- Taiwan

- /

- Tech Hardware

- /

- TWSE:3013

High Growth Tech Stocks In Asia To Watch September 2025

Reviewed by Simply Wall St

As of late August 2025, Asian markets have shown mixed performances with China's stock indices advancing due to strong tech sector earnings despite broader economic challenges, while Japan's markets remained steady amid ongoing trade discussions and monetary policy expectations. In this dynamic environment, identifying high growth tech stocks in Asia involves looking for companies that demonstrate resilience and adaptability in the face of fluctuating market conditions and evolving economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Fositek | 33.77% | 43.92% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Eoptolink Technology | 31.37% | 31.28% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Foxconn Industrial Internet | 27.61% | 27.23% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| ALTEOGEN | 55.36% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Macnica Holdings (TSE:3132)

Simply Wall St Growth Rating: ★★★★☆☆

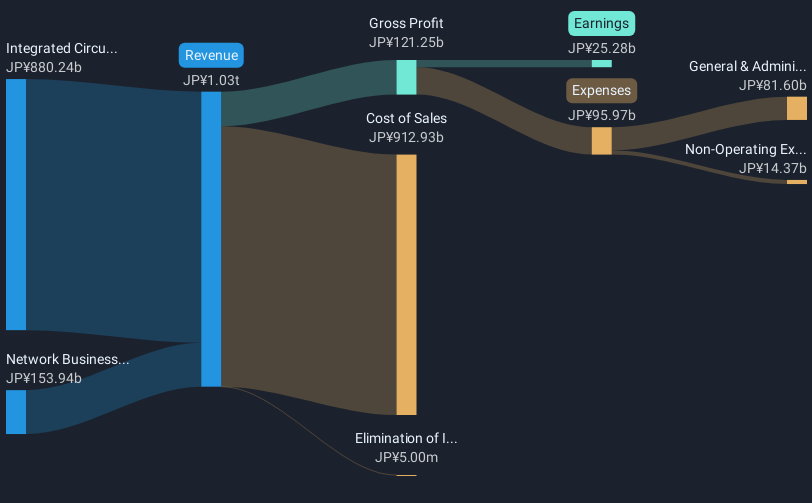

Overview: Macnica Holdings, Inc. is a company that focuses on importing, selling, and exporting electronic components in Japan with a market capitalization of approximately ¥358.97 billion.

Operations: The company generates revenue primarily through its Integrated Circuits, Electronic Devices, and Other Businesses segment, which accounts for ¥901.51 billion. Additionally, the Network Business contributes ¥158 billion to its revenue streams.

At the recent Gartner Security Summit in Tokyo, Macnica Holdings highlighted its strategic focus on security and risk management, a vital area as digital threats escalate globally. Despite a challenging year with earnings contracting by 47.5%, the company's commitment to innovation is evident in its R&D spending trends, maintaining robust investment levels to fuel future growth. With revenue expected to grow at 7.7% annually, outpacing the Japanese market's 4.3%, and earnings projected to surge by 26% per year, Macnica is positioning itself strongly within Asia’s tech landscape. Moreover, their proactive approach in board decisions regarding treasury shares underscores a strategic alignment towards enhancing shareholder value through internal restructuring and focused market segments like cybersecurity solutions for high-profile clients including TSMC.

- Navigate through the intricacies of Macnica Holdings with our comprehensive health report here.

Gain insights into Macnica Holdings' past trends and performance with our Past report.

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

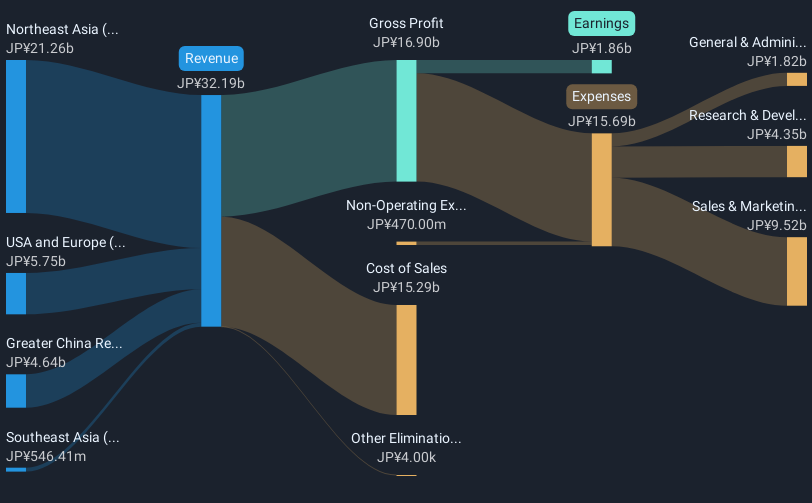

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of ¥159.55 billion.

Operations: Appier provides AI-driven platforms enabling enterprises to leverage data for informed decision-making across various markets. The company focuses on delivering software solutions that enhance business intelligence and operational efficiency.

Appier Group's recent performance underscores its potential in Asia's tech sector, with earnings growth soaring by 129.8% over the past year, significantly outpacing the software industry average of 14.9%. This robust increase is supported by projections of a 30.78% annual growth rate in earnings, dwarfing Japan's broader market forecast of 8.2%. Despite challenges in maintaining positive free cash flow, Appier continues to invest heavily in innovation as evidenced by its commitment to R&D—crucial for sustaining its competitive edge and capitalizing on increasing demands for advanced AI solutions across diverse industries. With revenue expected to climb at an impressive rate of 19.5% annually, Appier is well-positioned to leverage emerging technological trends and expand its market share within the rapidly evolving Asian tech landscape.

- Click here to discover the nuances of Appier Group with our detailed analytical health report.

Review our historical performance report to gain insights into Appier Group's's past performance.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

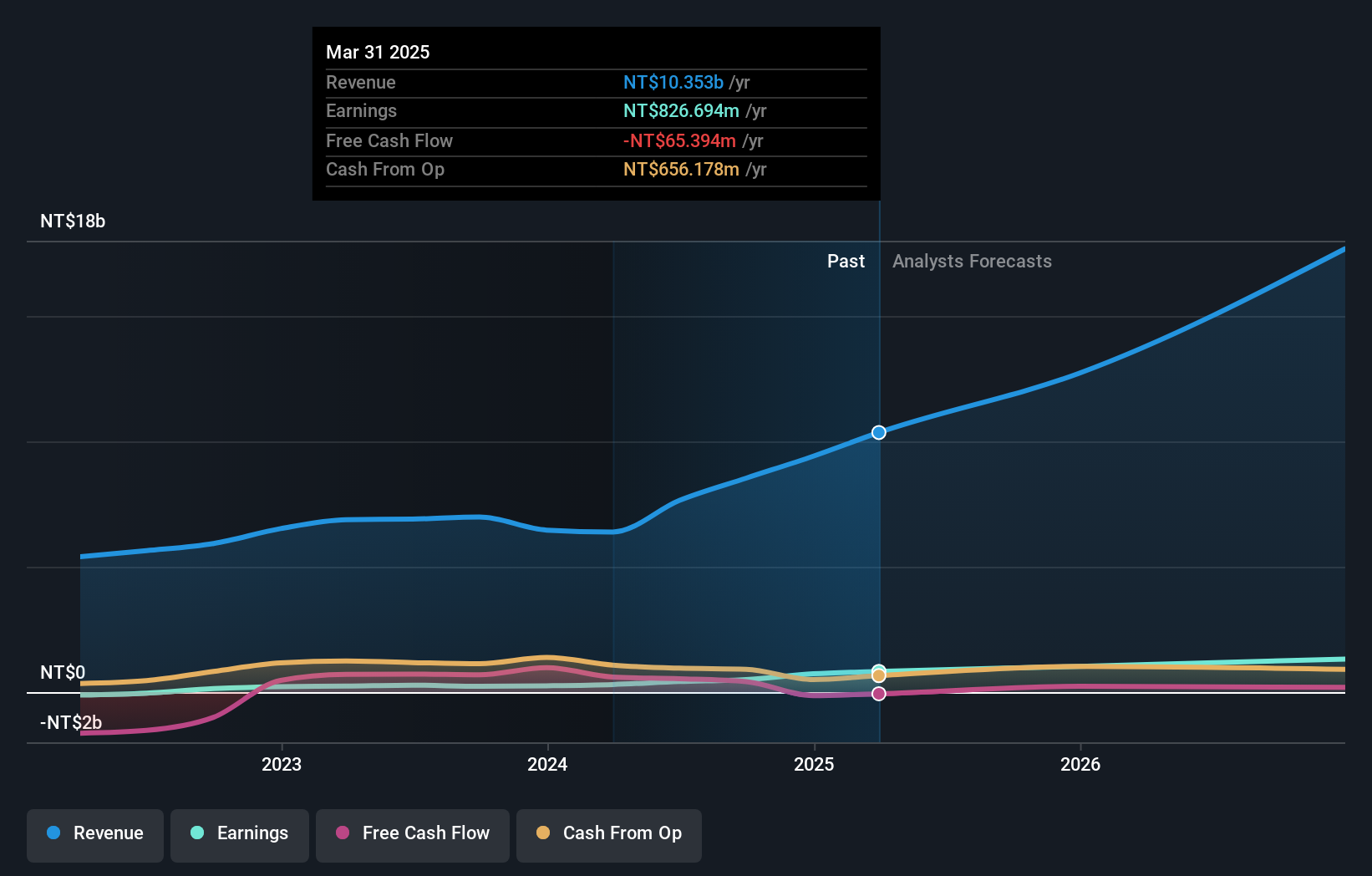

Overview: Chenming Electronic Tech Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally with a market cap of NT$26.98 billion.

Operations: The company's primary revenue stream is derived from the production and sales of computer and mobile device components, amounting to NT$10.37 billion.

Chenming Electronic Tech has demonstrated notable growth in the competitive Asian tech sector, with its revenue surging by 43% annually. This growth trajectory is complemented by a robust increase in earnings, up 65.7% per year, outpacing the broader Taiwanese market's average. Despite a recent dip in net income as reported in their latest semi-annual results—TWD 283.91 million from TWD 269.11 million—the company continues to invest significantly in R&D, allocating funds strategically to foster innovation and maintain its market position amidst evolving technological demands. With these investments and a strong revenue base, Chenming is poised to adapt and thrive even as market dynamics shift.

- Unlock comprehensive insights into our analysis of Chenming Electronic Tech stock in this health report.

Learn about Chenming Electronic Tech's historical performance.

Make It Happen

- Explore the 179 names from our Asian High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3013

Chenming Electronic Tech

An OEM/ODM manufacturer, engages in the research and development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds in Taiwan, China, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives