- Japan

- /

- Auto Components

- /

- TSE:7242

3 Undiscovered Gems To Enhance Your Global Portfolio

Reviewed by Simply Wall St

As global markets grapple with fluctuating consumer sentiment and economic uncertainty, small-cap stocks face unique challenges and opportunities. Despite recent volatility driven by tech sell-offs and macroeconomic concerns, investors can still find potential in lesser-known companies that demonstrate strong fundamentals and adaptability. In this environment, a good stock might be characterized by its resilience to market shifts, solid financial health, and the ability to capitalize on emerging trends or niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| JiaXing Gas Group | 49.18% | 19.35% | 19.32% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Fengyinhe Holdings | 9.39% | 53.36% | 74.10% | ★★★★☆☆ |

| Grupo Gigante S. A. B. de C. V | 34.19% | 6.87% | 32.95% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sun (TSE:6736)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sun Corporation operates in the global data intelligence, entertainment, and information technology sectors in Japan with a market capitalization of ¥197.74 billion.

Operations: Sun Corporation generates revenue primarily from its Entertainment Related Business, contributing ¥6.21 billion, followed by the New IT Related Business at ¥3.67 billion, and the Global Data Intelligence Business at ¥1.21 billion.

Sun, a tech player with a promising profile, has made strides by becoming profitable in the past year. Its debt-to-equity ratio impressively decreased from 24.6% to 5.8% over five years, indicating solid financial management. Despite its volatile share price recently, Sun's price-to-earnings ratio of 11.3x remains attractive compared to the JP market at 14.3x. The company also executed significant share buybacks this year, repurchasing 767,300 shares for ¥6.99 billion by October's end, reflecting confidence in its valuation and future prospects despite challenges like large one-off gains impacting earnings quality.

- Get an in-depth perspective on Sun's performance by reading our health report here.

Review our historical performance report to gain insights into Sun's's past performance.

KYB (TSE:7242)

Simply Wall St Value Rating: ★★★★★★

Overview: KYB Corporation is a global manufacturer and seller of automotive, hydraulic, and aircraft components with a market capitalization of ¥192.24 billion.

Operations: The primary revenue stream for KYB comes from its automotive components segment, generating ¥314.96 billion, followed by hydraulic components at ¥116.13 billion. The aviation equipment business contributes a smaller portion with ¥4.55 billion in revenue.

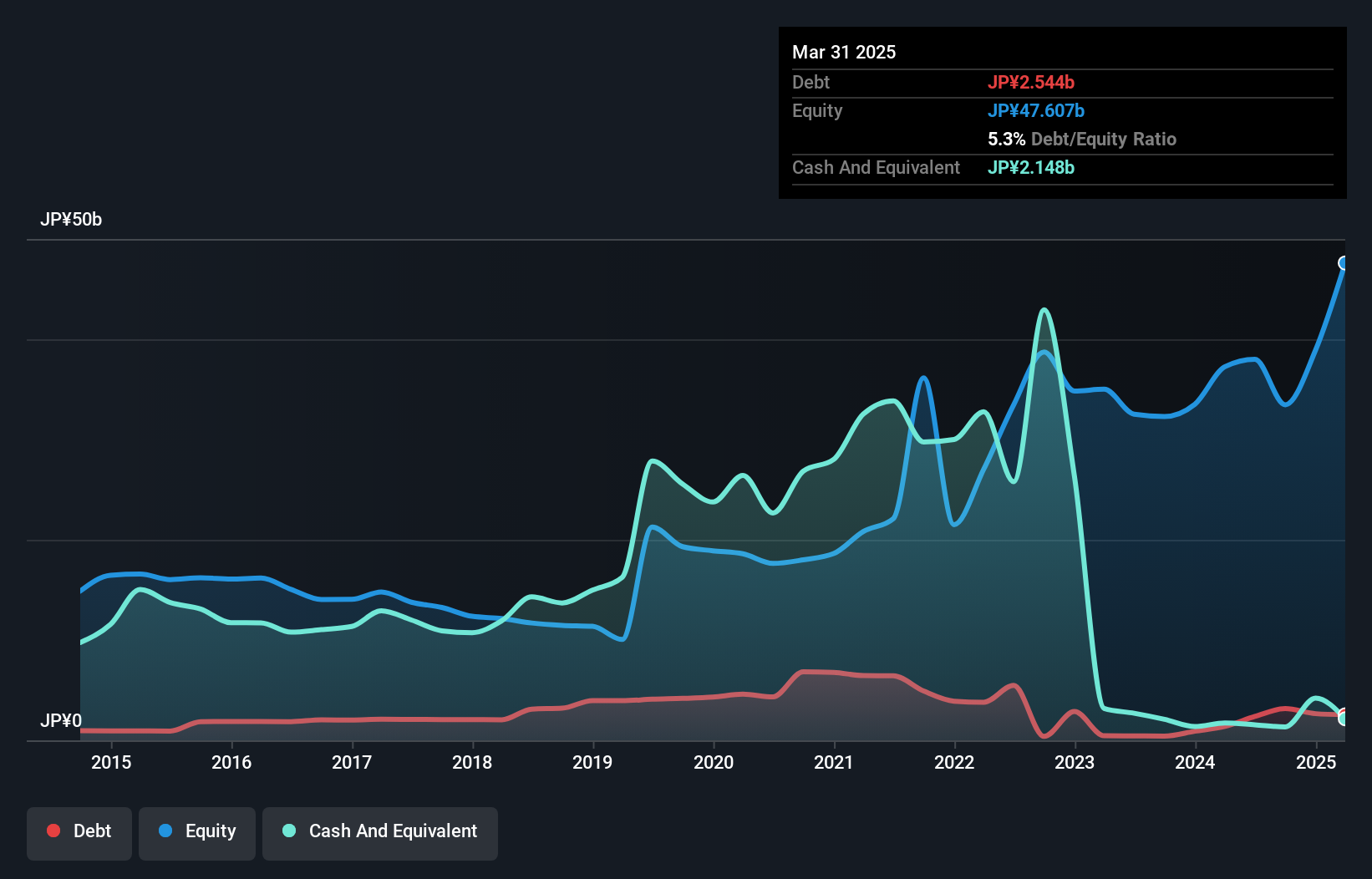

KYB's recent performance highlights its potential in the auto components sector. The company has achieved a remarkable earnings growth of 61.8% over the past year, significantly outpacing the industry's 4.4%. With a price-to-earnings ratio of 9.9x, it trades below Japan's market average of 14.3x, suggesting an attractive valuation for investors seeking value plays in smaller companies. KYB's net debt to equity ratio stands at a satisfactory 19.4%, down from 184.6% five years ago, reflecting prudent financial management and reduced leverage risk while maintaining high-quality earnings and robust interest coverage at 58 times EBIT payments.

Walsin Technology (TWSE:2492)

Simply Wall St Value Rating: ★★★★★☆

Overview: Walsin Technology Corporation, along with its subsidiaries, specializes in the development, manufacturing, and sale of passive electronic components across Asia, America, and Europe with a market capitalization of NT$57.69 billion.

Operations: Walsin Technology generates revenue primarily from the sale of passive electronic components. The company's financial performance includes a net profit margin that has shown fluctuations in recent periods. Cost breakdowns are not specified, but operating expenses and production costs are likely significant factors influencing profitability.

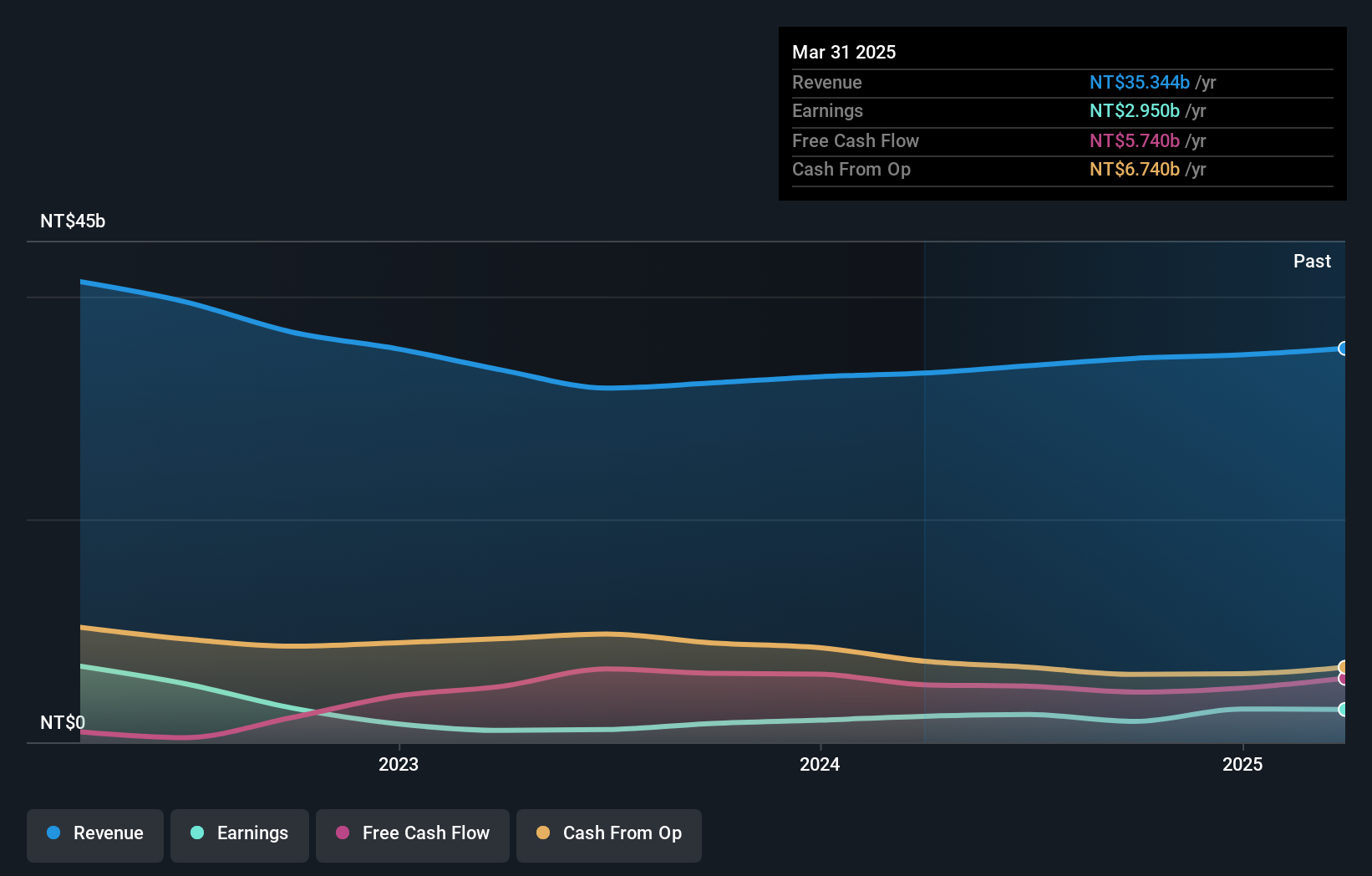

Walsin Technology, a small cap player in the electronic components sector, has demonstrated resilience with recent earnings growth of 25.6%, outpacing the industry average of 0.9%. Despite a volatile share price recently, its high-quality earnings and positive free cash flow reflect solid operational performance. For Q3 2025, net income surged to TWD 1,057 million from TWD 445 million year-on-year, while basic EPS rose to TWD 2.18 from TWD 0.92 previously. However, over five years earnings have seen an annual decline of around 33%, and its debt-to-equity ratio increased to a satisfactory level of 55%.

- Unlock comprehensive insights into our analysis of Walsin Technology stock in this health report.

Evaluate Walsin Technology's historical performance by accessing our past performance report.

Key Takeaways

- Delve into our full catalog of 2988 Global Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KYB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7242

KYB

Manufactures and sells automotive, hydraulic, and aircraft components worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives