- Japan

- /

- Trade Distributors

- /

- TSE:2768

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, investors are keenly observing central bank policies and their impact on market volatility. With the Federal Reserve holding rates steady amidst solid economic growth and inflation concerns, attention is turning to stable income opportunities such as dividend stocks. In this environment, selecting dividend stocks that offer consistent payouts can provide a buffer against market unpredictability while potentially enhancing portfolio returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Sojitz (TSE:2768)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sojitz Corporation is a general trading company involved in diverse global business activities, with a market cap of approximately ¥665.62 billion.

Operations: Sojitz Corporation generates revenue through several key segments, including Chemicals (¥577.78 billion), Automotive (¥419.28 billion), Retail & Consumer Service (¥427.75 billion), Metals, Mineral Resources & Recycling (¥486.07 billion), and Consumer Industry & Agriculture Business (¥264.51 billion).

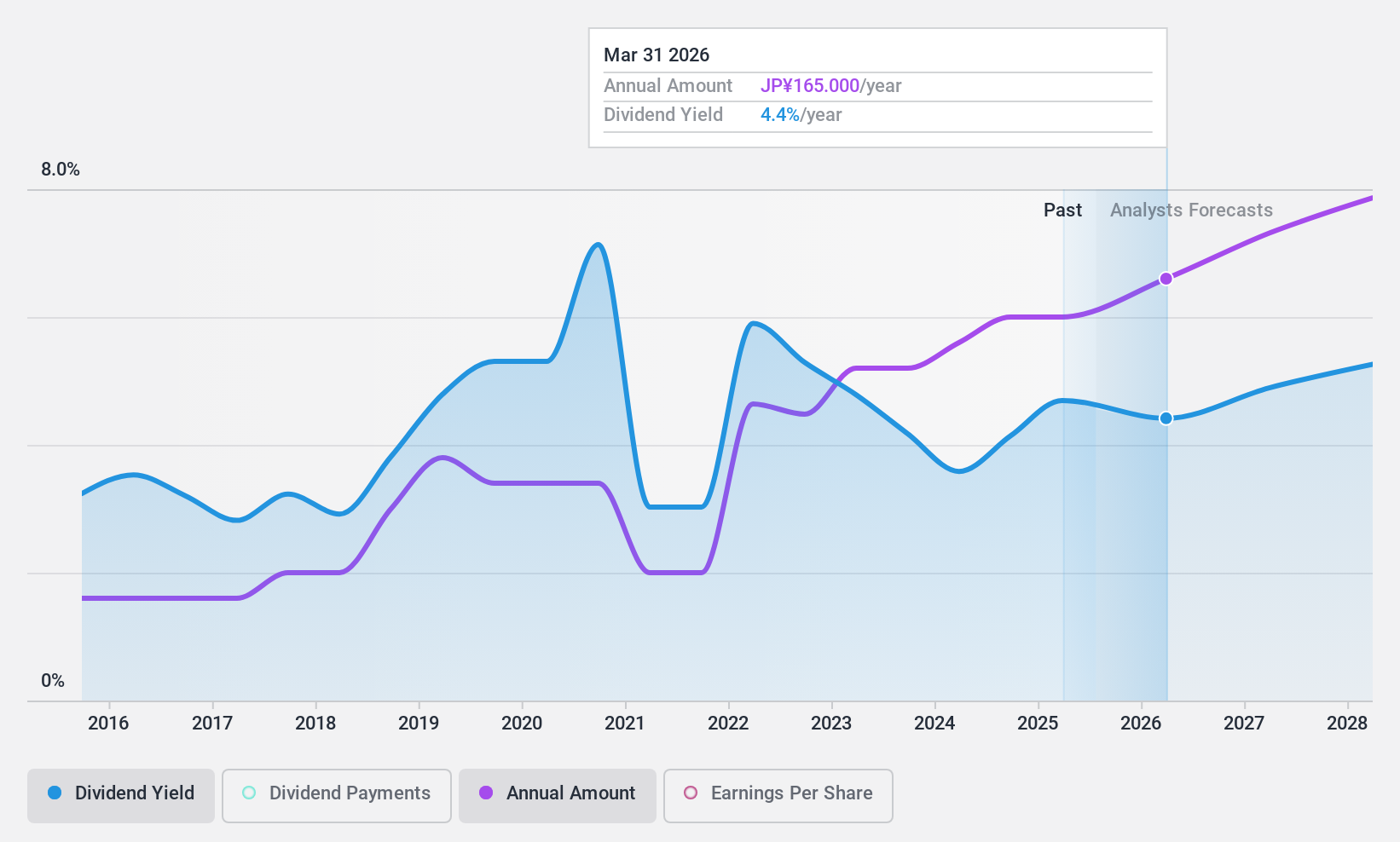

Dividend Yield: 4.6%

Sojitz's dividend yield of 4.58% ranks in the top 25% of Japanese market payers, but its sustainability is questionable due to lack of free cash flow coverage. The payout ratio remains low at 32.7%, suggesting earnings cover dividends adequately, yet past payments have been volatile and unreliable over a decade. Recent restructuring efforts, including divesting marine vessel trading operations into a new subsidiary, aim to optimize business operations and could impact future dividend stability.

- Click here to discover the nuances of Sojitz with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Sojitz is priced lower than what may be justified by its financials.

Good Will Instrument (TWSE:2423)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Good Will Instrument Co., Ltd. manufactures and markets electrical test and measurement instruments for educational and industrial manufacturing markets, with a market cap of NT$6.45 billion.

Operations: The company generates revenue of NT$2.85 billion from its Electronic Test & Measurement Instruments segment.

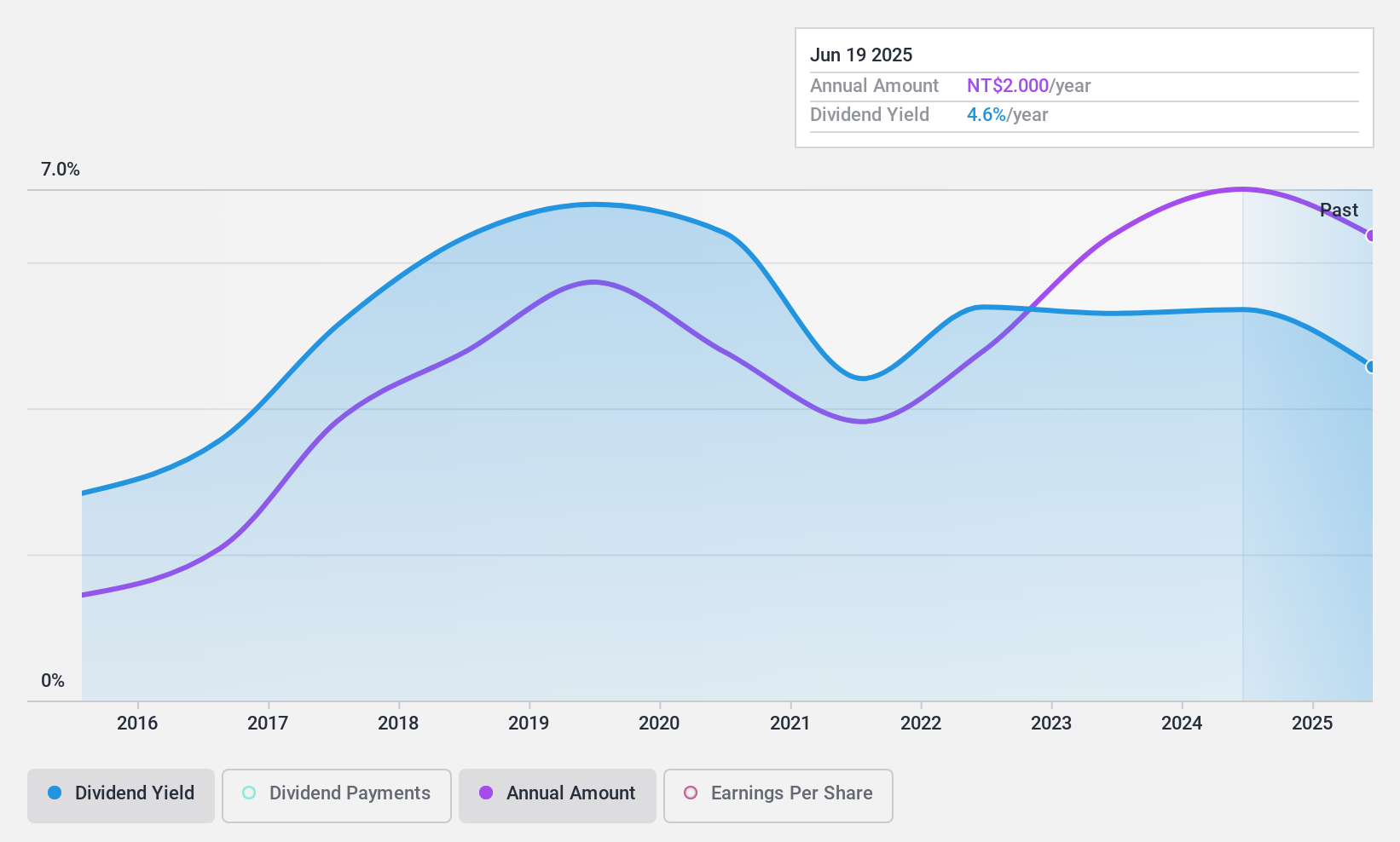

Dividend Yield: 4.9%

Good Will Instrument's dividend yield of 4.95% is among the top 25% in Taiwan, supported by a stable payout ratio of 85% and cash flow coverage at 54.4%. Dividends have grown consistently over the past decade with minimal volatility. Despite recent declines in sales and net income for Q3 and the first nine months of 2024, dividends remain covered by earnings and free cash flow, indicating reliability amidst current financial challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Good Will Instrument.

- Our valuation report here indicates Good Will Instrument may be undervalued.

Stark Technology (TWSE:2480)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Stark Technology Inc. offers system integration services for information and communication technology products in Taiwan, with a market cap of NT$15.74 billion.

Operations: Stark Technology Inc.'s revenue from computer services is NT$7.27 billion.

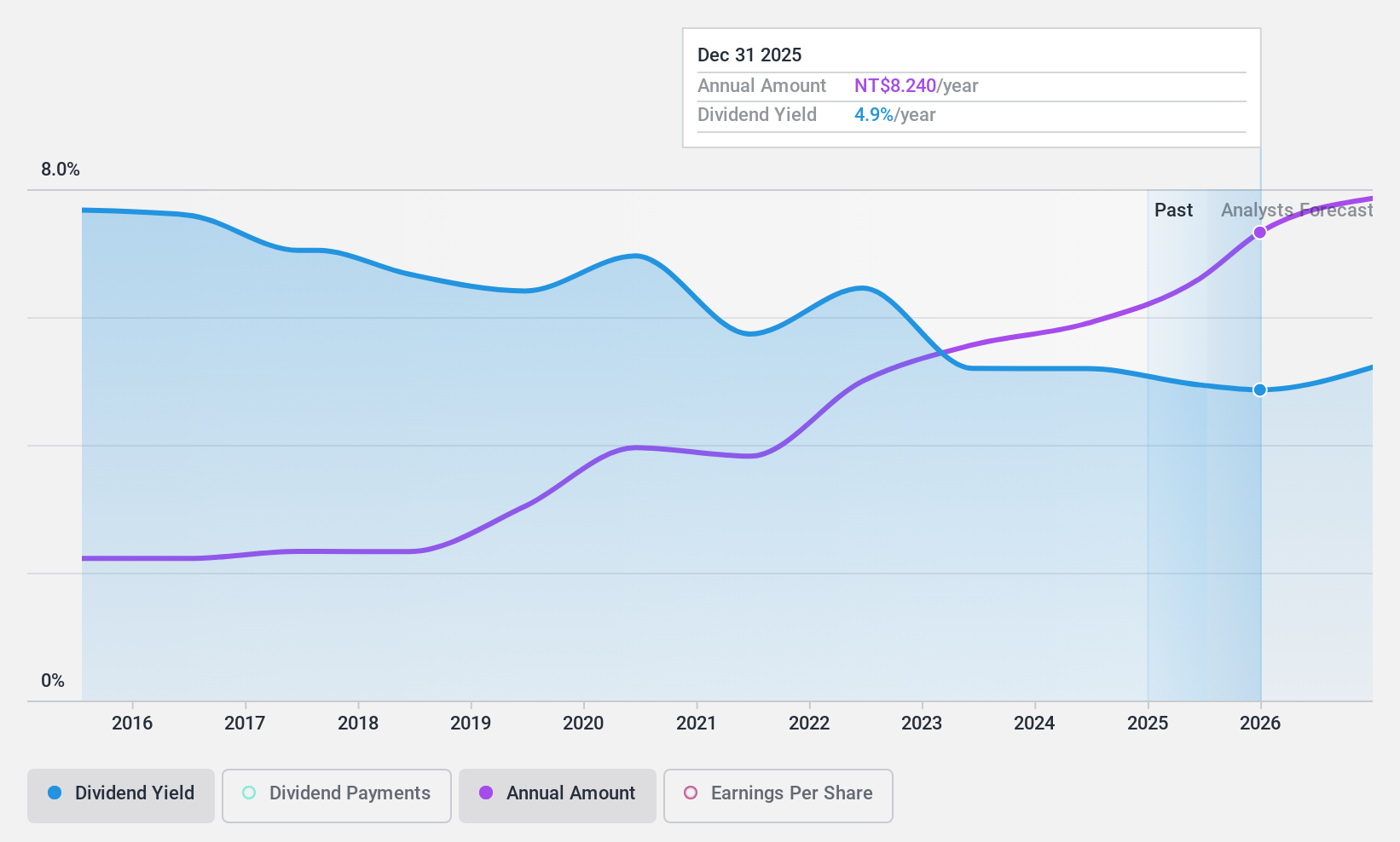

Dividend Yield: 4.5%

Stark Technology offers a 4.49% dividend yield, slightly below Taiwan's top 25% threshold, but maintains stability and growth over the past decade. The payout ratio stands at 89.9%, with cash flow coverage at 84.8%, ensuring dividends are supported by earnings and cash flows. Despite recent modest sales growth to TWD 1,762.56 million in Q3 2024 and stable net income, Stark's dividends remain reliable amidst these financial results.

- Get an in-depth perspective on Stark Technology's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Stark Technology shares in the market.

Next Steps

- Navigate through the entire inventory of 1984 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Sojitz

Operates as a general trading company that engages in various business activities worldwide.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives