- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2392

Is Now The Time To Put Cheng Uei Precision Industry (TWSE:2392) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Cheng Uei Precision Industry (TWSE:2392). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Cheng Uei Precision Industry

How Quickly Is Cheng Uei Precision Industry Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Over the last three years, Cheng Uei Precision Industry has grown EPS by 14% per year. That's a good rate of growth, if it can be sustained.

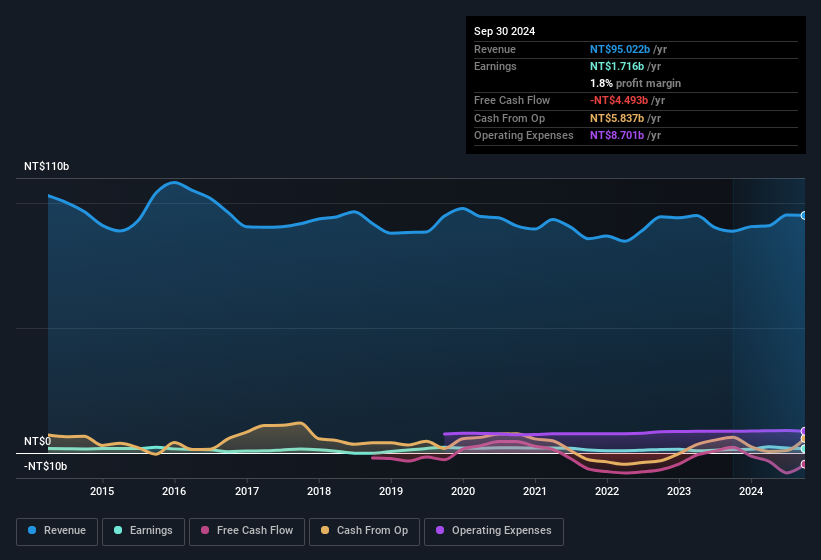

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Cheng Uei Precision Industry remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.1% to NT$95b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Cheng Uei Precision Industry's balance sheet strength, before getting too excited.

Are Cheng Uei Precision Industry Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Cheng Uei Precision Industry followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have NT$469m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Cheng Uei Precision Industry To Your Watchlist?

As previously touched on, Cheng Uei Precision Industry is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. What about risks? Every company has them, and we've spotted 3 warning signs for Cheng Uei Precision Industry (of which 2 can't be ignored!) you should know about.

Although Cheng Uei Precision Industry certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Taiwanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2392

Cheng Uei Precision Industry

Designs, manufactures, processes, assembles, and sells plastic injection molding products and their components, molds, electronic connectors, precision terminals, electronic wires and parts, and chargers worldwide.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success