- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:9911

High Growth Tech in Asia Featuring Newborn Town and Two More Stocks

Reviewed by Simply Wall St

In recent weeks, global markets have experienced heightened volatility, with small-cap indexes like the S&P MidCap 400 and Russell 2000 facing declines amid geopolitical tensions and fluctuating economic indicators. As investors navigate these uncertain times, identifying high-growth opportunities in Asia's tech sector becomes crucial, where companies that demonstrate resilience and innovation can stand out despite broader market challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking sector with a market capitalization of HK$14.49 billion.

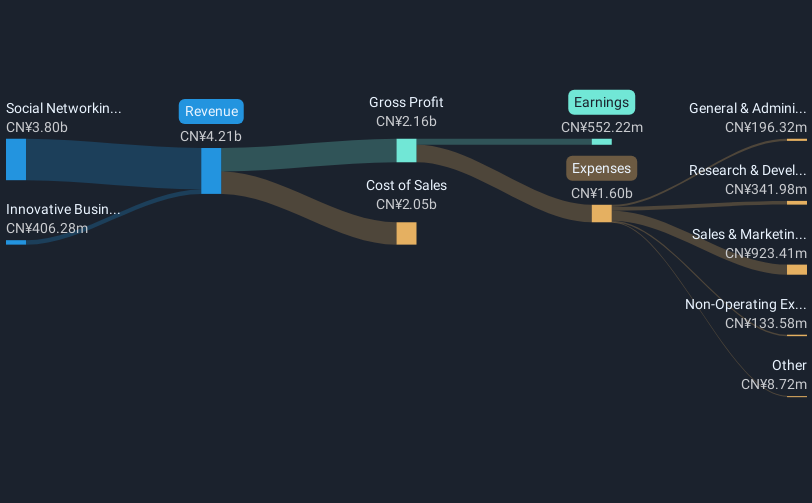

Operations: The company primarily generates revenue from its Social Networking Business, which accounts for CN¥4.63 billion, significantly overshadowing its Innovative Business segment at CN¥459.64 million.

Newborn Town's recent strategic expansion with its new global headquarters in Hong Kong underscores its commitment to leveraging the region's robust business ecosystem and talent pool. This move coincides with a remarkable quarterly revenue forecast, projecting an increase of up to 48.1% year-on-year, signaling strong market demand for their offerings. Despite a dip in profit margins from 15.5% to 9.4%, the firm is poised for significant earnings growth, estimated at 30.3% annually over the next three years, outpacing both local and industry averages. This growth trajectory is supported by substantial R&D investments aimed at driving innovation and maintaining competitive advantage in the rapidly evolving tech landscape.

- Get an in-depth perspective on Newborn Town's performance by reading our health report here.

Review our historical performance report to gain insights into Newborn Town's's past performance.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for treating autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States with a market cap of HK$35.93 billion.

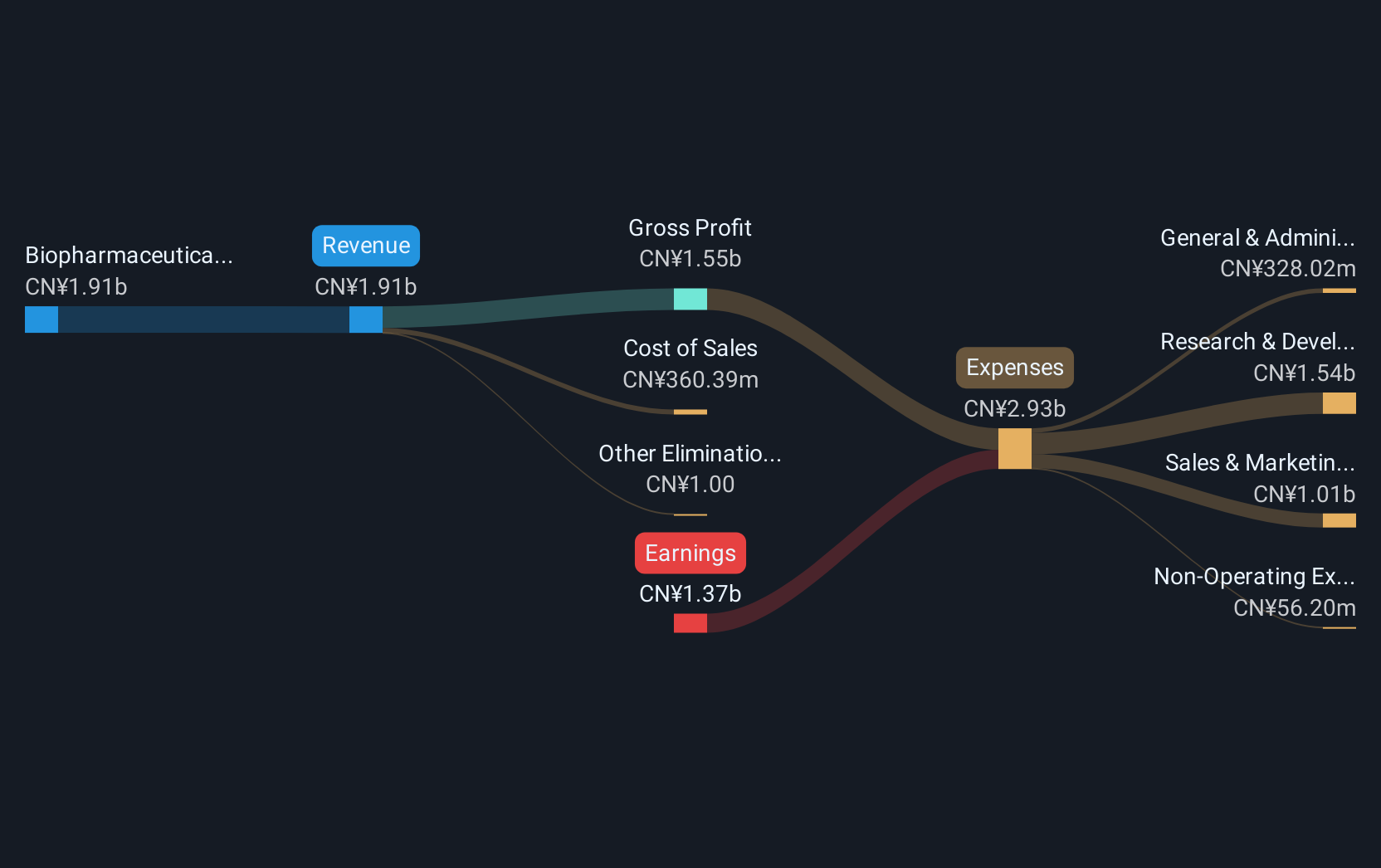

Operations: RemeGen Co., Ltd. generates revenue primarily through its biopharmaceutical research, service, production, and sales activities, amounting to CN¥1.91 billion. The company operates in the biopharmaceutical sector with a focus on addressing unmet medical needs in autoimmune, oncology, and ophthalmic diseases across Mainland China and the United States.

RemeGen's strategic advancements in oncology and autoimmune treatments underscore its potential within Asia's biotech landscape. The company recently showcased promising Phase 2 results for disitamab vedotin in gastric cancer treatment at the ASCO Annual Meeting, highlighting significant efficacy improvements over standard therapies. This innovation follows their successful HKD 806.36 million equity offering, bolstering financial flexibility for further R&D. Moreover, the NMPA's approval of Telitacicept marks a breakthrough in treating myasthenia gravis, positioning RemeGen at the forefront of addressing complex medical needs with novel biologics. These developments reflect a robust pipeline capable of driving sustained revenue growth and expanding market presence.

- Delve into the full analysis health report here for a deeper understanding of RemeGen.

Gain insights into RemeGen's past trends and performance with our Past report.

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★☆☆

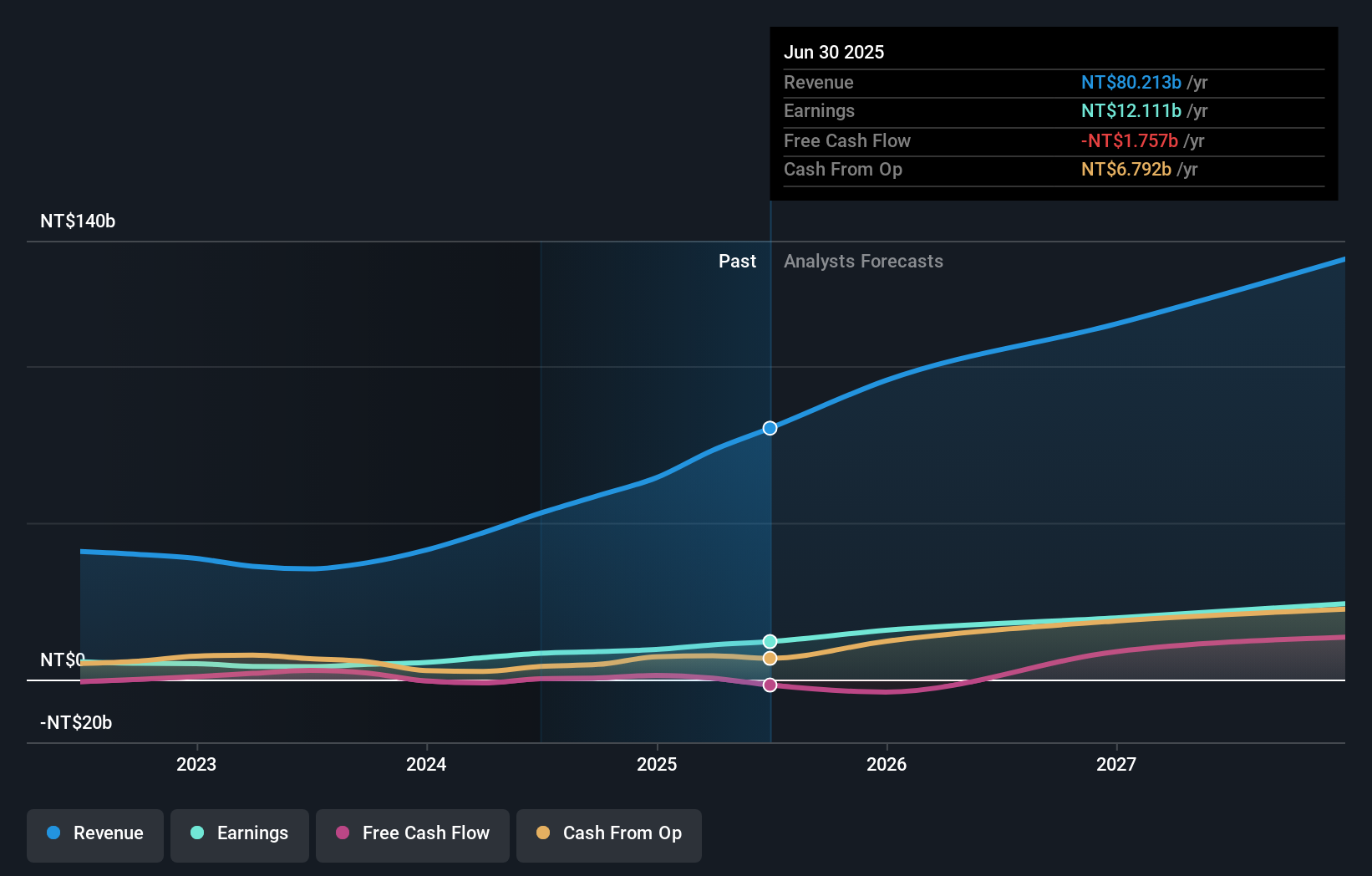

Overview: Elite Material Co., Ltd. specializes in manufacturing and selling copper clad laminates, electronic-industrial specialty chemicals, raw materials, and electronic components across Taiwan, China, and international markets with a market cap of NT$298.23 billion.

Operations: With a focus on copper clad laminates and specialty chemicals, Elite Material Co., Ltd. generates revenue primarily from foreign markets, contributing NT$69.60 billion, while domestic operations add NT$16.17 billion.

Elite Material's recent performance underscores its robust position in the high-growth tech sector in Asia, with a notable 58.4% surge in earnings over the past year, outpacing the electronic industry's growth of 14.2%. This surge is supported by aggressive expansion strategies, such as the TWD 3.31 billion construction of their Tayuan factory aimed at boosting production capabilities. The company also demonstrated significant financial growth with first-quarter sales soaring to TWD 21.68 billion from TWD 12.90 billion year-over-year, complemented by a net income increase to TWD 3.47 billion from TWD 1.98 billion, reflecting a strategic focus on scaling operations and optimizing product offerings to meet escalating market demand.

- Unlock comprehensive insights into our analysis of Elite Material stock in this health report.

Explore historical data to track Elite Material's performance over time in our Past section.

Summing It All Up

- Get an in-depth perspective on all 489 Asian High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives