- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2359

Solomon Technology Corporation's (TWSE:2359) Shares Leap 33% Yet They're Still Not Telling The Full Story

Solomon Technology Corporation (TWSE:2359) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

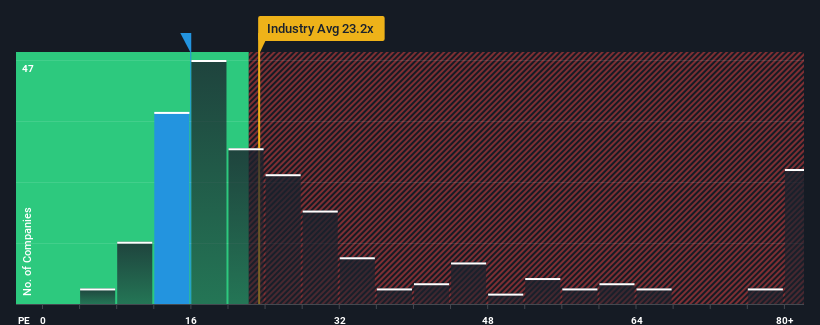

Even after such a large jump in price, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 23x, you may still consider Solomon Technology as an attractive investment with its 15.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Solomon Technology's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Solomon Technology

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Solomon Technology's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.9%. Still, the latest three year period has seen an excellent 452% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Solomon Technology's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Solomon Technology's P/E?

The latest share price surge wasn't enough to lift Solomon Technology's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Solomon Technology revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Solomon Technology that we have uncovered.

If these risks are making you reconsider your opinion on Solomon Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2359

Solomon Technology

Operates as an electronic components sales agency in Taiwan, Mainland China, Hong Kong, and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026