- Taiwan

- /

- Tech Hardware

- /

- TWSE:2357

ASUSTeK Computer Inc.'s (TWSE:2357) Shares Bounce 26% But Its Business Still Trails The Industry

ASUSTeK Computer Inc. (TWSE:2357) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 69%.

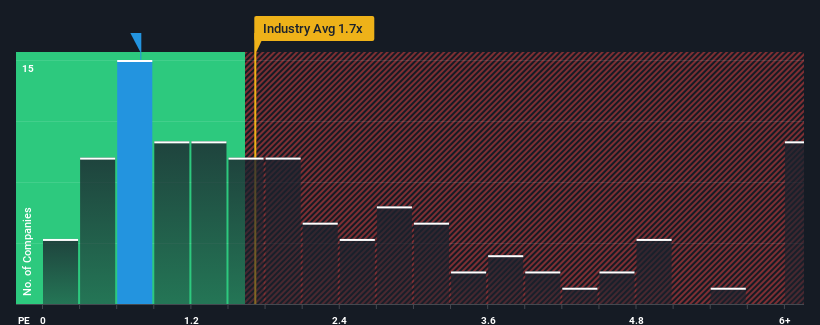

In spite of the firm bounce in price, ASUSTeK Computer may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Tech industry in Taiwan have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for ASUSTeK Computer

How ASUSTeK Computer Has Been Performing

With only a limited decrease in revenue compared to most other companies of late, ASUSTeK Computer has been doing relatively well. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ASUSTeK Computer.Do Revenue Forecasts Match The Low P/S Ratio?

ASUSTeK Computer's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.5% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 17% during the coming year according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 29%, which is noticeably more attractive.

With this information, we can see why ASUSTeK Computer is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite ASUSTeK Computer's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ASUSTeK Computer maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware ASUSTeK Computer is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on ASUSTeK Computer, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2357

ASUSTeK Computer

Researches and develops, designs, manufactures, sells, and repairs computers, communications, and consumer electronic products in Taiwan, China, Singapore, Europe, the United States, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives