- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3548

Uncovering February 2025's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets grapple with uncertainties surrounding tariffs and a cooling labor market, small-cap stocks have shown resilience amid fluctuating economic indicators. The S&P 600 Index, which tracks these smaller companies, offers a fertile ground for discovering potential opportunities that might be overlooked in broader market narratives. In this environment, identifying promising stocks requires a keen eye for companies that demonstrate robust fundamentals and adaptability to shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 11.98% | 17.61% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jarllytec (TPEX:3548)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jarllytec Co., Ltd. is engaged in the design, development, manufacturing, assembly, inspection, and sale of stamping parts, hinges, and metal injections/MIM across China, the United States, Thailand, Taiwan, and internationally with a market cap of NT$12.16 billion.

Operations: Jarllytec generates its revenue primarily from the Hub Segment, contributing NT$8.90 billion, while the Optical Fiber Segment adds NT$253.80 million.

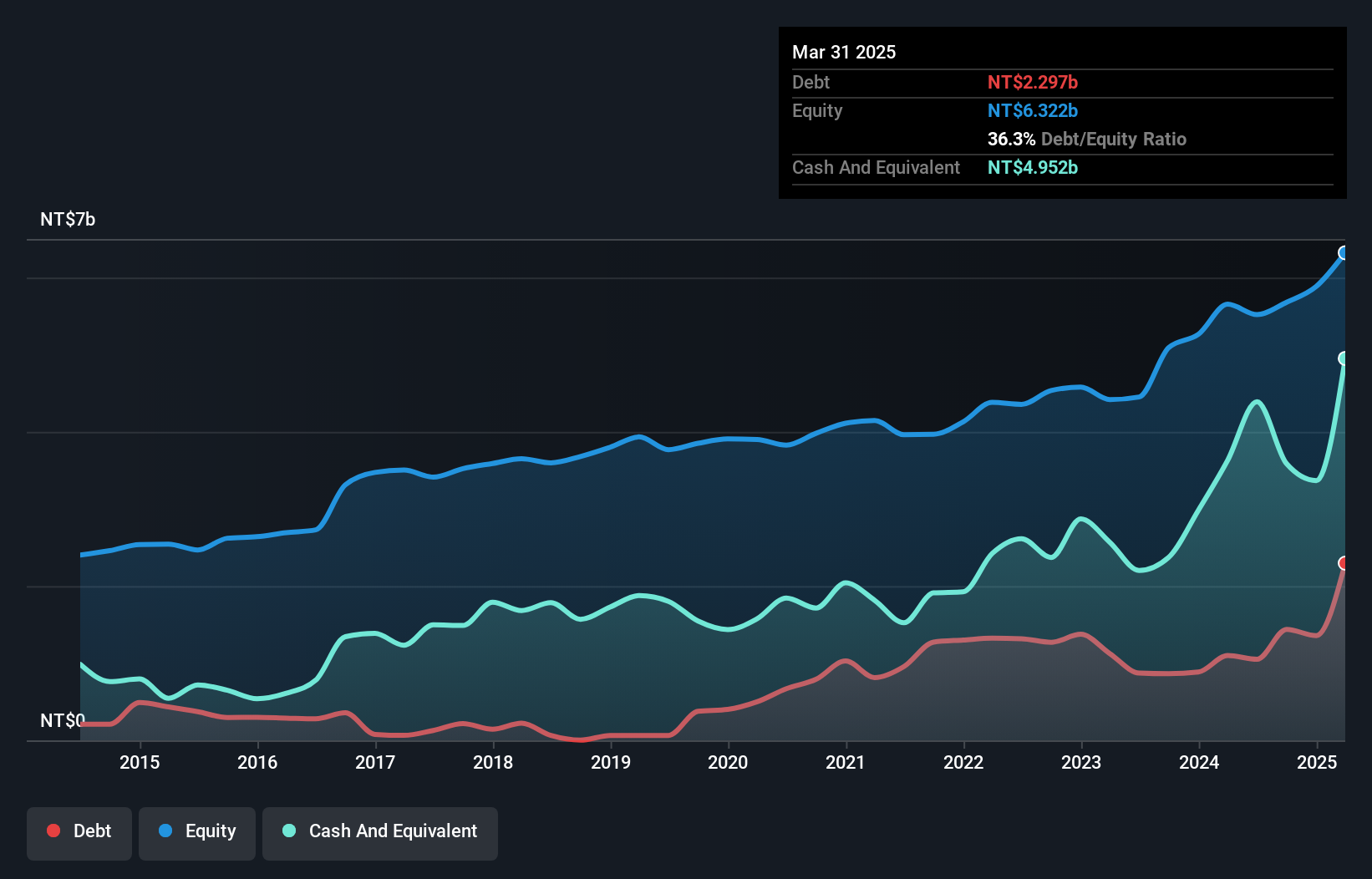

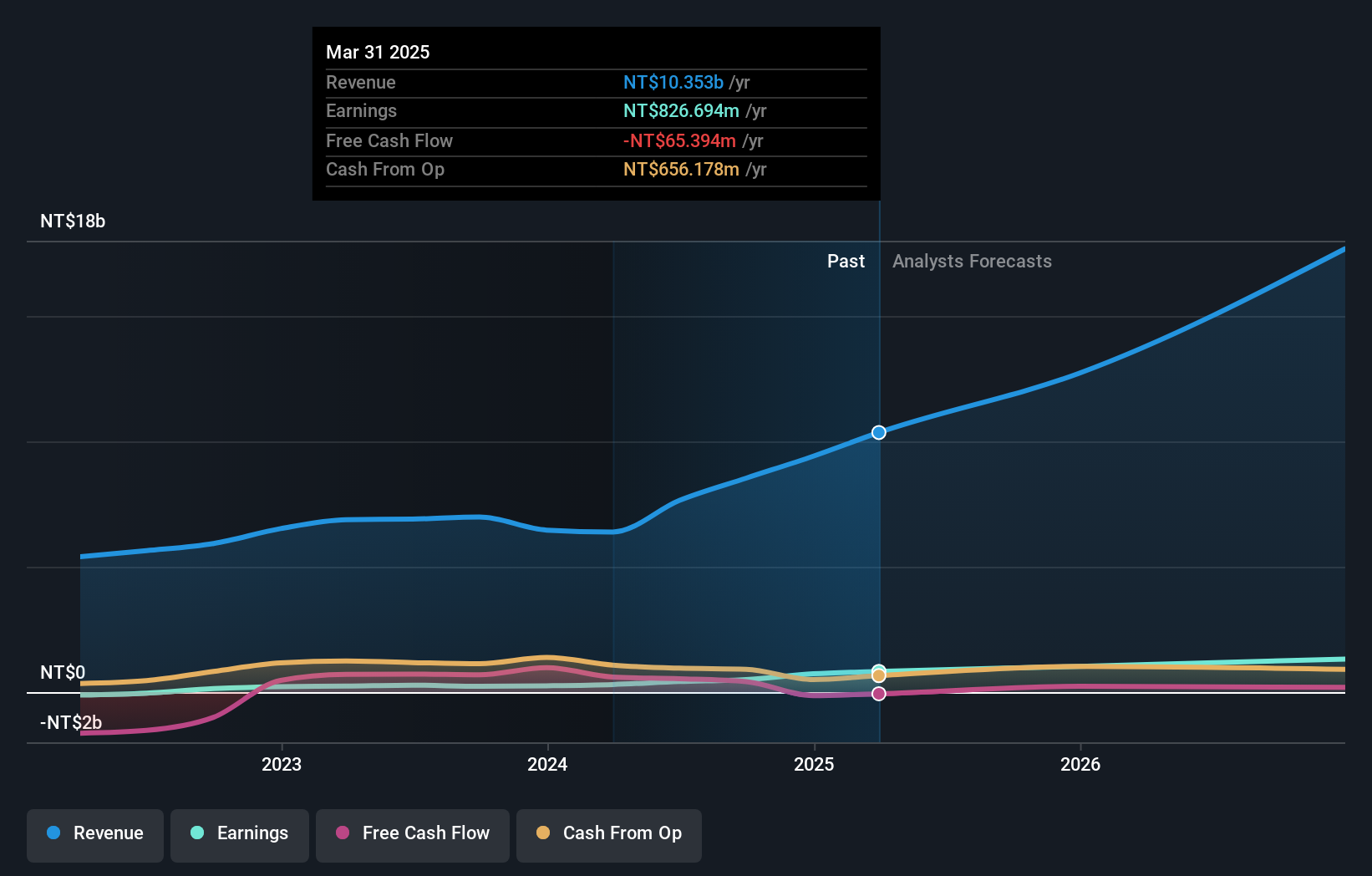

Jarllytec, a promising player in the electronics sector, has seen its earnings grow by 42% over the past year, outpacing the industry's 6.6% growth. Despite a volatile share price recently, it trades at about 54.6% below its estimated fair value. The company reported third-quarter sales of TWD 2.15 billion and net income of TWD 72 million, down from TWD 228 million last year; however, nine-month figures show improvement with sales at TWD 6.81 billion and net income rising to TWD 401 million from TWD 354 million previously. This suggests potential for recovery and growth ahead.

- Dive into the specifics of Jarllytec here with our thorough health report.

Explore historical data to track Jarllytec's performance over time in our Past section.

Fuso ChemicalLtd (TSE:4368)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fuso Chemical Co., Ltd. is a global manufacturer and seller of life science, electronic material, and functional chemical products with a market cap of ¥121.64 billion.

Operations: Fuso Chemical Co., Ltd. generates revenue through its diverse product lines, including life science, electronic materials, and functional chemicals. The company's financial performance is influenced by the cost structure associated with these segments. Notably, Fuso Chemical's net profit margin has shown variation over recent periods.

Fuso Chemical, a promising player in the chemicals sector, showcases impressive earnings growth of 23.6% over the past year, outpacing the industry average of 18.2%. The company is trading at a significant discount, about 61.3% below its estimated fair value, which could suggest potential for value appreciation. With high-quality past earnings and no concerns regarding interest coverage due to earning more interest than it pays, Fuso seems financially robust. Recent executive changes might influence strategic directions positively as they align with their life sciences business ambitions starting February 2025.

- Click here to discover the nuances of Fuso ChemicalLtd with our detailed analytical health report.

Gain insights into Fuso ChemicalLtd's past trends and performance with our Past report.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Value Rating: ★★★★★★

Overview: Chenming Electronic Tech. Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally with a market cap of approximately NT$27.28 billion.

Operations: Chenming Electronic Tech. generates revenue primarily through the production and sales of computer and mobile device components, amounting to NT$8.53 billion.

Chenming Electronic Tech, a smaller player in the tech sector, is catching eyes with its impressive earnings growth of 119.4% over the past year, outpacing the industry average of 12.9%. The company seems to be on solid financial footing with a debt-to-equity ratio that has improved from 25.2% to 11.1% over five years, indicating effective debt management. Trading at a discount of 33.1% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite recent volatility in share price, Chenming's high-quality earnings and positive free cash flow position it well for future growth prospects.

Turning Ideas Into Actions

- Gain an insight into the universe of 4708 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3548

Jarllytec

Designs, develops, manufactures, assembles, inspects, and sells stamping parts, hinges, and metal injections/MIM in China, the United States, Thailand, Taiwan, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives