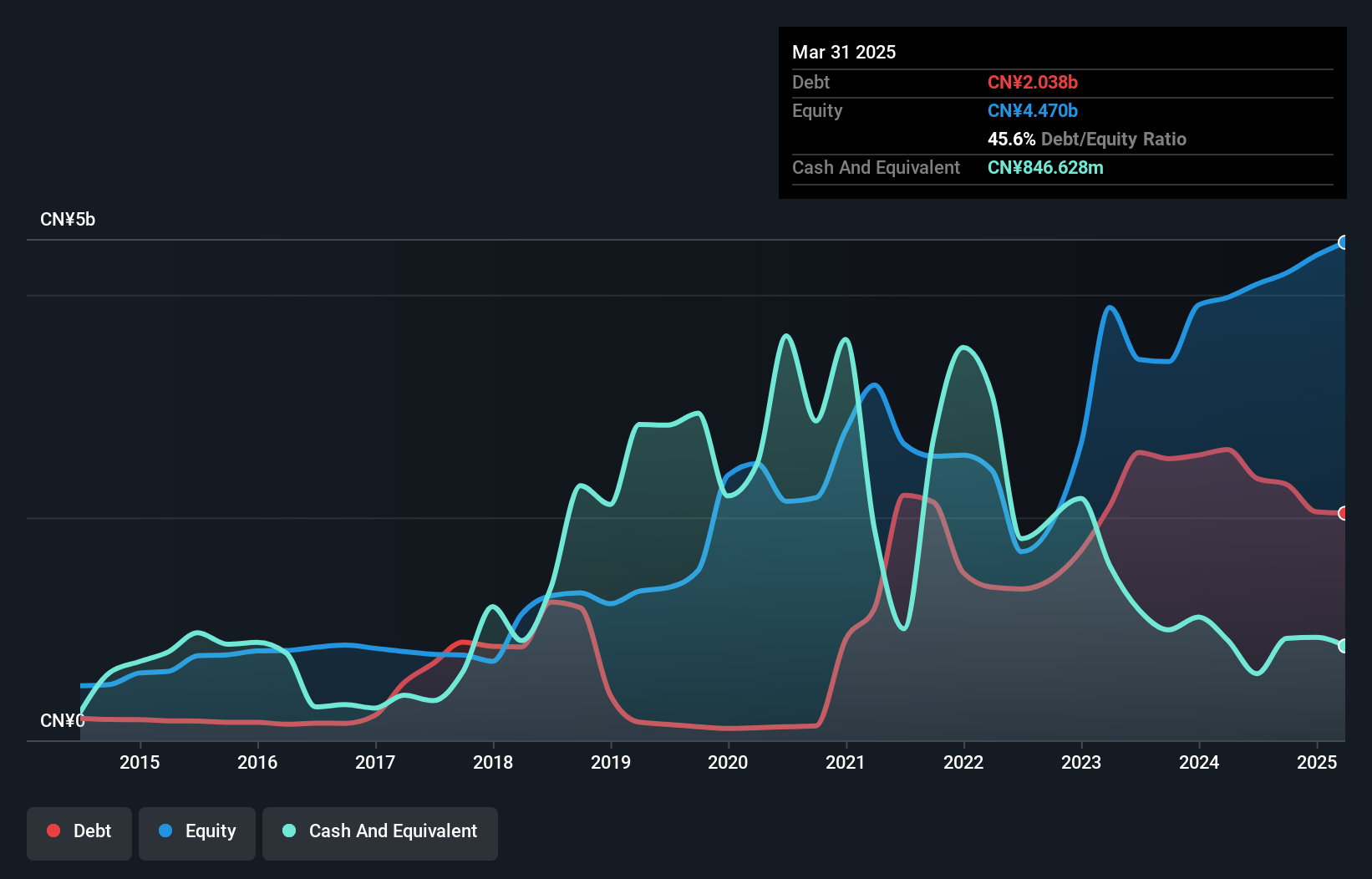

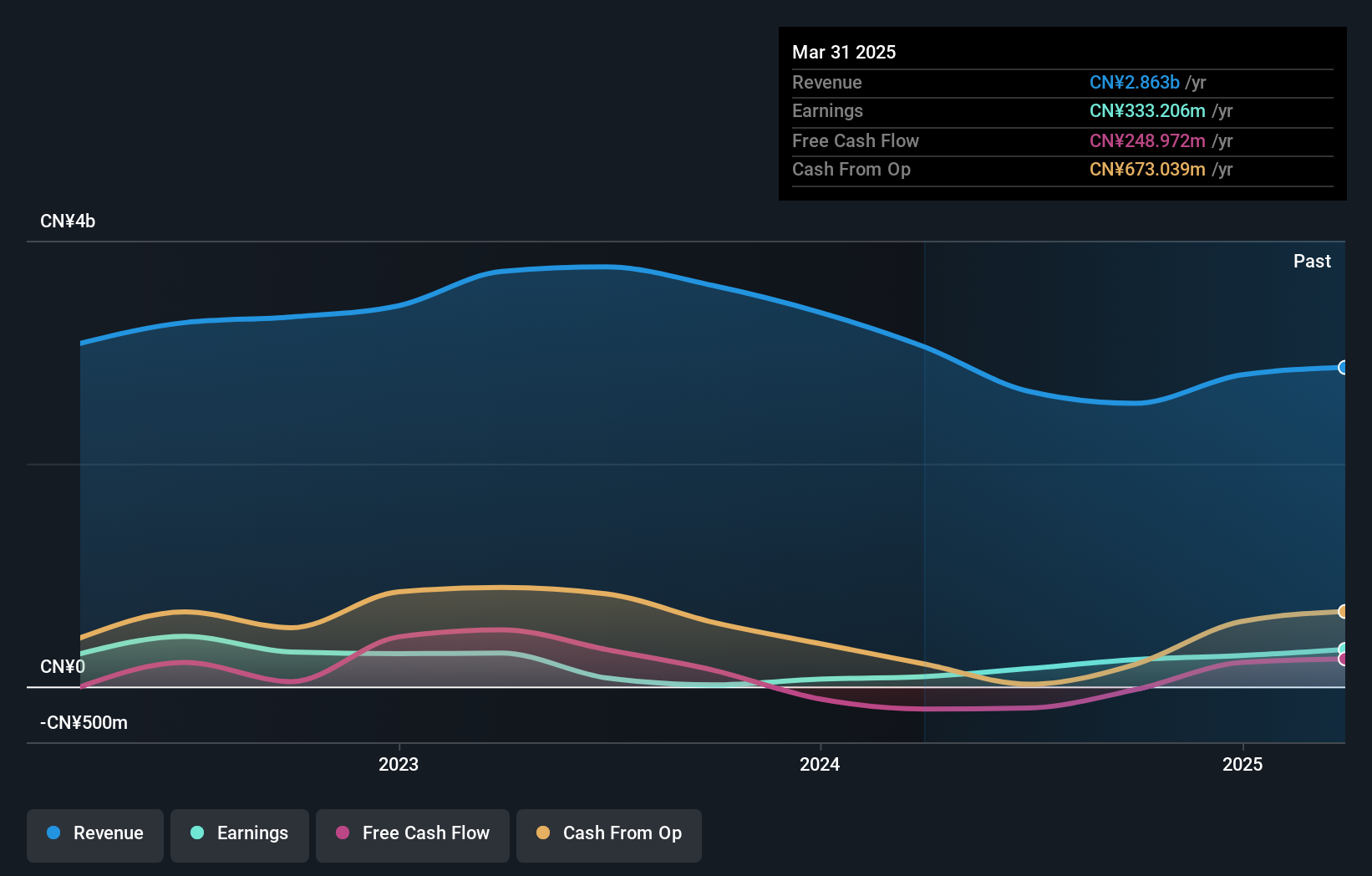

Guangxi Yuegui Guangye Holdings has shown impressive growth, with earnings surging by 276% over the past year, outpacing the forestry industry. The company's debt to equity ratio rose from 29% to 40% in five years, yet its net debt to equity remains satisfactory at 16%. Recent financial results highlight a robust performance with first-quarter sales reaching CNY 682 million and net income climbing to CNY 117 million from CNY 62 million a year prior. The company also approved a cash dividend of CNY 1.22 per ten shares for the year, reflecting strong profitability and shareholder returns.

- Take a closer look at Guangxi Yuegui Guangye Holdings' potential here in our health report.

Understand Guangxi Yuegui Guangye Holdings' track record by examining our Past report.

Asia Optical (TWSE:3019)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Optical Co., Inc. is a Taiwanese company that manufactures and sells a range of optical products including cameras, lenses, and optical sights both domestically and internationally, with a market cap of NT$38.95 billion.

Operations: Asia Optical generates revenue primarily through the sale of optical products such as cameras and lenses. The company operates both in Taiwan and internationally, contributing to its market cap of NT$38.95 billion.

Asia Optical, a dynamic player in the electronics sector, has shown impressive earnings growth of 98.9% over the past year, outpacing the industry average of 22.6%. The company is debt-free and boasts high-quality past earnings, which enhances its financial stability. Recent results for Q1 2025 highlighted sales reaching TWD 5.41 billion from TWD 4.29 billion a year earlier, with net income doubling to TWD 220.56 million from TWD 110.84 million previously reported. Despite its small size and volatile share price recently, Asia Optical's robust performance and forecasted annual earnings growth of over 27% suggest promising potential ahead.

- Click here to discover the nuances of Asia Optical with our detailed analytical health report.

Review our historical performance report to gain insights into Asia Optical's's past performance.

Turning Ideas Into Actions

- Explore the 2666 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000833

Guangxi Yuegui Guangye Holdings

Guangxi Yuegui Guangye Holdings Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives