- China

- /

- Electronic Equipment and Components

- /

- SHSE:688531

High Growth Tech Stocks In Asia For November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian tech stocks continue to draw attention, particularly in light of recent fluctuations in key indices and investor sentiment. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation capabilities and resilience amidst broader market challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Zhongji Innolight | 34.27% | 34.88% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent training, testing, and application systems for motor vehicle drivers in China, with a market capitalization of CN¥6.59 billion.

Operations: The company generates revenue primarily through its electronic security devices segment, which contributes CN¥411.95 million. Its focus on innovative solutions for motor vehicle driver systems is central to its operations.

DuoLun Technology, amidst a challenging fiscal period, reported a significant revenue drop to CNY 312.27 million in the first nine months of 2025 from CNY 422.96 million the previous year, alongside transitioning from a net profit to a loss of CNY 19.81 million. Despite these setbacks, forecasts suggest an optimistic turnaround with expected revenue growth at an impressive rate of 28.4% annually and earnings potentially surging by 72.18% per year over the next three years. This projected recovery is underpinned by strategic shifts towards high-demand sectors within tech, leveraging DuoLun's capabilities in adapting to market needs and enhancing their product offerings to meet evolving consumer and business requirements effectively.

- Click here to discover the nuances of DuoLun Technology with our detailed analytical health report.

Explore historical data to track DuoLun Technology's performance over time in our Past section.

Unicomp Technology Group (SHSE:688531)

Simply Wall St Growth Rating: ★★★★★☆

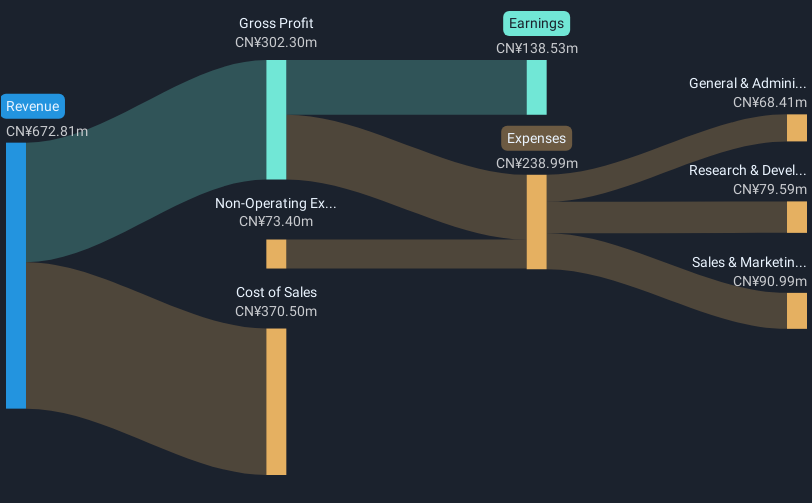

Overview: Unicomp Technology Group Co., Ltd. specializes in the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China with a market capitalization of CN¥10.14 billion.

Operations: The company focuses on X-ray technology and intelligent detection equipment, deriving revenue primarily from these specialized products. It operates within China and targets sectors requiring advanced inspection solutions.

Unicomp Technology Group has demonstrated robust growth with a 32.1% annual increase in revenue, reaching CNY 737.09 million this year, up from CNY 511.82 million previously. The company's earnings have also surged by 39.9% annually, reflecting a strong upward trajectory in its financial performance. Notably, Unicomp has invested significantly in innovation, allocating resources to R&D which now represents a substantial portion of its revenue, ensuring the firm stays at the forefront of technological advancements and market demands. This strategic focus on research is pivotal as it supports sustained growth and competitiveness within Asia's high-growth tech landscape.

- Take a closer look at Unicomp Technology Group's potential here in our health report.

Gain insights into Unicomp Technology Group's past trends and performance with our Past report.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★☆☆

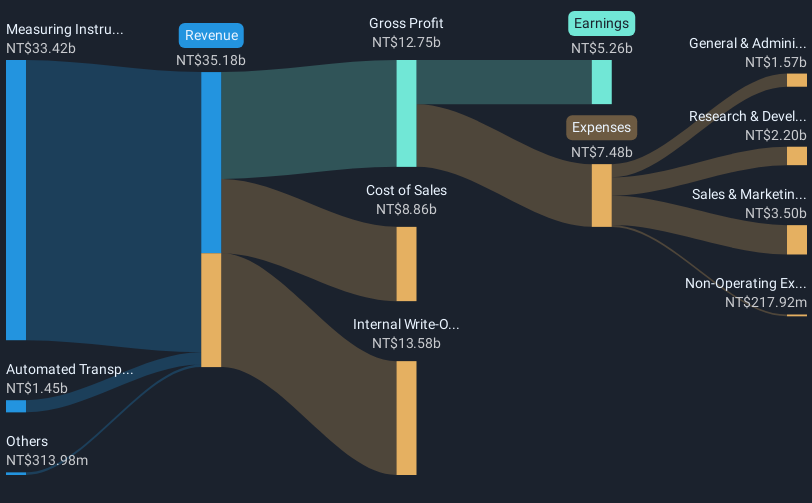

Overview: Chroma ATE Inc. operates in the design, assembly, manufacturing, sales, repair, and maintenance of software and hardware for computers and peripherals as well as various electronic testing systems and instruments across Taiwan, China, the United States, and internationally with a market cap of approximately NT$343.17 billion.

Operations: The company generates revenue primarily through its diverse range of products, including computerized automatic test systems and electronic test instruments. Its operations span multiple regions, contributing to a market cap of approximately NT$343.17 billion.

Chroma ATE has showcased a dynamic growth trajectory with its revenue soaring by 21.1% annually, outpacing the Taiwanese market's average of 13.2%. This robust expansion is mirrored in its earnings, which have surged by an impressive 131.5% over the past year, significantly ahead of the electronic industry's growth rate of 6.6%. The company’s commitment to innovation is evident from its R&D investments, crucial for maintaining technological leadership and competitive edge in Asia's tech sector. Despite a highly volatile share price in recent months, Chroma ATE continues to strengthen its market position, underscored by a substantial increase in net income to TWD 9.14 billion from TWD 3.79 billion year-over-year as reported in their latest earnings call.

- Delve into the full analysis health report here for a deeper understanding of Chroma ATE.

Evaluate Chroma ATE's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 192 Asian High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688531

Unicomp Technology Group

Engages in the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success