- Taiwan

- /

- Tech Hardware

- /

- TWSE:2385

There's Reason For Concern Over Chicony Electronics Co., Ltd.'s (TWSE:2385) Massive 36% Price Jump

Chicony Electronics Co., Ltd. (TWSE:2385) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

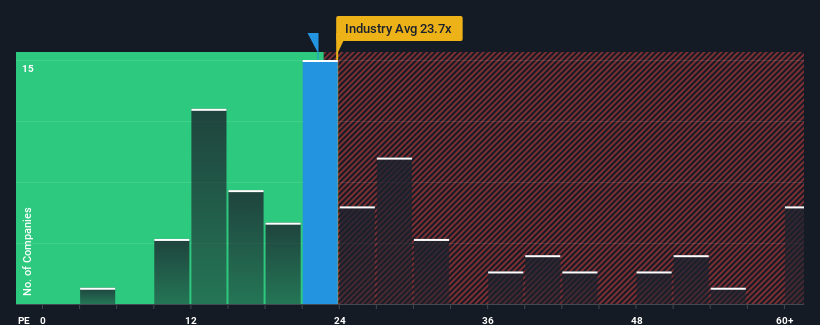

Although its price has surged higher, there still wouldn't be many who think Chicony Electronics' price-to-earnings (or "P/E") ratio of 22.2x is worth a mention when the median P/E in Taiwan is similar at about 22x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been more advantageous for Chicony Electronics as its earnings haven't fallen as much as the rest of the market. One possibility is that the P/E is moderate because investors think this relatively better earnings performance might be about to evaporate. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue outplaying the market.

See our latest analysis for Chicony Electronics

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Chicony Electronics would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 9.8% during the coming year according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 22%, which is noticeably more attractive.

With this information, we find it interesting that Chicony Electronics is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Chicony Electronics' P/E?

Chicony Electronics appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chicony Electronics currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Chicony Electronics with six simple checks on some of these key factors.

You might be able to find a better investment than Chicony Electronics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2385

Chicony Electronics

Engages in the manufacture and sale of electronic parts and components in Taiwan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives