- Taiwan

- /

- Tech Hardware

- /

- TWSE:2385

Chicony Electronics Co., Ltd. (TWSE:2385) Doing What It Can To Lift Shares

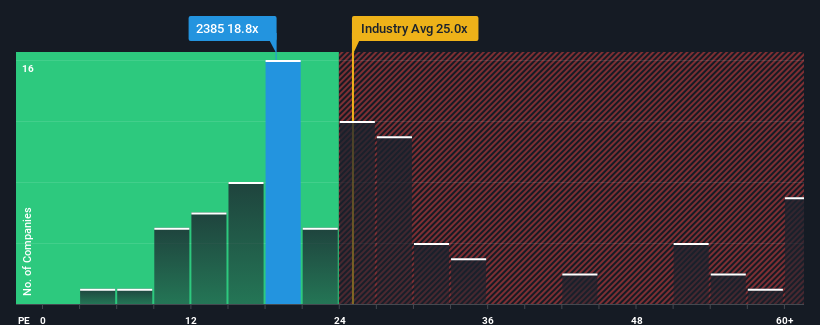

When close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 23x, you may consider Chicony Electronics Co., Ltd. (TWSE:2385) as an attractive investment with its 18.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Chicony Electronics as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Chicony Electronics

Is There Any Growth For Chicony Electronics?

There's an inherent assumption that a company should underperform the market for P/E ratios like Chicony Electronics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 8.2%. The latest three year period has also seen a 7.0% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 13% per annum over the next three years. With the market predicted to deliver 12% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Chicony Electronics is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Chicony Electronics' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chicony Electronics currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Chicony Electronics with six simple checks on some of these key factors.

If you're unsure about the strength of Chicony Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2385

Chicony Electronics

Engages in the manufacture and sale of electronic parts and components in Taiwan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives