- China

- /

- Semiconductors

- /

- SHSE:688498

Asian Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience, with Chinese stocks advancing amid hopes for government stimulus following weaker-than-expected economic indicators. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.4% | 23.5% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| NEXTIN (KOSDAQ:A348210) | 12.4% | 33.8% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

Let's take a closer look at a couple of our picks from the screened companies.

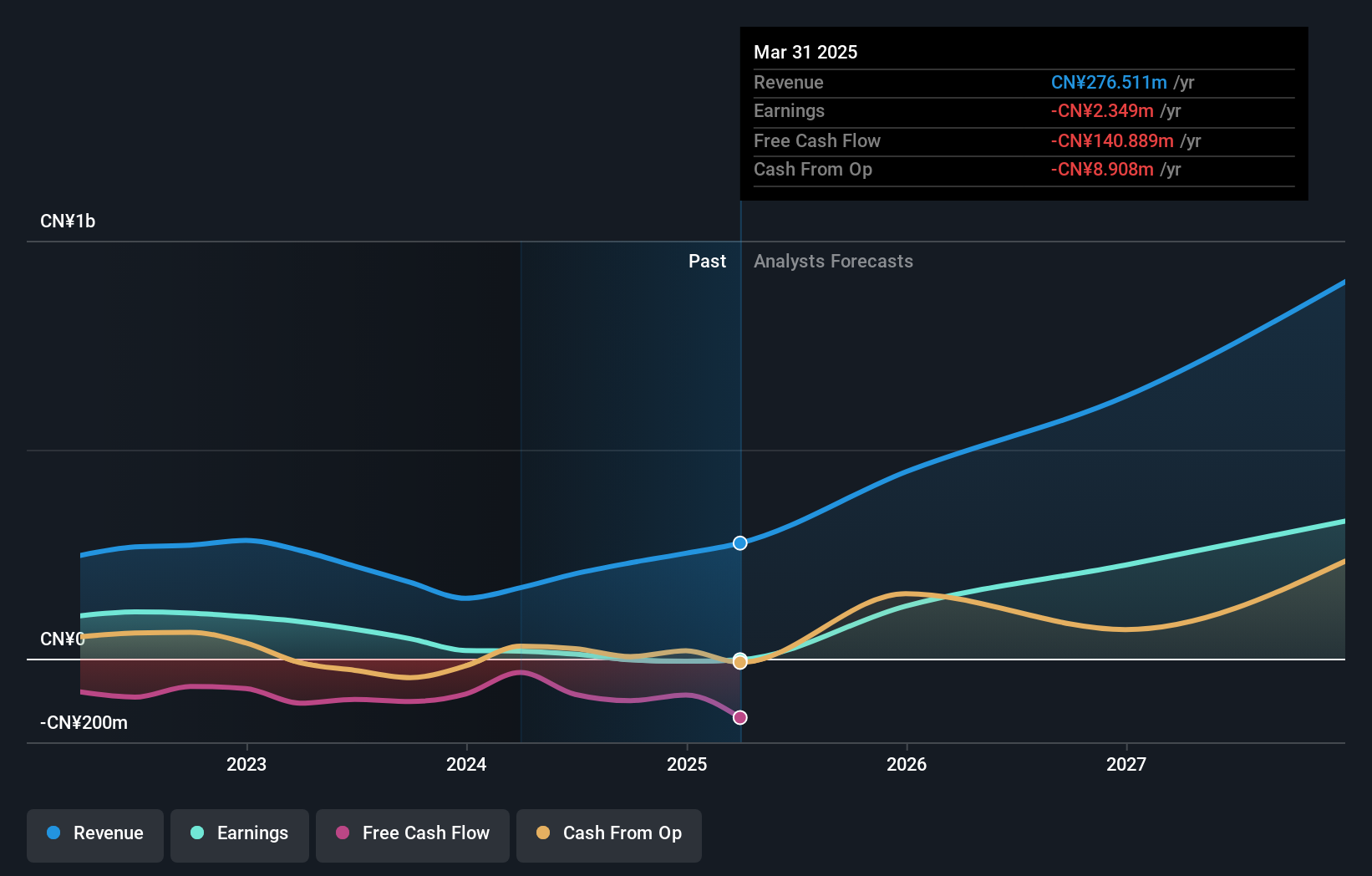

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) operates in the semiconductor industry and has a market cap of CN¥12.20 billion.

Operations: Unfortunately, the revenue segment information for Yuanjie Semiconductor Technology Co., Ltd. is not provided in the text you shared. Therefore, I am unable to summarize their revenue segments at this time.

Insider Ownership: 27.9%

Revenue Growth Forecast: 39.4% p.a.

Yuanjie Semiconductor Technology is experiencing significant growth, with its revenue forecasted to increase by 39.4% annually, outpacing the Chinese market's average of 12.4%. The company reported a strong Q1 2025 performance, with sales rising to CNY 84.4 million and net income reaching CNY 14.32 million. Despite high share price volatility and low forecasted return on equity at 9.8%, it is expected to become profitable within three years, indicating robust potential for investors focused on growth companies in Asia.

- Unlock comprehensive insights into our analysis of Yuanjie Semiconductor Technology stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Yuanjie Semiconductor Technology shares in the market.

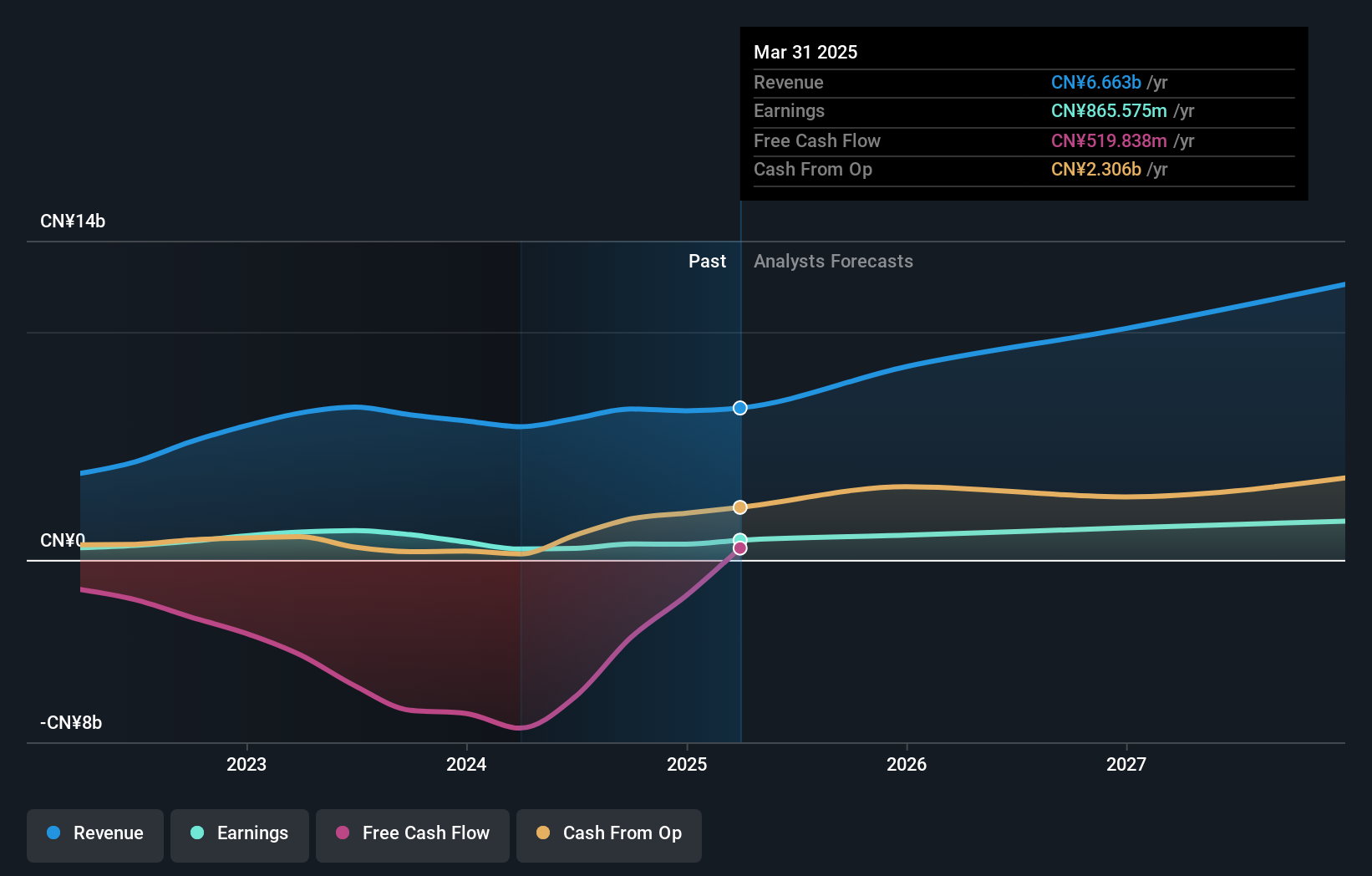

Ginlong Technologies (SZSE:300763)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ginlong Technologies Co., Ltd. is involved in the research, development, production, service, and sale of string inverters globally with a market cap of CN¥21.77 billion.

Operations: Ginlong Technologies Co., Ltd. generates revenue from the global research, development, production, service, and sale of string inverters.

Insider Ownership: 38.2%

Revenue Growth Forecast: 20.7% p.a.

Ginlong Technologies is positioned for growth, with revenue expected to rise over 20% annually, surpassing the Chinese market average. The company trades at a favorable price-to-earnings ratio of 25.1x compared to the market's 39x. Despite high debt levels and a forecasted low return on equity of 13.7%, its earnings are anticipated to grow significantly at 24.2% per year, indicating strong potential amidst insider ownership dynamics in Asia's growth sector.

- Dive into the specifics of Ginlong Technologies here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Ginlong Technologies is priced lower than what may be justified by its financials.

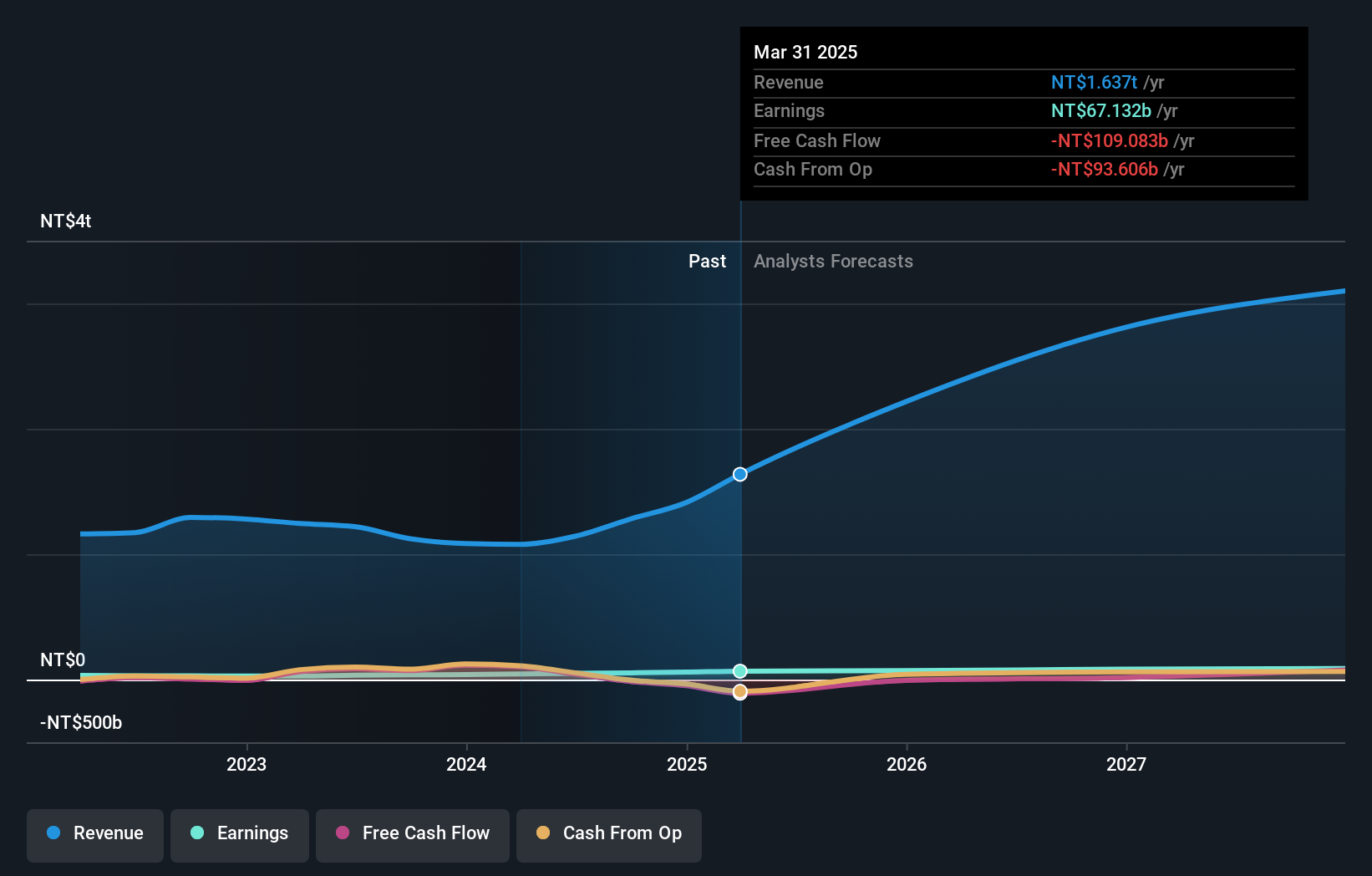

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a company that manufactures, processes, and sells laptop computers and telecommunication products globally, with a market capitalization of NT$1.09 trillion.

Operations: The company's revenue is derived from the manufacturing, processing, and sale of laptop computers and telecommunication products across various international markets including the United States, Mainland China, the Netherlands, and Japan.

Insider Ownership: 13.9%

Revenue Growth Forecast: 23.2% p.a.

Quanta Computer's revenue is forecast to grow at 23.2% annually, outpacing the Taiwan market average, although its earnings growth of 11.2% lags behind. The company trades significantly below its estimated fair value and presents good relative value compared to peers. Recent financials show robust performance with TWD 485.67 billion in sales for Q1 2025, up from the previous year. However, the dividend yield of 4.59% is not well covered by free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Quanta Computer.

- The analysis detailed in our Quanta Computer valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 615 Fast Growing Asian Companies With High Insider Ownership here.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688498

Yuanjie Semiconductor Technology

Yuanjie Semiconductor Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives